GLOBAL POULTRY TRENDS: Significant Chicken Trade in Some Countries of Africa and Oceania

Africa and Oceania are the two regions that trade the lowest volumes of chicken meat, according to industry analyst, Terry Evans. However, within those areas, South Africa and Benin export significant volumes and Angola is a leading importer within Africa. In Oceania, Australia is the main exporter while French Polynesia and Samoa lead the league table of chicken meat importers.Angola Set to Become Biggest Chicken Importer in Africa

As economic conditions improve throughout Africa, so the demand for animal protein will rise. However, doubts have been expressed about the region’s ability to meet this growing demand, in which case increased imports are envisaged.

This concern is underlined by the data presented in Table 1, which show that imports of fresh/frozen chicken into African countries increased almost five-fold between 2000 and 2011 when they totalled 1.25 million tonnes.

| Table 1. World trade in fresh/frozen chicken meat ('000 tonnes) | |||||||

| 2000 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

|---|---|---|---|---|---|---|---|

| EXPORTS | |||||||

| Africa | 9.5 | 3.0 | 6.5 | 9.5 | 46.2 | 61.5 | 56.2 |

| Americas | 3,627.4 | 5,445.3 | 6,366.4 | 7,311.6 | 7,234.9 | 7,252.7 | 7,530.4 |

| Asia | 1,432.2 | 482.9 | 639.1 | 765.8 | 876.2 | 1,187.7 | 1,373.1 |

| Europe | 1,805.1 | 2,157.6 | 2,302.6 | 2,344.7 | 2,592.1 | 3,115.7 | 3,477.8 |

| Oceania | 14.3 | 20.7 | 28.2 | 31.0 | 33.3 | 29.2 | 32.8 |

| World | 6,888.4 | 8,109.5 | 9,342.9 | 10,462.6 | 10,782.7 | 11,646.8 | 12,470.2 |

| IMPORTS | |||||||

| Africa | 259.0 | 612.3 | 673.6 | 717.8 | 861.2 | 1,065.5 | 1,254.4 |

| Americas | 556.0 | 1,033.4 | 1,132.3 | 1,373.7 | 1,380.3 | 1,416.6 | 1,509.8 |

| Asia | 3,276.7 | 2,976.2 | 3,654.0 | 4,274.9 | 4,670.9 | 5,021.5 | 5,780.0 |

| Europe | 1,811.2 | 3,094.2 | 3,171.0 | 3,374.2 | 3,095.0 | 2,879.7 | 2,790.3 |

| Oceania | 26.4 | 32.0 | 35.6 | 37.9 | 42.6 | 47.0 | 57.0 |

| World | 5,929.3 | 7,748.4 | 8,666.5 | 9,778.5 | 10,050.0 | 10,430.4 | 11,391.5 |

| Source: FAO | |||||||

Up until 2011, South Africa was the biggest importer of fresh/frozen chicken in the region. In this instance, the increase was not the result of the inability of domestic producers to meet the growing demand but because of a significant rise in relatively low-priced imports. In broad terms, imports currently account for around 18 per cent of the South African market. According to the South African Poultry Association (SAPA) the local industry is competitive in the production of whole birds and would support a lowering in the tariff applicable to imported whole birds, provided more severe tariffs and anti-dumping measures are applied to imports of chicken portions.

Having peaked at some 371,000 tonnes in 2012, South Africa's frozen broiler imports declined to 355,000 tonnes in 2013 while, according to USDA forecasts, this year will witness a further contraction to around 340,000 tonnes. Of the total in 2013, whole bone-in broiler portions accounted for 41 per cent and MDM (Mechanically Deboned Meat) 40 per cent. The remainder comprises whole birds, boneless portions and offal.

There has been a major change in the sources of supplies with recent years, seeing a big increase in shipments from the European Union, which enjoys a free-trade agreement with South Africa. Imports from this source accounted for 42 per cent of the total in 2013. In 2013, the EU is considered to have supplied nearly 150,000 tonnes of South Africa’s frozen broiler imports compared with little more than 4,000 tonnes back in 2009. The Netherlands was the leading supplier here, accounting for 45 per cent, followed by the UK with 26 per cent, Germany 15 per cent and Denmark five per cent. Some 79 per cent of this trade was bone-in portions.

Excluding receipts from the EU, Brazil accounted for 82 per cent of the remaining import business supplying almost 170,000 tonnes compared with about 190,000 tonnes in 2012. Some 72 per cent of the quantity from Brazil was MDM meat. SAPA contends that Brazil remains a threat due to its exchange rate dynamics and its competitive advantages in terms of climate, feed costs, economies of scale and government support.

The US is broadly excluded from the South African market by anti-dumping duties and technical trade barriers, hence is has tended to supply only niche markets with MDM meat and livers, worth some $3 million which is less than one per cent of South Africa’s total poultry meat imports. Some reports indicate that South Africa is considering the introduction of tariff rate quotas on US chicken in exchange for South Africa’s continued participation in the African Growth and Opportunity Act (AGOA) preferential trade scheme, which allows almost 95 per cent of South Africa’s exports into the US at zero or greatly reduced tariffs.

In July 2014, it was reported that preliminary anti-dumping duties on imports of frozen bone-in chicken from Germany, the Netherlands and the UK had improved the situation in South Africa’s domestic market.

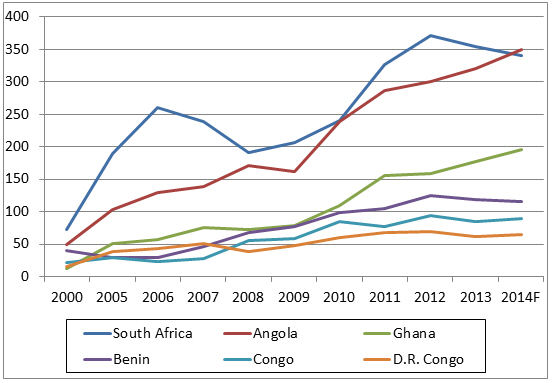

According to USDA data this year, Angola will become Africa’s largest chicken meat importer (Figure 1), purchases having risen rapidly from less than 50,000 tonnes in 2000 to an estimated 350,000 tonnes for 2014. Of the 290,000 tonnes bought in 2011, some 164,000 tonnes came from the US and almost 100,000 tonnes from Brazil.

One of the most dramatic changes in the import scene in this region has been the growth in purchases by Ghana. Back in 2000, the volume imported was a mere 12,000 tonnes but since 2010, the quantity has jumped from 109,000 tonnes to an estimated almost 200,000 tonnes for 2014 (Table 2, Figure 1). In 2011, the most recent year showing a breakdown of Ghana’s imports, the USA supplied nearly 43,500 tonnes, Belgium 42,500 tonnes and Brazil 41,500 tonnes.

| Table 2. Imports of fresh/frozen chicken meat by African countries (tonnes) | |||||||||||

| Country | 2000 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Angola | 47,300 | 128,969 | 137,543 | 170,612 | 160,770 | 238,357 | 286,761 | ||||

| Benin | 33,030 | 28,875 | 35,270 | 60,602 | 75,791 | 78,070 | 104,164 | ||||

| Botswana | 54 | 288 | 615 | 2,331 | 2,768 | 4,260 | 3,658 | ||||

| Burkina Faso | 0 | 0 | 0 | 0 | 4 | 14 | 5 | ||||

| Burundi | 0 | 195 | 5 | 0 | 0 | 15 | 11 | ||||

| Cameroon | 13,481 | 2,952 | 2,862 | 148 | 17 | 45 | 124 | ||||

| Cape Verde | 1,447 | 4,804 | 5,729 | 5,889 | 6,534 | 7,046 | 7,050 | ||||

| Central African Rep. | 0 | 46 | 63 | 82 | 163 | 192 | 256 | ||||

| Chad | 9 | 26 | 24 | 30 | 30 | 74 | 65 | ||||

| Comoros | 932 | 4,794 | 5,748 | 5,596 | 6,805 | 10,923 | 8,017 | ||||

| Congo | 8,959 | 22,732 | 27,670 | 25,641 | 50,936 | 22,187 | 79,200 | ||||

| Congo Dem. Rep. | 11,800 | 42,996 | 52,034 | 52,452 | 64,672 | 58,348 | 66,384 | ||||

| Cote d'Ivoire | 1,381 | 597 | 806 | 832 | 804 | 697 | 945 | ||||

| Djibouti | 420 | 6,184 | 5,786 | 6,214 | 4,330 | 1,348 | 714 | ||||

| Egypt | 4,000 | 10,105 | 9,037 | 20,900 | 56,164 | 126,041 | 34,731 | ||||

| Equatorial Guinea | 3,800 | 8,097 | 12,216 | 12,615 | 14,415 | 13,917 | 20,178 | ||||

| Ethiopia | 1 | 1 | 1 | 2 | 0 | 0 | 1 | ||||

| Gabon | 13,399 | 22,639 | 32,624 | 30,410 | 44,357 | 43,686 | 54,901 | ||||

| Gambia | 1,790 | 4,327 | 6,250 | 2,475 | 4,197 | 3,558 | 5,682 | ||||

| Ghana | 13,865 | 51,403 | 75,373 | 71,731 | 78,837 | 109,179 | 155,056 | ||||

| Guinea | 798 | 2,336 | 2,187 | 3,106 | 3,100 | 5,569 | 8,202 | ||||

| Guinea-Bissau | 430 | 708 | 744 | 1,029 | 979 | 1,208 | 1,450 | ||||

| Kenya | 1 | 0 | 0 | 0 | 0 | 0 | 0 | ||||

| Lesotho | 4,600 | 5,300 | 5,400 | 5,400 | 5,500 | 5,500 | 5,500 | ||||

| Liberia | 2,700 | 3,752 | 6,219 | 7,719 | 6,481 | 11,441 | 20,397 | ||||

| Libyan Arab Jam | 651 | 0 | 60 | 0 | 0 | 0 | 6 | ||||

| Madagascar | 0 | 0 | 0 | 101 | 0 | 161 | 553 | ||||

| Malawi | 0 | 0 | 0 | 8 | 33 | 3 | 4 | ||||

| Mali | 7 | 25 | 96 | 130 | 130 | 27 | 27 | ||||

| Mauritania | 2,786 | 2,689 | 6,267 | 5,423 | 8,818 | 7,306 | 11,377 | ||||

| Mauritius | 2 | 204 | 195 | 190 | 124 | 146 | 117 | ||||

| Morocco | 395 | 282 | 327 | 530 | 160 | 364 | 412 | ||||

| Mozambique | 2,900 | 10,812 | 8,461 | 9,199 | 12,605 | 9,748 | 12,797 | ||||

| Namibia | 16,909 | 10,853 | 10,644 | 26,936 | 3,606 | 3,245 | 9,970 | ||||

| Niger | 10 | 1 | 1 | 1 | 1 | 118 | 298 | ||||

| Nigeria | 0 | 145 | 2,972 | 600 | 32,837 | 45,032 | 1,009 | ||||

| Rwanda | 0 | 0 | 0 | 1 | 4 | 2 | 9 | ||||

| Sao Tome/Principe | 0 | 322 | 489 | 721 | 680 | 1,145 | 1,131 | ||||

| Senegal | 413 | 82 | 230 | 1,100 | 1 | 0 | 0 | ||||

| Seychelles | 329 | 1,034 | 1,137 | 988 | 1,548 | 1,767 | 2,691 | ||||

| Sierra Leone | 1,189 | 1,908 | 3,632 | 4,141 | 3,838 | 6,421 | 8,840 | ||||

| South Africa | 66,577 | 228,068 | 210,153 | 169,013 | 184,522 | 219,638 | 298,560 | ||||

| Sudan | 0 | 450 | 262 | 677 | 835 | 1,623 | 3,627 | ||||

| Swaziland | 592 | 179 | 105 | 28 | 21 | 21 | 21 | ||||

| Tanzania Un. Rep. | 74 | 31 | 2 | 1 | 0 | 72 | 786 | ||||

| Togo | 1,829 | 2,845 | 2,636 | 11,559 | 6,876 | 6,715 | 8,972 | ||||

| Tunisia | 71 | 95 | 1,583 | 132 | 1,102 | 2,599 | 2,529 | ||||

| Uganda | 13 | 0 | 1 | 2 | 7 | 17 | 351 | ||||

| Zambia | 1 | 1 | 1 | 1 | 0 | 558 | 967 | ||||

| Zimbabwe | 24 | 143 | 133 | 655 | 15,803 | 17,123 | 25,905 | ||||

| AFRICA | 258,970 | 612,295 | 673,596 | 717,773 | 861,205 | 1,065,526 | 1,254,411 | ||||

| Source: FAO | |||||||||||

Congo and the Democratic Republic of Congo are expected to import less chicken this year than two years ago but compared with 2000, the quantities are substantially higher.

| Table 3. Leading chicken meat importers in Africa ('000 tonnes) | |||||||||||

| 2000 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013E | 2014F | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| South Africa | 72 | 189 | 260 | 239 | 191 | 206 | 240 | 326 | 371 | 355 | 340 |

| Angola | 49 | 103 | 130 | 138 | 171 | 161 | 239 | 287 | 301 | 321 | 350 |

| Ghana | 12 | 51 | 57 | 75 | 72 | 79 | 109 | 155 | 158 | 177 | 195 |

| Benin | 40 | 29 | 29 | 46 | 67 | 77 | 98 | 104 | 124 | 118 | 115 |

| Congo | 21 | 29 | 23 | 28 | 56 | 58 | 84 | 77 | 94 | 84 | 90 |

| Dem. Rep. Congo | 15 | 38 | 43 | 51 | 39 | 47 | 60 | 67 | 69 | 62 | 65 |

| E = estimate; F = forecast Source: USDA |

|||||||||||

African countries are not heavily involved in exporting chicken meat, the total amounting to around 50,000 to 60,000 tonnes a year in 2010/2011 (Table 4).

Since 2009, the major player appears to have been Benin, selling between 30,000 and 42,000 tonnes a year, the main recipient being Nigeria.

Until recently, shipments from South Africa were small. However, 2012 witnessed a massive 80 per cent rise in this country’s poultry exports, of which chicken accounted for more than 23,000 tonnes. The main destinations were Mozambique (37 per cent), Lesotho (21 per cent), with Zimbabwe and Namibia each taking nine per cent.

| Table 4. Exports of fresh/frozen chicken meat from African countries (tonnes) | |||||||

| Country | 2000 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|

| Algeria | 0 | 3 | 11 | 0 | 0 | 6 | 33 |

| Benin | 722 | 26 | 2,850 | 4 | 30,340 | 41,807 | 41,807 |

| Botswana | 0 | 10 | 60 | 220 | 1 | 8 | 26 |

| Burundi | 0 | 0 | 0 | 2 | 0 | 0 | 0 |

| Cameroon | 1 | 5 | 0 | 0 | 1 | 1 | 0 |

| Cape Verde | 1 | 7 | 7 | 5 | 0 | 0 | 0 |

| Chad | 0 | 1 | 0 | 0 | 0 | 0 | 0 |

| Congo | 0 | 5 | 0 | 0 | 0 | 0 | 0 |

| Cote d'Ivoire | 2 | 2 | 4 | 3 | 20 | 17 | 12 |

| Egypt | 458 | 94 | 32 | 206 | 1,928 | 1,928 | 2,165 |

| Ethiopia | 0 | 1 | 0 | 0 | 0 | 0 | 0 |

| Gabon | 6 | 0 | 0 | 0 | 0 | 0 | 0 |

| Ghana | 14 | 0 | 0 | 0 | 18 | 0 | 0 |

| Kenya | 6 | 15 | 20 | 185 | 29 | 50 | 50 |

| Malawi | 0 | 0 | 0 | 0 | 0 | 0 | 2 |

| Mali | 0 | 25 | 1 | 0 | 0 | 84 | 84 |

| Mauritania | 0 | 0 | 0 | 0 | 0 | 28 | 0 |

| Mauritius | 10 | 2 | 0 | 0 | 0 | 1 | 92 |

| Morocco | 27 | 0 | 0 | 1,800 | 32 | 34 | 34 |

| Namibia | 122 | 676 | 1,655 | 4,204 | 455 | 283 | 283 |

| Senegal | 2 | 228 | 38 | 1 | 1 | 1 | 0 |

| Seychelles | 0 | 44 | 56 | 26 | 26 | 26 | 26 |

| South Africa | 6,393 | 1,773 | 1,714 | 2,319 | 11,802 | 14,708 | 6,789 |

| Swaziland | 250 | 33 | 0 | 0 | 0 | 0 | 0 |

| Tanzania Un. Rep. | 160 | 0 | 0 | 0 | 0 | 0 | 1 |

| Togo | 175 | 24 | 0 | 0 | 307 | 248 | 138 |

| Tunisia | 0 | 0 | 76 | 393 | 1,173 | 2,228 | 4,524 |

| Uganda | 0 | 0 | 10 | 0 | 3 | 3 | 3 |

| Zambia | 46 | 1 | 1 | 31 | 22 | 8 | 50 |

| Zimbabwe | 1,116 | 0 | 0 | 51 | 0 | 5 | 0 |

| AFRICA | 9,511 | 2,975 | 6,535 | 9,502 | 46,210 | 61,526 | 56,171 |

| Source: FAO | |||||||

Oceania Imports More Chicken

Imports of fresh/frozen chickens into Oceania more than doubled between 2000 and 2011 to reach 57,000 tonnes (Table 5). In the latter year, French Polynesia was the major buyer taking almost 14,000 tonnes – of which 11,800 tonnes came from the US – followed by Samoa with nearly 11,000 tonnes and Tonga 9,500 tonnes.

| Table 5. Imports of fresh/frozen chicken meat by countries in Oceania (tonnes) | |||||||

| Country | 2000 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|

| American Samoa | 1,600 | 25 | 45 | 0 | 0 | 0 | 0 |

| Australia | 0 | 19 | 1 | 0 | 0 | 41 | 12 |

| Cook Isl. | 520 | 784 | 857 | 729 | 637 | 878 | 1,538 |

| Fiji | 707 | 1,948 | 1,082 | 1,408 | 1,116 | 1,419 | 1,137 |

| French Polynesia | 9,912 | 11,412 | 12,076 | 11,888 | 12,312 | 12,755 | 13,763 |

| Guam | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Kiribati | 570 | 1,008 | 957 | 757 | 762 | 617 | 492 |

| New Caledonia | 5,300 | 6,354 | 7,683 | 8,024 | 8,627 | 7,709 | 8,478 |

| Niue | 60 | 79 | 82 | 54 | 45 | 60 | 25 |

| Papua New Guinea | 1 | 986 | 1,305 | 2,269 | 3,881 | 3,779 | 6,169 |

| Samoa | 4,100 | 4,445 | 6,022 | 7,191 | 7,489 | 9,660 | 10,859 |

| Solomon Isl. | 100 | 295 | 459 | 657 | 817 | 879 | 2,801 |

| Tonga | 2,531 | 3,768 | 3,934 | 3,475 | 5,376 | 7,156 | 9,512 |

| Tuvalu | 290 | 190 | 243 | 234 | 286 | 336 | 325 |

| Vanuatu | 740 | 1,037 | 873 | 1,169 | 1,243 | 1,720 | 1,933 |

| OCEANIA | 26,431 | 32,350 | 35,619 | 37,855 | 42,591 | 47,009 | 57,044 |

| Source: FAO | |||||||

Exports of fresh/frozen chicken from the region have shown little movement in recent years around 33,000 tonnes a year, of which 29,000 tonnes were shipped from Australia and 4,000 tonnes from New Zealand (Table 6).

Of Australia’s exports in 2011, some 6,700 tonnes went to Hong Kong, almost 6,000 tonnes to both Papua New Guinea and the Philippines and 4,000 tonnes to South Africa. Australian exports are currently put at around 34,000 tonnes a year or about three per cent of production.

Some 95 per cent comprise frozen cuts and offal, such as feet, kidneys and livers. The remaining five per cent is frozen whole chicken. It is generally thought that exports will grow to around 36,000 tonnes this year and again to about 45,000 tonnes by 2018/19, as the demand for frozen cuts and offal increases from South-East Asia and the Pacific regions.

Tegel is the main exporter in New Zealand and fully-cooked products account for 22 per cent of its business. Australia has been the main export destination to date but this company is now looking to sell to Japan, Hong Kong and African countries.

| Table 6. Exports of fresh/frozen chicken meat from countries in Oceania (tonnes) | |||||||

| Country | 2000 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 |

|---|---|---|---|---|---|---|---|

| Australia | 14,127 | 16,149 | 24,541 | 271,879 | 29,231 | 24,741 | 29,235 |

| Fiji | 3 | 42 | 29 | 88 | 98 | 29 | 61 |

| New Zealand | 128 | 4,470 | 3,584 | 3,738 | 3,998 | 4,379 | 3,457 |

| Tonga | - | - | 1 | 0 | 0 | 0 | 0 |

| OCEANIA | 14,258 | 20,661 | 28,155 | 31,015 | 33,327 | 29,149 | 32,767 |

| - no figure Source: FAO |

|||||||

November 2014