GLOBAL POULTRY TRENDS 2014: Slowing of Asian Population Growth to Impact Chicken Consumption

As the rate of growth in Asia's human population slows down, average poultry meat consumption per person has increased to 9.4kg, according to the latest estimate, reports industry analyst, Terry Evans.As birth rates decline, so population growth continues to slow. Over the decade to 2023, population growth is projected at around one per cent per year compared with 1.2 per cent in the previous decade.

According to USDA long-term projections, while population growth rates in developing countries are expected to decline, they will remain above those pertaining to the rest of the world. Hence, the developing countries’ share of the global population will continue to rise and could account for 82 per cent of the total in 2023.

While India’s population forecast growth is expected to slip from 1.5 per cent (for 2001 to 2010) to 1.2 per cent per year for the period 2013 to 2023, China’s will slow from 0.5 to 0.3 per cent. Consequently, by 2030, Asia’s human population at almost 4,900 million will actually represent a smaller percentage of the global total at 58 per cent than the figure of 3,717 million or almost 61 per cent in 2000.

Global economic growth is assumed to average 3.2 per cent per year from now until 2023 with relatively weak growth in the developed economies being offset by a stronger growth in developing countries reflecting in particular, relatively high growth in China, India and other areas of developing Asia.

An economic growth rate of 7.2 per cent is projected for China and 7.0 per cent for India while, for Asia as a whole, an annual growth rate of some 4.6 per cent is envisaged.

As standards of living improve, low-and middle-income consumers not only buy more food but also tend to eat more varied diets that include increasing their consumption of meat.

Global meat consumption is forecast by the OECD and the FAO to reach 36.3kg in retail weight by 2023, or some 2.4kg per person higher than in 2013. During this period, poultry meat uptake is expected to rise from 13.2kg to 14.9kg per person. Hence, more than 70 per of the increase in meat uptake will be accounted for by poultry.

After population growth, and real income increases among the poorer sections of communities, the other key factors influencing the demand for chicken are the prices of competitive meats and changes in people’s attitudes to food and their eating habits. In both instances the prevailing factors favour chicken.

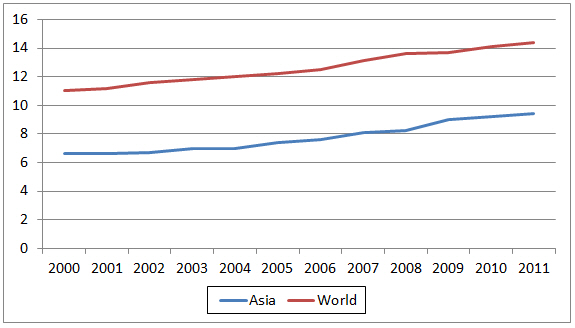

On poultry meat consumption, the good news from the FAO is that it has, at last, updated the data from 2009 to 2011 (Table 1 and Figure 1).

| Table 1. Asia's human population and poultry meat consumption | ||||||||||

| Human population (millions) | Poultry meat consumption (kg/person/year) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Country | 2000 | 2010 | 2020 | 2030 | 2000 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Afghanistan | 20.6 | 28.4 | 35.7 | 43.5 | 0.6 | 1.1 | 2.0 | 1.6 | 2.3 | 2.6 |

| Armenia | 3.1 | 3.0 | 3.0 | 3.0 | 5.3 | 10.9 | 14.7 | 11.1 | 14.0 | 14.6 |

| Azerbaijan | 8.1 | 9.1 | 10.0 | 10.5 | 4.4 | 6.9 | 7.3 | 8.9 | 8.8 | 9.8 |

| Bahrain | 0.7 | 1.3 | 1.5 | 1.6 | - | - | - | - | - | - |

| Bangladesh | 132.4 | 151.1 | 169.6 | 185.1 | 1.0 | 1.3 | 1.3 | 1.3 | 1.4 | 1.4 |

| Bhutan | 0.6 | 0.7 | 0.8 | 0.9 | - | - | - | - | - | - |

| Brunei Darussalam | 0.3 | 0.4 | 0.5 | 0.5 | 42.8 | 54.3 | 54.7 | 55.5 | 56.9 | 62.5 |

| Cambodia | 12.2 | 14.4 | 17.0 | 19.1 | 2.1 | 1.9 | 2.0 | 2.3 | 2.0 | 1.9 |

| China, mainland | 1,280.4 | 1,359.8 | 1,432.9 | 1,453.3 | 9.5 | 11.1 | 11.8 | 12.1 | 12.3 | 12.1 |

| China, Hong Kong SAR | 6.8 | 7.1 | 7.6 | 7.9 | 52.9 | 54.5 | 53.2 | 54.5 | 64.4 | 67.1 |

| China, Macao SAR | 0.4 | 0.5 | 0.6 | 0.7 | 23.0 | 28.2 | 34.3 | 33.4 | 34.8 | 36.7 |

| China, Taiwan | 21.9 | 23.2 | 23.6 | 23.5 | 34.3 | 33.0 | 35.0 | 38.5 | 32.7 | 33.9 |

| Cyprus | 0.9 | 1.1 | 1.2 | 1.3 | 29.3 | 25.9 | 27.3 | 26.3 | 26.5 | 26.6 |

| Georgia | 4.7 | 4.4 | 4.2 | 4.0 | 6.3 | 8.7 | 11.2 | 11.6 | 11.6 | 12.7 |

| India | 1,042.3 | 1,205.6 | 1,353.3 | 1,476.4 | 0.9 | 1.5 | 1.6 | 1.8 | 1.9 | 1.8 |

| Indonesia | 208.9 | 240.7 | 269.4 | 293.5 | 4.0 | 5.8 | 5.9 | 6.0 | 6.5 | 7.0 |

| Iran Isl. Rep. | 65.9 | 74.5 | 84.2 | 91.3 | 12.6 | 20.6 | 21.7 | 27.3 | 25.2 | 25.9 |

| Iraq | 23.8 | 31.0 | 40.7 | 51.0 | 3.1 | 7.2 | 7.6 | 11.7 | 10.2 | 14.4 |

| Israel | 6.0 | 7.4 | 8.5 | 9.6 | 58.2 | 67.9 | 68.6 | 66.6 | 66.7 | 69.7 |

| Japan | 125.7 | 127.4 | 125.4 | 120.6 | 15.6 | 17.2 | 17.3 | 17.0 | 18.3 | 19.1 |

| Jordan | 4.8 | 6.5 | 8.1 | 9.4 | 25.3 | 28.2 | 28.3 | 27.9 | 33.6 | 33.7 |

| Kazakhstan | 14.6 | 15.9 | 17.5 | 18.6 | 3.7 | 13.4 | 12.5 | 11.9 | 12.6 | 16.1 |

| Korea Dem. Peo. Rep. | 22.8 | 24.5 | 25.8 | 26.7 | 1.3 | 1.8 | 1.8 | 1.8 | 1.7 | 1.7 |

| Korea Rep | 46.0 | 48.5 | 50.8 | 52.2 | 10.8 | 13.3 | 13.2 | 14.0 | 15.3 | 16.4 |

| Kuwait | 1.9 | 3.0 | 4.0 | 4.8 | 49.6 | 70.8 | 75.6 | 88.2 | 74.9 | 63.3 |

| Kyrgyzstan | 5.0 | 5.3 | 6.2 | 6.9 | 1.3 | 4.0 | 5.3 | 6.4 | 8.2 | 6.5 |

| Lao Peo. Dem. Rep. | 5.4 | 6.4 | 7.7 | 8.8 | 2.2 | 3.4 | 3.4 | 3.5 | 3.7 | 3.8 |

| Lebanon | 3.2 | 4.3 | 4.9 | 5.2 | 26.8 | 26.6 | 26.9 | 25.3 | 20.8 | 22.0 |

| Malaysia | 23.4 | 28.3 | 32.9 | 36.9 | 31.4 | 37.0 | 36.3 | 38.6 | 38.2 | 38.1 |

| Maldives | 0.3 | 0.3 | 0.4 | 0.4 | 6.1 | 11.5 | 11.3 | 11.4 | 11.9 | 12.9 |

| Mongolia | 2.4 | 2.7 | 3.1 | 3.4 | 0.1 | 0.5 | 0.8 | 0.8 | 1.8 | 2.1 |

| Myanmar | 48.5 | 51.9 | 56.1 | 58.7 | 5.0 | 15.4 | 16.7 | 19.2 | 20.9 | 22.0 |

| Nepal | 23.2 | 26.9 | 30.0 | 32.9 | 0.6 | 0.6 | 0.6 | 0.6 | 0.6 | 1.4 |

| Occ. Palestinian Terr. | 3.2 | 4.0 | 5.1 | 6.4 | 22.9 | 13.5 | 14.4 | 14.4 | 15.6 | 19.9 |

| Oman | 2.2 | 2.8 | 4.5 | 4.9 | - | - | - | - | - | - |

| Pakistan | 143.8 | 173.2 | 203.4 | 231.7 | 2.3 | 3.4 | 3.6 | 3.9 | 4.1 | 4.4 |

| Philippines | 77.7 | 93.4 | 110.4 | 127.8 | 7.4 | 9.2 | 9.8 | 10.0 | 10.7 | 11.0 |

| Qatar | 0.6 | 1.8 | 2.5 | 2.8 | - | - | - | - | - | - |

| Saudi Arabia | 20.2 | 27.3 | 32.3 | 35.6 | 39.3 | 38.7 | 39.5 | 41.9 | 45.5 | 48.0 |

| Singapore | 3.9 | 5.1 | 6.1 | 6.6 | - | - | - | - | - | - |

| Sri Lanka | 18.9 | 20.8 | 22.3 | 23.3 | 3.4 | 5.1 | 5.1 | 4.8 | 4.9 | 4.9 |

| Syrian Arab Rep. | 16.4 | 21.5 | 25.7 | 29.9 | 6.6 | 9.1 | 7.6 | 8.3 | 8.8 | 8.6 |

| Tajikstan | 6.2 | 7.6 | 9.6 | 11.4 | 0.1 | 2.9 | 3.5 | 3.8 | 3.2 | 3.3 |

| Thailand | 62.3 | 66.4 | 67.9 | 67.6 | 12.5 | 12.4 | 11.8 | 11.9 | 12.2 | 12.3 |

| Timor - Leste | 0.9 | 1.1 | 1.3 | 1.6 | 6.0 | 5.1 | 5.0 | 5.0 | 4.8 | 4.9 |

| Turkey | 63.2 | 72.1 | 80.3 | 86.8 | 10.4 | 14.8 | 14.5 | 16.8 | 18.3 | 19.0 |

| Turkmenistan | 4.5 | 5.0 | 5.7 | 6.2 | 2.3 | 3.9 | 5.1 | 4.9 | 4.1 | 3.9 |

| United Arab Emirates | 3.0 | 8.4 | 10.6 | 12.3 | 44.7 | 44.4 | 44.4 | 43.8 | 37.5 | 39.4 |

| Uzbekistan | 24.8 | 27.8 | 31.5 | 34.2 | 1.0 | 1.1 | 1.0 | 1.0 | 1.2 | 1.5 |

| Viet Nam | 80.9 | 89.1 | 97.1 | 101.8 | 4.5 | 6.8 | 8.8 | 10.0 | 11.7 | 15.6 |

| Yemen | 17.5 | 22.8 | 28.4 | 34.0 | 7.2 | 10.6 | 9.6 | 11.2 | 10.9 | 9.9 |

| ASIA | 3,717.4 | 4,165.4 | 4,581.5 | 4,886.9 | 6.6 | 8.1 | 8.5 | 9.0 | 9.2 | 9.4 |

| WORLD | 6,127.7 | 6,916.2 | 7,716.7 | 8,424.9 | 11.0 | 13.1 | 13.7 | 13.6 | 14.1 | 14.4 |

| - no data available Source: FAO |

||||||||||

Global poultry meat consumption expanded by 2.5 per cent per year between 2000 and 2011 from 11kg per person per year to 14.4kg on an eviscerated weight basis.

Uptake in Asia has been a little more rapid at 3.3 per cent per year as it rose from 6.6kg to 9.4kg per person. By now, the global figure will likely exceed 15kg per person.

The individual country data is most heartening with only a handful recording a lower average uptake in 2011 than in 2000. When looking at what may appear to be disappointing figures or even a reduction in consumption, it is important to take account of how the rate of population growth compares with that for the available supplies of poultry meat.

Based on this FAO data, the Israelis are the biggest poultry meat eaters in Asia with an average annual consumption of 69.7kg per person in 2011. Others recording high consumption levels include Hong Kong, Kuwait and Brunei Darussalam. However, the human populations in these countries are relatively small and hence the total meat consumed is not great.

In contrast, while uptake in India in 2011 averaged around 1.8kg per person, when this is multiplied by the human population of some 1.2 billion, the total quantity of poultry eaten is a massive 2.2 million tonnes. Currently uptake is considered to be in the region of 3kg per person, and the industry considers that this will triple to 9kg by 2030.

Although per-capita chicken consumption in China has remained steady at around 12kg per person between 2009 and 2011, expansion is anticipated as living standards rise.

Consumption patterns are changing such that pork, which back in 1985 commanded an 80per cent market share, now only accounts for 65 per cent. Poultry is increasing in popularity primarily because it is cheaper than pork.

According to a Rabobank report, poultry is particularly popular in quick-service restaurants which are on the increase. Most Chinese purchase their meat requirements from “wet” markets but urban shoppers are increasingly buying perishable foods from supermarkets. Per-capita chicken consumption is estimated to increase by 2.4 per cent per year in the next 10 years.

Further Reading

You can view the previous article on trends in the Asian chicken sector by clicking here.

September 2014