GLOBAL POULTRY TRENDS - Slow Growth Forecast for Turkey Meat

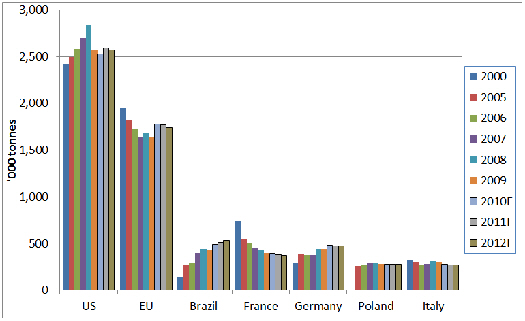

Since 2000, there have been years when global turkey production has expanded and others in which it has contracted, hence over the period to the estimates for 2012, the industry has recorded only slow growth averaging well below one per cent per year, according to industry watcher, Terry Evans, in his latest update on the prospects for the global turkey industry.According to FAOSTAT, data turkey meat production between 2000 and 2009 (table 1) expanded by some 0.4 per cent from a little under 5.1 million tonnes to almost 5.3 million tonnes. However, when making these calculations, FAOSTAT has assumed that annual production in Poland has been between 50,00 and 60,000 tonnes, despite data on Poland's turkey meat exports amounting to 80,000 tonnes in 2008 and 73,000 tonnes in 2009! Another statistical source has indicated that turkey production in Poland is in the region of 280,000 tonnes which, if correct, would mean that the FAOSTAT total for Europe and the world is understated by at least 200,000 tonnes.

So, the actual global total for 2009 could be about 5.5 million tonnes while the forecasts for 2011 and 2012 would rise to around 5.7 million tonnes. This again underlines the point that on many occasions, a series of data should not be taken too literally; the trend being much more important.

Based on FAOSTAT figures, the number of turkeys slaughtered worldwide in 2009 was a little more than 656 million, which represented a reduction of some 34 million (five per cent) on the 2008 record of almost 691 million. Of the 2009 total, 380.6 million (58 per cent) were killed in the Americas and 212 million (32 per cent) in Europe.

An interesting feature of the development of the turkey industry has been how the average eviscerated of birds has increased. Back in 2000, the average carcass weight globally was around 7.6kg. However, this disguises big differences between regions and, more importantly, countries. Thus, at that time, the average eviscerated weight of turkeys in Italy was 9.7kg, which contrasted with just over 9kg in the USA and 6.4kg in France. By 2009, the global average had risen to almost 8.1kg. While the average in Italy had increased by 0.7kg to 10.4kg, the gain in the USA was even more rapid as the average went up by 1.5kg to 10.5kg. In contrast, the increase in France was just 0.5kg to reach 6.8kg while in Germany, the weight gain was marginal, the average rising from 8.6kg to 8.7kg.

The higher slaughter weights reflect changes in the market place, with consumers not only buying whole birds for special holiday occasions, while consuming turkey portions and prepared product at other times of the year. For example, in the US back in the 1970s, at least half the turkeys produced were eaten over the festive holidays, while today this proportion has contracted to around 30 per cent.

Although the number of turkeys slaughtered worldwide actually declined from 667 million in 2000 to 656 million in 2009, because of the rise in slaughter weights, the actual yield of turkey meat went up from just under 5.1 million tonnes to 5.3 million tonnes.

On a regional basis, while the Americas and Europe combined accounted for 94 per cent of global production in 2000 and 2009, this figure conceals the fact that during this period, the Americas increased its market share from 56 per cent to 63 per cent, while Europe lost ground its share falling from 39 per cent to less than 32 per cent.

The changes in the top 10 turkey-producing countries over the period are shown in table 2.

Broadly speaking, table 2 shows that the 10 biggest turkey meat producers accounted for 90 per cent of global production in 2000 and also in 2009. However, there have been some dramatic changes in the ranking of those countries, which underline the point that Europe's share of the total has declined over the review period. Thus, in 2000, four European countries occupied the second to fifth places in the league table but by 2009, France, Italy and the UK had slipped down to the fourth, fifth and seventh positions, respectively. On the other hand, the expansion that has occurred in Germany had pushed this country into the number two position although forecasts for 2011 and 2012 indicate that, in these years, Brazil (which was eighth in 2000) with a forecast production of some 500,000 tonnes a year, will have knocked Germany off the number two spot.

Outside of the Americas and Europe, the only country producing significant quantities of turkey meat is Israel although even here, output has contracted to less than 100,000 tonnes a year.

Figure 1 shows how Brazil and Germany are the only countries among the major producers to exhibit consistent growth throughout the period 2000 to 2009 but the forecasts for 2011 and 2012 (which are included in the graph) reveal that, while continued growth is anticipated in Brazil, output in Germany likely to level out and possibly decline slightly. The chart also presents what one statistical reporting authority considers is happening in Poland with production rising from around 260,000 tonnes to 285,000 tonnes between 2005 and 2008 and having since contracted a little to around 280,000 tonnes.

The 38 per cent expansion that occurred in Africa between 2000 and 2009 was mainly the result of significant increases in Morocco, Tunisia and Algeria. However, the regional total still represents no more than 2.5 per cent of the global figure.

Clearly, the Americas is the main producing region with the United States easily the number one producer, accounting for almost 2.6 million tonnes a year or some three-quarters of the regional total. Back in 2000, this country's share was considerably higher at 85 per cent, however.

In 2011, it is estimated that 244 million turkeys will be killed in the US although in 2000, the number was higher at 271 million which, in turn, was well below the 1996 record of more than 300 million. In 2009/10 half of the birds were grown in just four states – Minnesota, North Carolina, Arkansas and Missouri. Also, more than a half were processed by just three companies – Butterball LLC, Jennie-O Turkey Store, Inc and Cargill Value Added Meats.

The expansion in Brazil has been nothing short of dramatic, output having increased four-fold between 2000 and the forecast for 2012. Much of the increase has been built on an expanding export trade. However, there are now signs that exports have suffered a set-back, which is likely to apply a brake on the rate of production growth even though domestic consumption continues to go up.

Production in Europe is entirely related to developments in the European Union and, as has been noted earlier, the current and short-term prospects for which are for a level of growth well below what has been achieved during the first half of the past decade. Among the major producers only Germany has expanded output as production in France, Italy and the UK has markedly declined.

The doubling of output in Oceania is a direct reflection of the gains made by Australia's turkey industry, where annual output currently stands around 53,000 tonnes.

Turkey Trade Flat

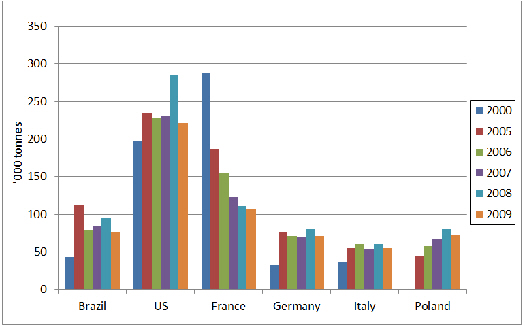

International trade in turkey meat can be described as 'flat' as global exports have hovered between 830,000 tonnes and 950,000 tonnes throughout the past decade with no definite trend emerging.

Exports of turkey meat, like its production, are primarily restricted to two regions – Europe and the Americas, and a handful of countries (table 3). The Americas' role in this trade has increased at the expense of Europe. In 2009, the Americas accounted for some 41 per cent of the global total and Europe 57 per cent, which compares with 29 per cent and 68 per cent, respectively, back in 2000.

The Americas has the world's biggest exporter, the US, whose volumes of fresh/frozen product traded have fluctuated from year to year between 180,000 and 280,000 tonnes between 2000 and 2009. In 2010, US turkey meat exports amounted to 265,000 tonnes, of which 146,000 tonnes went to Mexico, while a further 63,000 tonnes were shipped to China, Hong Kong, Canada and the Dominican Republic, these five markets accounting for 80 per cent of the total. During that year, exports represented around 10.5 per cent of US domestic production. More than 90 per cent of shipments are turkey parts and dark meat products. USDA forecasts for 2011 anticipate an increase in US exports to 295,000 tonnes, though for 2012, a cut-back to 281,000 tonnes is foreseen.

Having expanded throughout the period 2000 to 2008, exports from Brazil have since declined, primarily as a result of reduced purchases by its largest market, the European Union. However, Brazilian traders are currently optimistic about sales to the EU and are also seeking out new markets in Asia, particularly Malaysia and Indonesia.

Canada exports around 25,000 tonnes a year though the figure has not changed greatly over the past decade, its two biggest customers being the US and South Africa.

The other country in this region shipping significant amounts is Chile, the total having risen from around 5,500 tonnes in 2000 to nearly 18,000 tonnes in 2009.

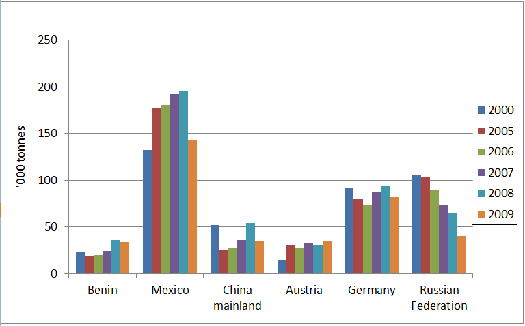

Europe's exports are almost all accounted for by shipments from EU member countries but the annual total has declined from more than 600,000 tonnes to 470,000 tonnes in 2009. If sales to fellow EU countries are discounted, annual exports are less than 150,000 tonnes. A major factor contributing to the decline has been the reduction in purchases by Russia from more than 100,000 tonnes back in 2000 to just 40,000 tonnes in 2009, while the forecasts for 2011 and 2012 point to this figure falling further to around 30,000 tonnes.

Outside Europe, turkey meat imports are almost negligible with the exceptions of Mexico and China. Purchases by Mexico escalated to around 200,000 tonnes in 2008 but then fell back to 143,000 tonnes, as the quantity bought from the US slumped from 154,000 tonnes to 111,000 tonnes. However, since then, Mexico's total imports have climbed back to the 160,000-tonne level with the forecast for 2012 at 164,000 tonnes.

Recent years have witnessed an increase in purchases by China where virtually all the turkey meat consumed is imported and the total is forecast to reach almost 50,000 tonnes by 2012 with some 90 per cent being bought from the US.

Europe imported 450,000 tonnes of turkey meat in 2009 (table 4) with EU member states taking 380,000 tonnes. If intra-EU trade is excluded then annual receipts amounted to around 100,000 tonnes and this figure is expected to contract to some 90,000 tonnes in the next couple of years.

Little Increase in Turkey Consumption

Although there are few measurements of turkey meat consumption, while the total quantity consumed globally has increased, the rate of growth has not matched that of the human population. As a result, the uptake per person has not gone up and worldwide, it looks to average around 0.8kg per person per year.

Detailed figures are only available for a few countries (table 5) and readers should note that the uptakes for 2010 and 2011 have been presented to the nearest whole number, as it can be argued that the errors involved in calculating the available supplies of turkey meat, as well as human population numbers, make assessing consumption levels more precisely debatable. By far the world's biggest eaters of turkey meat are the Israelis whose average annual consumption is around 10kg.

Consumer appreciation of turkey's good taste and nutritional value gave consumption in the US a massive boost in the 1980s when average uptake reached 7.7kg per person, which was more than double the levels recorded in the 1970s. However, since 1990, the quantity eaten has broadly settled at this level and is calculated to have averaged 7.5kg in 2010, though it is forecast to slip to 7.4kg in 2011 an 2012.

Per-capita consumption in Canada is around 5kg a year, while the average for the EU is assessed at around 4kg.

Consumption in Mexico and Brazil appears to range between 1.0 and 2.0kg while, for all the other countries where this assessment is made, the average is 1kg or less.

It is difficult to see per-capita turkey meat consumption increasing much in developed countries although significant gains may occur in some of those with expanding economies, such as Russia and China and where currently the level of uptake is low.

January 2012