Livestock and Poultry World Markets and Trade

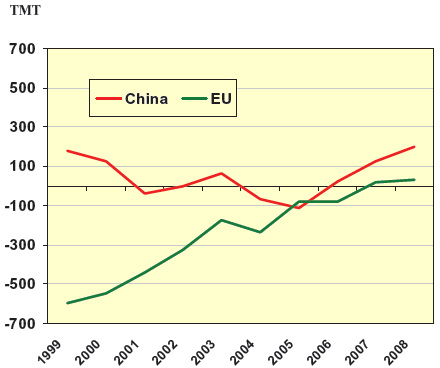

China and the European Union are expected to be net broiler meat importers again in 2008 on the basis of continued strong demand, higher domestic prices, and strengthening currencies, writes the United States Department of Agriculture Foreign Agricultural Service.Broiler Meat Trade Continues to Climb

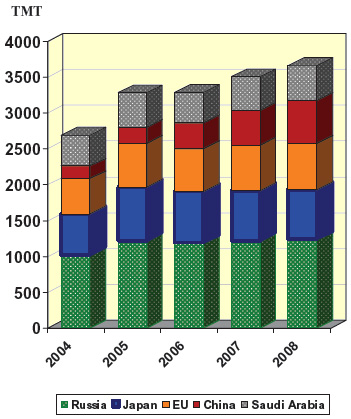

Top 5 Importers

Net Importers Again

China is expected to be supplied mostly by the United States, whereas the EU is expected to be supplied by Brazil and Thailand. It is interesting to note that in the case of the EU, there’s a distinct 10-year upward trend as exports have fallen and imports have been rising. In the case of China, the trend of more imports and less exports is only prevalent in the past few years as consumers have shifted to poultry from more expensive pork.

Broiler Meat: 2008 Revised Forecast Overview

New countries have been added to the broiler meat PSD to reduce the gap between total imports and total exports by selected countries. These additional countries have data for 1997 to 2008 and are included in this circular as well as in the PSD Online. As a result, any comparison between the 2008 forecast published in November and the revised 2008 forecast should take this modification into account.

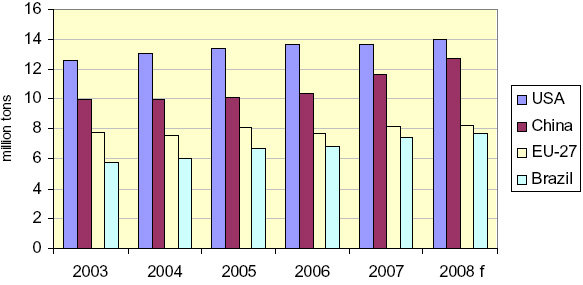

Production

The forecast for broiler production is raised to 71 million tons. Whereas broiler production forecasts for major producers (U.S., Brazil, and the European Union) are slightly higher, China’s broiler production is expected to grow by 10 percent over the November forecast.

- United States is up 22,000 tons to 16.6 million tons based on strong demand.

- China is raised 1.1 million tons to 12.5 million due to strong demand for the cheaper protein as pork prices continue to be high.

- Brazil is boosted 345,000 tons to 10.9 million tons. Producers are expected to expand poultry output as local feed supplies are raised to record levels. Also, foreign and domestic demand continues to be strong.

- European Union is up 110,000 tons to 8.2 million tons due to growing demand for the cheaper protein as meat prices rise and also additional capacity in Germany and Romania while UK recovers from AI losses.

U.S. Southern States Chicken LQ Prices

Consumption

The forecast for broiler consumption was raised to 70 million tons. Growth in major broiler consumer nations, such as China, European Union, and Brazil, are expected to be strong in 2008.

- China is up 1.1 million tons to 12.7 million tons due to continued high pork prices spurring demand for broiler meat.

- European Union is raised nearly 300,000 tons to 8.2 million tons. Despite higher prices, domestic demand continues to be strong as broiler meat is still the lower cost protein option.

- Brazil is up 230,000 tons to 7.7 million tons as consumer’s real incomes continue to rise with a healthy growing economy expected in 2008.

Exports

Broiler exports are revised up nearly 500,000 tons to 7.7 million tons. Growth in the United States and Brazil is strong while the European Union is expected to decline in 2008.

- United States is up nearly 200,000 tons to 2.7 million due to the favorable exchange rates. Chinese and Russian pace of imports from the US is expected to continue strong. U.S. chicken leg quarter prices averaged $904 per ton in March, up over $28 from February. Foreign demand for leg quarters has kept prices strong.

- Brazil is boosted 115,000 tons to a record 3.2 million. Year-to-year export growth is modest compared to past years (except for the decline in 2006). Brazil’s major destinations in 2007 were the EU, Saudi Arabia, Japan, Hong Kong and United Arab Emirates (UAE). The UAE is the fifth newest market, having displaced Russia in 2007, and imported 195,000 tons, up 48,000 tons over the previous year. So far in 2008, export growth is strongest to Saudi Arabia and the UAE.

- European Union is down 80,000 tons to 620,000 as the Europeans are becoming less competitive due to the rising euro. Exports were down last year to major markets such as Russia and Ukraine. The European Union is expected to be a net importer in 2008, with Brazil as the major supplier.

U.S. Southern States Chicken LQ Prices

Imports

Broiler imports are forecast at 7.2 million tons. Imports to major markets Russia, European Union, China, Saudi Arabia, are increased for 2008 as demand continues strong.

- Russia is up 60,000 tons to 1.2 million tons due to continued shortage of supplies in red meats and favorable broiler prices. Consumer demand continues to expand because of growing incomes. Imports are still somewhat constrained by the government policies to encourage domestic production.

- European Union is boosted by 100,000 tons to 650,000 tons, the highest since 1999 when the EU-27 was formed, based on pace of shipments from Brazil and higher domestic prices. Despite the lower TRQ for salted poultry in 2008, European Union imports are expected to surpass the quota because it continues to be profitable.

- China is raised 40,000 tons to 600,000 tons because of strong consumer demand, an appreciating Renminbi, and higher domestic prices. Nearly 70 percent of this market is supplied by the United States, the rest comes from Brazil.

- Saudi Arabia is boosted 40,000 tons to 490,000 tons based on strong shipments from Brazil. Over 80 percent of its imports are supplied by Brazil, the rest comes from the European Union. Also, recent reports indicate that the government will be cutting import tariffs for frozen poultry from 20 to 5 percent to help control food price inflation.

Further Reading

| - | You can view the full report by clicking here. |

April 2008