EU 27: Poultry and Products Semi Annual Report 2008

By the USDA, Foreign Agricultural Service - This article provides the poultry industry data from the USDA FAS Poultry and Products Semi Annual 2008 report for the EU. A link to the full report is also provided. The full report includes all the tabular data which we have ommited from this article.Report Highlights

EU-27 broiler production is expected to grow 1 percent in 2008. Broilers imports, mainly from Brazil, are expected to increase in 2008, including imports at full duty price, while exports will continue to decline. The EU-27 may become for the first time, in 2008, a net importer of chicken meat. EU-27 chicken meat consumption is expected to increase in 2008 as it remains an inexpensive source of protein.

Executive Summary

In 2007, the EU-27 broiler market recovered from a 2006 decline resulting from an avian influenza (AI) crisis. EU-27 chicken meat consumption is expected to grow in 2008 as chicken meat remains an attractive, low cost protein source. Broiler production is expected to grow 1 percent in 2008 in response to higher domestic consumption.

EU-27 broilers imports grew significantly in 2007, and are expected to increase in 2008, albeit at a slower pace. Brazil, the main supplier of chicken meat to the EU-27, is expected to fill its 2007/2008 tariff rate quota (TRQ) and even over-quota imports in 2008 may still be profitable for Brazil poultry exporters. After a small rebound in 2007, EU-27 exports are expected to decline in 2008. France, the main EU-27 chicken meat exporter, continues to lose market share to Brazil in Middle East and Sub-Sahara African markets. The EU-27 may become a net importer of chicken meat in 2008.

AI outbreaks in wild birds, and occasional AI outbreaks in small farms, occurred in various EU member states (MS) in 2007. However, EU poultry markets remained stable and no major exporting regions faced export bans. An EU Food and Veterinary Office (FVO) report on poultry was critical of Brazil’s ability to conduct serological analyses, especially in the case of a future AI outbreak but confirmed that the hygiene conditions for slaughter, cutting and processing of poultry meat were generally satisfactory in Brazil. Brazil voiced dissatisfaction with the EU’s poultry quota management system.

Production

2006 and 2007 production data are adjusted to reflect new data from reporting countries. In the absence of official Eurostat figures for broiler meat production, FAS figures for EU-27 should be interpreted as representative of production and trade.

In 2007, EU-27 broiler production is almost back to pre-AI levels, except for the UK which had an AI case in 2007. Other AI cases in Poland and Germany did not impact production. In fact, Germany’s production increased sharply (up 14 percent) in 2007 as one company doubled its slaughter capacity. French production also increased but was still below its 2005 level as producers remained cautious about market conditions, including potential AI impacts, decreasing exports and growing production costs.

EU-27 broiler production is expected to grow 1 percent in 2008 driven by higher consumption, additional capacity (Germany), resumption of UK production and investments in Eastern Europe, mainly Romania, which will boost broiler production as well.

Trade

In 2007, the EU-27 broiler imports rose with Brazil remaining the primary chicken meat supplier. The growth was notable for HT line 021099 (Meat & Offal, Salt, in Brine, Dried, Smoked, incl. Flr etc, nesoi) which almost tripled from 2006, due to two factors: first, a reduced tariff for imports of salted poultry in the first half of 2007, and second, the implementation of a new TRQ for salted and cooked poultry for Brazil and Thailand in the second half of 2007. Thai poultry exports to the EU-27 remain limited to heat-treated products due to AI concerns, but nevertheless grew 11 percent in 2007.

FAS EU-27 analysts assumed a moderate 1.5 percent growth for total poultry imports in 2008 from 2007 levels. The 2007/08 TRQ is expected to fill and the TRQ for the first half of 2008 is limited to 40 percent of the total 2007/08 TRQ. However, according to trade contacts, exports of 20 to 30 percent over the TRQ could still be profitable for Brazilian exporters.

Brazilian poultry meat exporters have recently purchased several European poultry processors and Brazil poultry giant SADIA may buy the UK poultry leader Grampian Country Group in 2008. These purchases guarantee stable and significant commercial outlets for Brazilian products in the EU.

It is yet to be seen if the trade dispute between the EU-27 and the United States on Pathogen Reduction treatments (PRT) on poultry carcasses could be resolved in 2008, despite advances on this issue by the Transatlantic Economic Council (TEC). It would be then over-optimistic to assume that the United States could resume its chicken meat exports to the EU-27 in CY 2008.

After a small rebound in 2007, the decline in EU-27 exports is expected to continue in 2008. France, the main EU-27 chicken meat exporter, is losing market share to Brazil in the Middle East and Sub-Saharan Africa. EU-27 chicken meat competitiveness in 2008 will be impacted by the rising value of the Euro and increased internal production costs. Overall, the EU-27 may become a net importer of chicken meat in 2008.

Consumption

In 2007, EU-27 chicken meat demand returned to pre-2006 levels and consumption is expected to show growth in 2008. Despite rising prices due to higher feed costs (grain comprises as much as 70 percent of chicken production costs) chicken meat remains a low cost protein source and is especially important to the growing EU-27 Muslim population.

Policy

Avian Influenza (AI) still most pronounced threat

AI H5N1 outbreaks in wild birds1 occurred in various EU MS, such as Poland, the United Kingdom, and Germany, signaling the need for continued vigilance by commercial poultry breeders. AI outbreaks in 2007 occurred in small operations that observe less strict biosecurity measures. No major exporting regions faced export bans.

EU poultry market developments

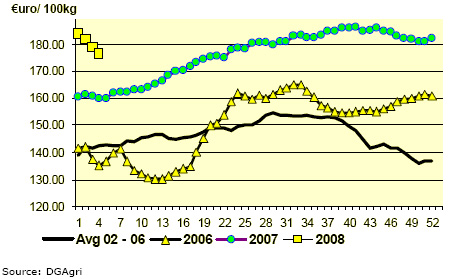

Throughout 2007, poultry producers kept poultry production numbers tight, fearing market disruptions in case of AI outbreaks. This helped increase EU poultry prices to record levels, thus preserving poultry production margins in spite of increased feed costs.

Weekly evolution of the Community price for Broiler

An EU Food and Veterinary Office (FVO) report 7214/20072 on poultry, poultry meat and poultry meat products was critical of Brazil’s capacity to conduct serological analyses, especially in the case of a future AI outbreak, as only one laboratory is currently able to perform this analysis. The report nevertheless confirmed that the hygiene conditions for slaughter, cutting and processing of poultry meat are generally satisfactory.

Brazil has voiced dissatisfaction with the EU’s poultry quota management system where strong demand has led to license trading between companies.

Footnotes

1 http://ec.europa.eu/food/animal/diseases/adns/adns_wildbirds2007.pdf2 http://ec.europa.eu/food/fvo/ir_search_en.cfm

Further Reading

| - | You can view the full report by clicking here. |

List of Articles in this series

To view our complete list of Poultry and Products Annual and Semi Annual reports, please click hereMarch 2008