GLOBAL POULTRY TRENDS 2014: Poultry Meat Uptake in Europe Sure to Slow

Poultry meat consumption in the Russian Federation and Ukraine has increased quite rapidly in recent years and has now caught up with the average for the European Union, according to Terry Evans in his final report looking at the chicken meat industry in Europe.Price competitiveness, convenience and health considerations will guarantee that poultry meat consumption (primarily chicken) will continue to expand for the foreseeable future.

Global meat consumption per person, expressed in retail weight, is expected to reach 36.3kg by 2023. This will be 2.4kg more than the average for 2010 to 2012, with poultry meat accounting for 1.7kg or 72 per cent of this gain. By 2023, poultry uptake will come close to 15kg per person on a retail weight basis, which is calculated at 88 per cent of the carcass or eviscerated weight.

For Europe, the 2023 figure stands at 23.6kg against 21.2kg for 2011-2013, while the corresponding figures for the EU are 21.0kg and 22.2kg.

The poultry meat consumption data provided by the FAO (Table 1 and Figure 1) are on a carcass weight or ready-to-cook basis. The figures do not actually relate to consumption but to an estimate of the quantity available for consumption. Account is taken of production adjusted for trade, changes in stocks and losses in storage and transportation. In addition, it must be remembered that in most instances, the number of people eating the food in any year is also an estimate.

| Table 1. Poultry meat consumption (kg per person and year) | |||||||

| 2000 | 2005 | 2007 | 2008 | 2009 | 2010 | 2011 | |

|---|---|---|---|---|---|---|---|

| Africa | 4.3 | 4.7 | 5.2 | 5.5 | 5.6 | 6.1 | 6.2 |

| Americas | 31.5 | 34.1 | 36.0 | 37.1 | 35.9 | 37.6 | 38.6 |

| Asia | 6.6 | 7.4 | 8.1 | 8.5 | 9.0 | 9.2 | 9.4 |

| Europe | 15.9 | 19.2 | 20.2 | 21.3 | 21.7 | 21.4 | 21.7 |

| EU | 19.6 | 21.0 | 20.6 | 21.5 | 21.9 | 21.4 | 21.7 |

| Oceania | 30.1 | 35.6 | 36.8 | 35.4 | 35.6 | 37.4 | 42.1 |

| WORLD | 11.0 | 12.2 | 13.1 | 13.6 | 13.7 | 14.1 | 14.4 |

| Source: FAO | |||||||

Clearly, the calculated uptake per person has increased in all regions of the world between 2000 and 2011 (Table 1).

Not surprisingly, consumption is lowest in Africa at 6.2kg per person but even here, uptake rose by almost 2kg per person.

Per-capita consumption in 2011 was highest in Oceania at more than 42kg per person, the increase since 2000 amounting to a massive 12kg per person. But, it must be remembered that the population of this region at that time was just 37.2 million (0.5 per cent of the world total of nearly 7,000 million), contrasting markedly with the 1,057 million (15 per cent) of people living in Africa.

The Americas recorded a consumption gain of more than 7kg over the period to reach a high of 38.6kg per person.

The increase in Asia was relatively small at 2.8kg but again, consideration has to be given to the size of this region's human population which stood at 4,210 million or 60 per cent of the global total in 2011.

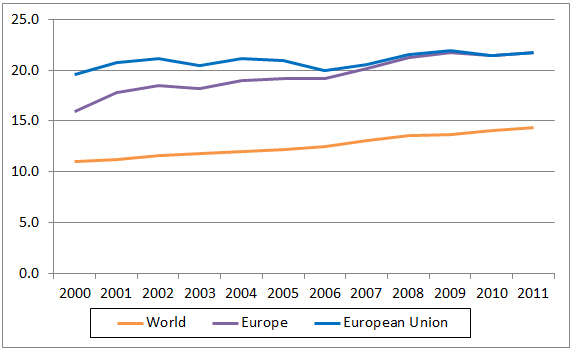

The gain in Europe of 5.8kg compared with the smaller 3.4kg world average rise. However, it is noticeable that the increase in the EU was just 2.1kg and that the average for the whole of Europe has risen more quickly and now matches that for the EU (Table 1 and Figure 1).

| Table 2. Human population of Europe and poultry meat consumption | ||||||||||

| Human population (millions) | Poultry meat consumption (kg/person/year) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Country | 2000 | 2010 | 2015 | 2020 | 2000 | 2007 | 2008 | 2009 | 2010 | 2011 |

| Albania | 3.3 | 3.2 | 3.2 | 3.3 | 5.3 | 9.8 | 12.8 | 13.7 | 14.3 | 13.4 |

| Andorra | 0.1 | 0.1 | 0.1 | 0.1 | - | - | - | - | - | - |

| Austria | 8.0 | 8.4 | 8.7 | 9.0 | 17.1 | 17.7 | 17.1 | 17.7 | 19.1 | 19.2 |

| Belarus | 10.3 | 10.9 | 11.4 | 11.7 | 9.1 | 18.0 | 20.9 | 22.2 | 24.6 | 25.2 |

| Belgium | 10.3 | 10.9 | 11.4 | 11.7 | 19.6 | 24.8 | 24.3 | 21.5 | 21.4 | 22.9 |

| Bosnia/Herzegovina | 3.8 | 3.9 | 3.8 | 3.7 | 4.0 | 7.5 | 10.4 | 11.4 | 11.9 | 14.2 |

| Bulgaria | 8.0 | 7.4 | 6.8 | 6.2 | 16.4 | 19.2 | 20.0 | 21.9 | 18.8 | 21.1 |

| Croatia | 4.5 | 4.3 | 4.2 | 4.0 | 7.0 | 10.5 | 10.5 | 10.3 | 8.2 | 8.9 |

| Czech Rep. | 10.3 | 10.6 | 10.9 | 11.1 | 22.2 | 24.6 | 24.7 | 25.0 | 24.0 | 23.1 |

| Denmark | 5.3 | 5.6 | 5.8 | 6.0 | 17.3 | 20.0 | 22.7 | 18.9 | 22.0 | 25.4 |

| Estonia | 1.4 | 1.3 | 1.3 | 1.2 | 17.7 | 17.7 | 18.3 | 20.0 | 21.0 | 19.2 |

| Faroe Isl. | 0.1 | 0.1 | 0.1 | 0.1 | - | - | - | - | - | - |

| Finland | 5.2 | 5.4 | 5.5 | 5.7 | 13.7 | 18.8 | 19.7 | 18.4 | 17.5 | 18.2 |

| France | 59.2 | 63.2 | 66.6 | 69.3 | 26.5 | 21.0 | 21.2 | 23.7 | 23.1 | 23.1 |

| Germany | 83.5 | 83.0 | 81.9 | 79.6 | 13.3 | 13.8 | 14.7 | 15.0 | 14.9 | 14.7 |

| Gibraltar | # | # | # | # | - | - | - | - | - | - |

| Greece | 11.0 | 11.1 | 11.1 | 11.0 | 13.3 | 13.8 | 14.7 | 15.0 | 14.9 | 14.7 |

| Holy See | # | # | # | # | - | - | - | - | - | - |

| Hungary | 10.2 | 10.0 | 9.8 | 9.5 | 34.0 | 27.7 | 28.3 | 27.4 | 23.7 | 25.2 |

| Iceland | 0.3 | 0.3 | 0.4 | 0.4 | 11.3 | 26.1 | 25.8 | 23.9 | 22.9 | 24.5 |

| Ireland | 3.8 | 4.5 | 5.0 | 5.4 | 30.9 | 26.1 | 27.6 | 26.0 | 23.2 | 21.4 |

| Italy | 57.0 | 60.5 | 61.4 | 61.2 | 18.9 | 15.8 | 17.0 | 17.4 | 17.6 | 18.1 |

| Latvia | 2.4 | 2.1 | 2.0 | 1.9 | 10.3 | 21.6 | 22.3 | 20.9 | 21.5 | 20.8 |

| Liechtenstein | # | # | # | # | - | - | - | - | - | - |

| Lithuania | 3.5 | 3.1 | 3.0 | 2.8 | 9.8 | 26.3 | 26.6 | 24.4 | 23.2 | 23.4 |

| Luxembourg | 0.4 | 0.5 | 0.6 | 0.6 | 14.8 | 18.0 | 20.0 | 19.0 | 19.7 | 24.2 |

| Macedonia Rep. | 2.1 | 2.1 | 2.1 | 2.1 | 12.1 | 19.0 | 15.6 | 17.0 | 17.4 | 17.0 |

| Malta | 0.4 | 0.4 | 0.4 | 0.4 | 15.1 | 24.0 | 24.7 | 25.6 | 26.2 | 25.5 |

| Moldova | 4.1 | 3.6 | 3.3 | 3.1 | 5.1 | 12.3 | 14.5 | 12.0 | 15.7 | 15.6 |

| Monaco | # | # | # | # | - | - | - | - | - | - |

| Montenegro | - | 0.6 | 0.6 | 0.6 | - | 11.4 | 13.3 | 12.5 | 14.5 | 13.8 |

| Netherlands | 15.9 | 16.6 | 17.0 | 17.3 | 12.6 | 14.5 | 27.0 | 22.5 | 16.1 | 12.4 |

| Norway | 4.5 | 4.9 | 5.4 | 5.8 | 10.1 | 14.9 | 17.6 | 17.0 | 17.1 | 17.2 |

| Poland | 38.3 | 38.2 | 38.2 | 37.5 | 14.5 | 21.1 | 18.6 | 21.4 | 21.5 | 21.7 |

| Portugal | 10.3 | 10.6 | 10.6 | 10.4 | 26.6 | 26.4 | 27.8 | 28.7 | 29.6 | 29.2 |

| Romania | 22.4 | 21.9 | 21.2 | 20.2 | 12.9 | 19.0 | 18.3 | 20.7 | 17.0 | 15.0 |

| Russian Federation | 146.8 | 143.6 | 140.0 | 133.6 | 9.8 | 22.0 | 22.4 | 22.8 | 22.3 | 23.1 |

| San Marino | # | # | # | # | - | - | - | - | - | - |

| Serbia | - | 9.7 | 9.2 | 8.6 | - | 7.0 | 7.8 | 8.3 | 8.8 | 11.0 |

| Slovakia | 5.4 | 5.4 | 5.5 | 5.4 | 12.6 | 18.1 | 18.1 | 17.5 | 16.1 | 16.4 |

| Slovenia | 2.0 | 2.1 | 2.1 | 2.1 | 28.9 | 19.8 | 24.5 | 26.2 | 24.8 | 23.5 |

| Spain | 40.3 | 46.2 | 47.8 | 48.2 | 25.4 | 27.4 | 25.4 | 27.7 | 25.5 | 27.0 |

| Sweden | 8.9 | 9.4 | 10.0 | 10.7 | 10.2 | 14.8 | 16.1 | 15.4 | 15.9 | 15.7 |

| Switzerland | 7.2 | 7.8 | 8.7 | 9.5 | 12.8 | 14.9 | 15.8 | 15.9 | 15.9 | 16.3 |

| Ukraine | 49.1 | 46.1 | 43.2 | 39.8 | 4.4 | 17.7 | 22.6 | 23.1 | 23.0 | 22.0 |

| United Kingdom | 59.2 | 62.3 | 65.9 | 68.9 | 28.5 | 29.0 | 28.2 | 29.0 | 30.2 | 30.8 |

| EUROPEAN UNION | 487.9 | 506.0 | 515.7 | 518.5 | 19.6 | 20.6 | 21.5 | 21.9 | 21.4 | 21.7 |

| EUROPE | 729.1 | 740.3 | 743.6 | 736.4 | 15.9 | 20.2 | 21.3 | 21.7 | 21.4 | 21.7 |

| # less than 50,000; - no figure Source: FAO |

||||||||||

This emphasises the rapid increase that has occurred in the Russian Federation and Ukraine (Table 2).

Although uptake in Ukraine was steady at 22 to 23kg per person since 2008, the gain of 4kg per person average recorded in 2000 has been amazing.

Uptake in the Russian Federation rose by more than 13 kg per person during the review period. Indeed, by 2023, consumption in Russia and Ukraine, on a retail weight basis, is forecast to reach 30.1kg and 25.8kg, respectively.

For the European Union, total poultry meat consumption is forecast to rise from around 12.3 million tonnes in 2013 to a shade over 13 million tonnes in 2023. When expressed on a per-capita retail weight basis, these figures are equivalent to 21.2kg rising to 22.1kg.

| Table 3. Human population of the world (millions) | ||||||||

| Region | 2000 | 2010 | 2020 | 2030 | ||||

|---|---|---|---|---|---|---|---|---|

| Number | % | Number | % | Number | % | Number | % | |

| Africa | 808.3 | 13.2 | 1,031.1 | 14.9 | 1,312.1 | 17.0 | 1,634.4 | 19.4 |

| Americas | 841.7 | 13.7 | 942.7 | 13.6 | 1,037.5 | 13.4 | 1,120.1 | 13.3 |

| Asia | 3,717.4 | 60.7 | 4,165.4 | 60.2 | 4,581.5 | 59.4 | 4,886.9 | 58.0 |

| Europe | 729.1 | 11.9 | 740.3 | 10.7 | 743.6 | 9.6 | 736.4 | 8.7 |

| Oceania | 31.2 | 0.5 | 36.7 | 0.5 | 42.1 | 0.6 | 47.3 | 0.6 |

| WORLD | 6,127.7 | 100.0 | 6,916.2 | 100.0 | 7,716.7 | 100.0 | 8,424.9 | 100.0 |

| Source: FAO | ||||||||

A key factor impacting on the growth in poultry meat consumption is any change in human population numbers.

Here, the picture for Europe is not good as, after peaking at 743.7 million in 2010, the total declines to 736.4 million in 2030 (Table 3). So, as a proportion of the global total, the population in Europe will fall from almost 12 per cent in 2000 to only 8.7 per cent in 2030. Hence, any growth in total poultry meat uptake in this region will have to come from increases in the quantities eaten per person.

Apart from the price advantage over its competitors, among the opportunities for EU poultry meat producers to expand demand Peter van Horne of Wageningen University in his 'Competitiveness of the EU Poultry meat sector' report, observes that consumption will continue to grow.

Dr van Horne explains that this is a result of the perception of poultry being a healthy meat and also because of a growing demand for alternative poultry, especially in north-west of Europe, where new market opportunities have emerged through segmenting the market with animal-welfare products such as freedom food, free-range or organic chickens. Although these birds grow more slowly than conventional broilers, they are considered to be a premium product for which consumers are willing to pay a higher price. Although such a move may result in a switch in purchases from the basic to the premium product and so total uptake may not increase, the price premiums which these 'speciality' products command can lead to improved profits for producers.

For most producers, however, increased benefits will come from further product development targeting added-value items to the needs of both the retail and food service sectors.

October 2014