GLOBAL POULTRY TRENDS 2013 - Hen Egg Production in Africa and Oceania

Africa offers great potential for increased egg production, according to industry analyst, Terry Evans, while just two countries dominate the market in Oceania.Great Potential for Eggs in Africa

Although egg production in Africa accounts for less than five per cent of the world total, there is great potential for growth in this region based primarily on the forecasts for increases in the human population.

During the period 2000 to 2012 egg production in Africa expanded by 1.1 million tonnes to reach 3.0 million tonnes, recording an average annual growth rate of 3.9 per cent. As this exceeded the global rate of 2.2 per cent, Africa’s share of world total production expanded from 3.7 per cent in 2000 to 4.5 per cent in 2012.

Since the last report in this series, the Food and Agriculture Organisation (FAO) has published its final figures for 2012, updated some of the earlier data and also released new forecasts for the human population. Consequently, some of the figures in Table 1 have been revised. It should be noted that the FAO data includes all hen eggs including commercial production, backyard output and also hatching eggs for both the layer and broiler industries.

| Table 1. World hen egg production (million tonnes) | ||||||||||

| 2000 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013E | |

|---|---|---|---|---|---|---|---|---|---|---|

| Africa | 1.9 | 2.2 | 2.3 | 2.5 | 2.6 | 2.5 | 2.8 | 2.9 | 3.0 | 3.0 |

| Americas | 10.5 | 11.7 | 12.3 | 12.3 | 12.5 | 12.8 | 13.0 | 13.3 | 13.3 | 13.6 |

| Asia | 29.0 | 32.6 | 32.9 | 34.5 | 36.2 | 37.0 | 37.7 | 38.1 | 39.2 | 39.4 |

| Europe | 9.5 | 9.9 | 10.1 | 10.1 | 10.2 | 10.3 | 10.5 | 10.6 | 10.6 | 10.7 |

| Oceania | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.3 | 0.3 | 0.3 | 0.3 |

| WORLD | 51.1 | 56.6 | 57.9 | 59.5 | 61.7 | 62.8 | 64.2 | 65.2 | 66.4 | 67.0 |

| E=estimate. Sources: FAO to 2012; 2013 author's estimates |

||||||||||

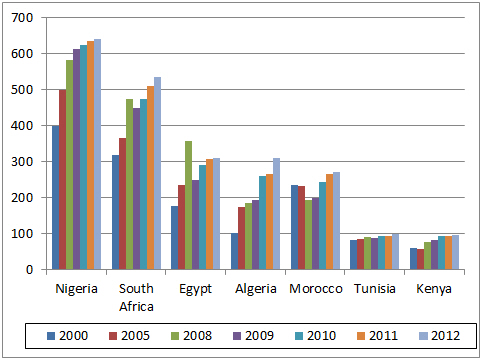

In the major producing regions of the world, just a handful of countries account for the bulk of output. And, as can be seen in Tables 2 and 3, Africa is no different with just five countries – Nigeria, South Africa, Egypt, Algeria and Morocco – having a combined output in 2012 of almost 2.1 million tonnes out of a regional total of a shade below three million.

The rate of industry growth in these five has outstripped that recorded by the rest of the region such that their share has increased from 65 per cent in 2000 to 69 per cent in 2012. Of the 50 or so countries in this region only a handful failed to expand their production over the past decade or so. This bodes well for the future which could see production in Africa approach four million tonnes by 2020.

| Table 2. Hen egg production in Africa ('000 tonnes) | |||||||

| Country | 2000 | 2005 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|

| Algeria | 101.0 | 175.0 | 184.4 | 193.6 | 260.5 | 265.8 | 308.6 |

| Angola | 4.3 | 5.2 | 4.9 | 4.5 | 4.5 | 4.5 | 4.5 |

| Benin | 7.2 | 7.2 | 13.8 | 13.1 | 9.9 | 10.7 | 11.6 |

| Botswana | 3.2 | 4.2 | 4.5 | 4.3 | 4.5 | 4.5 | 4.6 |

| Burkina Faso | 39.4 | 45.1 | 52.5 | 54.3 | 57.8 | 58.8 | 59.5 |

| Burundi | 3.0 | 3.1 | 3.1 | 3.1 | 3.0 | 3.1 | 3.1 |

| Cameroon | 13.0 | 13.4 | 13.5 | 14.9 | 15.0 | 15.0 | 15.5 |

| Cabo Verde | 1.9 | 1.8 | 2.0 | 2.1 | 2.2 | 2.2 | 2.2 |

| Central African Rep. | 2.1 | 2.2 | 2.6 | 2.7 | 3.1 | 3.2 | 2.5 |

| Chad | 3.6 | 3.7 | 3.9 | 4.0 | 4.0 | 4.0 | 4.0 |

| Comoros | 0.8 | 0.8 | 0.8 | 0.8 | 0.8 | 0.8 | 0.8 |

| Congo | 1.1 | 1.3 | 1.5 | 1.6 | 1.6 | 1.6 | 1.6 |

| Cote d'Ivoire | 33.0 | 28.7 | 30.4 | 30.0 | 32.0 | 33.0 | 34.0 |

| Dem. Rep. Congo | 7.0 | 6.9 | 7.5 | 8.7 | 8.9 | 8.9 | 9.0 |

| Egypt | 176.7 | 235.0 | 355.5 | 249.3 | 291.2 | 305.5 | 310.0 |

| Equatorial Guinea | 0.3 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 | 0.5 |

| Eritrea | 1.7 | 2.0 | 2.0 | 2.0 | 2.2 | 2.2 | 2.3 |

| Ethiopia | 28.6 | 35.0 | 38.5 | 39.0 | 39.0 | 39.6 | 40.0 |

| Gabon | 2.6 | 2.6 | 2.6 | 2.3 | 2.4 | 2.4 | 2.5 |

| Gambia | 0.7 | 0.8 | 0.9 | 0.9 | 0.9 | 0.9 | 1.0 |

| Ghana | 21.7 | 25.2 | 33.7 | 36.7 | 36.7 | 39.8 | 40.0 |

| Guinea | 12.2 | 18.6 | 22.2 | 23.5 | 23.6 | 24.5 | 24.5 |

| Guinea-Bissau | 1.0 | 1.1 | 1.3 | 1.3 | 1.3 | 1.4 | 1.4 |

| Kenya | 60.7 | 57.9 | 76.6 | 81.0 | 92.6 | 94.4 | 96.1 |

| Lesotho | 1.5 | 1.6 | 1.6 | 1.7 | 1.7 | 1.7 | 1.7 |

| Liberia | 4.2 | 4.6 | 4.8 | 5.0 | 5.2 | 5.4 | 5.5 |

| Libya | 60.0 | 63.1 | 60.0 | 62.2 | 62.5 | 63.0 | 63.6 |

| Madagascar | 14.9 | 15.1 | 15.8 | 16.2 | 16.1 | 16.6 | 17.0 |

| Malawi | 19.5 | 20.2 | 20.0 | 20.3 | 20.7 | 21.1 | 21.5 |

| Mali | 11.9 | 10.1 | 14.1 | 13.7 | 13.9 | 17.6 | 16.5 |

| Mauritania | 4.7 | 4.3 | 5.9 | 5.6 | 5.4 | 5.5 | 5.6 |

| Mauritius | 12.5 | 13.0 | 11.0 | 10.0 | 10.0 | 10.5 | 11.5 |

| Morocco | 235.0 | 232.0 | 192.4 | 200.0 | 244.0 | 265.0 | 272.0 |

| Mozambique | 1.7 | 9.8 | 19.0 | 21.9 | 27.1 | 35.0 | 46.9 |

| Namibia | 1.6 | 3.0 | 3.3 | 3.3 | 3.4 | 3.4 | 3.4 |

| Niger | 7.8 | 8.3 | 7.6 | 8.5 | 7.5 | 7.9 | 8.3 |

| Nigeria | 400.0 | 500.4 | 581.0 | 612.6 | 623.4 | 636.0 | 640.0 |

| Reunion | 5.1 | 6.0 | 6.5 | 5.9 | 6.7 | 6.7 | 7.0 |

| Rwanda | 2.2 | 2.7 | 2.8 | 2.9 | 2.9 | 2.9 | 3.0 |

| Sao Tome/Principe | 0.4 | 0.5 | 0.5 | 0.6 | 0.6 | 0.6 | 0.4 |

| Senegal | 10.4 | 20.2 | 36.6 | 26.6 | 27.4 | 28.9 | 27.4 |

| Seychelles | 2.2 | 1.2 | 1.1 | 1.3 | 1.1 | 1.3 | 1.4 |

| Sierra Leone | 4.6 | 3.7 | 7.4 | 9.9 | 10.8 | 12.0 | 12.0 |

| Somalia | 2.5 | 2.7 | 2.3 | 2.1 | 2.4 | 2.4 | 2.4 |

| South Africa | 318.0 | 365.5 | 473.0 | 450.0 | 473.0 | 511.0 | 535.0 |

| Sudan (former) | 34.0 | 30.0 | 32.0 | 32.0 | 35.0 | 38.0 | 38.5 |

| Swaziland | 1.1 | 1.3 | 1.1 | 1.1 | 1.2 | 1.2 | 1.2 |

| Togo | 6.3 | 8.0 | 8.7 | 9.3 | 9.3 | 9.3 | 9.5 |

| Tunisia | 82.0 | 84.0 | 89.0 | 88.0 | 92.0 | 92.6 | 97.7 |

| Uganda | 20.4 | 22.0 | 30.9 | 42.1 | 43.4 | 44.7 | 46.0 |

| United Rep. Tanzania | 33.8 | 36.3 | 33.3 | 31.2 | 32.5 | 32.5 | 32.5 |

| Zambia | 39.2 | 42.3 | 42.8 | 45.0 | 49.5 | 54.0 | 55.0 |

| Zimbabwe | 22.0 | 25.9 | 29.3 | 29.8 | 29.6 | 29.6 | 30.0 |

| AFRICA | 1,885.9 | 2,214.5 | 2,592.5 | 2,532.2 | 2,756.1 | 2,883.3 | 2,991.9 |

| WORLD | 51,046.2 | 56,614.2 | 61,699.6 | 62,794.0 | 64,202.8 | 65,233.6 | 66,373.6 |

| P=provisional; - no data. Countries producing less than 50 tonnes have been excluded. Source FAO |

|||||||

Nigeria is the largest egg producer recording an average annual growth rate of four per cent between 2000 and 2012 when output reached 640,000 tonnes. However, the rate of expansion has slowed to around 2.5 per cent since 2008, reflecting a large increase in input costs and their impact on profitability. The brown to white egg ratio is considered to be 98:2. Some 70 per cent of the birds are housed in cages with 30 per cent in barn systems.

The egg industry in South Africa expanded by more than four per cent per year from 2000 to 2012, when output totalled 535,000 tonnes. Egg price volatility has put pressure on producers with the result that egg output in 2013 is expected to be some 2.4 per cent below the 2012 level, while a continued decline is envisaged for 2014.

Despite problems as a result of avian influenza being indigenous in some governorates, Egypt’s egg industry has prospered, annual output showing an increase of almost five per cent per year to 2012, making this country the third largest producer in the region. However, while there is no doubting the upward trend in production a question mark must be placed against the 2008 figure of 356,000 tonnes (Table 2 and Figure 1), since the increase in layer numbers when compared with 2007 is put at just 14 per cent and yet the output figure is some 27 per cent higher.

FAO has raised its estimates of output in Algeria such that the total in 2012 was more than treble the 2000 level, recording an annual growth of nearly 10 per cent. While it is unlikely that this rate of expansion can be maintained, it does look as though this country will soon capture Egypt’s third place in the production league table (Table 3).

Although Morocco is the fourth largest egg producer in Africa, growth has been slow at a little over one per cent per year, production in 2012 amounting to 272,000 tonnes.

The same can be said for Tunisia. However, the egg industry in Kenya is expanding at four per cent a year and looks likely to overtake Tunisia in the near term.

| Table 3. Egg production ranking in Africa in 2012 ('000 tonnes) | |

| Country | Production |

|---|---|

| Nigeria | 640.0 |

| South Africa | 535.0 |

| Egypt | 310.0 |

| Algeria | 308.6 |

| Morocco | 272.0 |

| Tunisia | 97.7 |

| Kenya | 96.1 |

| Libya | 63.6 |

| Burkina Faso | 59.5 |

| Zambia | 55.0 |

| Mozambique | 46.9 |

| Uganda | 46.0 |

| Ethiopia | 40.0 |

| Ghana | 40.0 |

| Sudan (former) | 38.5 |

| Cote d'Ivoire | 34.0 |

| United Rep. Tanzania | 32.5 |

| Zimbabwe | 30.0 |

| Senegal | 27.4 |

| Guinea | 24.5 |

| Malawi | 21.5 |

| Madagascar | 17.0 |

| Mali | 16.5 |

| Cameroon | 15.5 |

| Sierra Leone | 12.0 |

| Benin | 11.6 |

| Mauritius | 11.5 |

| Togo | 9.5 |

| Dem. Rep. Congo | 9.0 |

| Niger | 8.3 |

| Reunion | 7.0 |

| Mauritania | 5.6 |

| Liberia | 5.5 |

| Botswana | 4.6 |

| Angola | 4.5 |

| Chad | 4.0 |

| Namibia | 3.4 |

| Burundi | 3.1 |

| Rwanda | 3.0 |

| Central African Rep. | 2.5 |

| Gabon | 2.5 |

| Somalia | 2.4 |

| Eritrea | 2.3 |

| Cabo Verde | 2.2 |

| Lesotho | 1.7 |

| Congo | 1.6 |

| Guinea-Bissau | 1.4 |

| Seychelles | 1.4 |

| Swaziland | 1.2 |

| Gambia | 1.0 |

| Comoros | 0.8 |

| Equatorial Guinea | 0.5 |

| Sao Tome/Principe | 0.4 |

| Source: FAO | |

Oceania’s Output Depends on Two Countries

Egg production in Oceania expanded at three per cent per year between 2000 and 2012 from almost 200,000 tonnes to nearly 290,000 tonnes (Table 4).

With Australia accounting for 74 per cent and New Zealand 19 per cent of the total, clearly this region’s growth will be closely linked with the egg industries’ fortunes in these two countries.

| Table 4. Hen egg production in Oceania ('000 tonnes) | |||||||

| Country | 2000 | 2005 | 2008 | 2009 | 2010 | 2011 | 2012 |

|---|---|---|---|---|---|---|---|

| Australia | 143.0 | 138.6 | 160.0 | 159.3 | 174.0 | 205.2 | 214.7 |

| Fiji | 3.2 | 3.8 | 3.4 | 3.5 | 5.7 | 5.5 | 6.0 |

| French Polynesia | 1.4 | 2.4 | 2.5 | 2.7 | 2.8 | 2.7 | 2.8 |

| Guam | 0.8 | 0.8 | 0.8 | 0.8 | 0.9 | 0.9 | 0.9 |

| Kiribati | 0.2 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.4 |

| Micronesia | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 | 0.2 |

| New Caledonia | 1.5 | 1.9 | 2.4 | 2.8 | 3.0 | 3.0 | 3.1 |

| New Zealand | 43.0 | 50.9 | 53.2 | 51.8 | 52.3 | 51.1 | 53.5 |

| Papua New Guinea | 4.5 | 4.8 | 4.8 | 4.8 | 5.0 | 5.1 | 5.3 |

| Samoa | 0.3 | 0.3 | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 |

| Solomon Isl. | 0.4 | 0.5 | 0.6 | 0.6 | 0.7 | 0.7 | 0.7 |

| Tonga | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 | 0.3 |

| Vanuatu | 0.3 | 0.4 | 0.8 | 0.8 | 0.6 | 0.7 | 0.7 |

| OCEANIA | 199.4 | 205.3 | 229.8 | 228.5 | 246.3 | 276.2 | 288.9 |

| WORLD | 51,046.2 | 56,614.2 | 61,699.6 | 62,794.0 | 64,202.8 | 65,233.6 | 66,373.6 |

| P=provisional; - no data. Countries producing less than 50 tonnes have been excluded. Source FAO |

|||||||

Production in Australia recorded an increase of 3.4 per cent per year from 2000 to 2012. However, there is a wide difference between the figures published by the FAO and those released by the Australian Egg Corporation Ltd (AECL). The AECL data is calculated from hatchings and for 2012 it has issued an output figure of 394 million dozen or about 288,000 tonnes, well above the FAO’s 215,000 tonnes.

Production in 2013 is estimated at around 397 million dozen. There are some 300 egg farms with nearly 17 million layers of which 68 per cent are in cages, seven per cent in barn systems and 25 per cent in free-range units. Some 98 per cent lay brown eggs.

According to Jeff Ironside, AECL’s chairman, 2013 has been a challenging year with the industry confronted by changing consumer and retail demand, increased government regulations and compliance requirements, greater community interest in the ways that eggs are produced, as well as having to cope with increased husbandry challenges including biosecurity threats, and higher operating costs.

New Zealand has a laying flock of just over three million birds. FAO data show little movement in the quantity of eggs produced since 2008. However, New Zealand’s representative at the International Egg Commission (IEC) claims that output in 2012 at 61,000 tonnes was some six per cent down on 2011.

Although 83 per cent of the flock is in conventional cages, these will have to be replaced - probably by colony systems - by 2022. Barn production currently accounts for three per cent of the birds with free-range flocks making up the remaining 14 per cent. The Egg Producers Federation of New Zealand represents the interests of some 125 commercial producers.

Among the other countries in Oceania, a significant number managed to double production over the 12 years reviewed.

April 2014