CME: 2011 Beef, Pork & Poultry Trade Surplus High

US - In 2011, the beef, pork and poultry trade surplus will exceed 12 billion pounds, write Steve Meyer and Len Steiner.Last week (DLR 10/17) we provided a recap of the latest trade data, which showed a significant increase in US beef, pork and poultry exports in August.

It is important to put that data in the broader context of trade flows and how that impacts the availability of red meat and poultry protein in the US market, now and in the coming months.

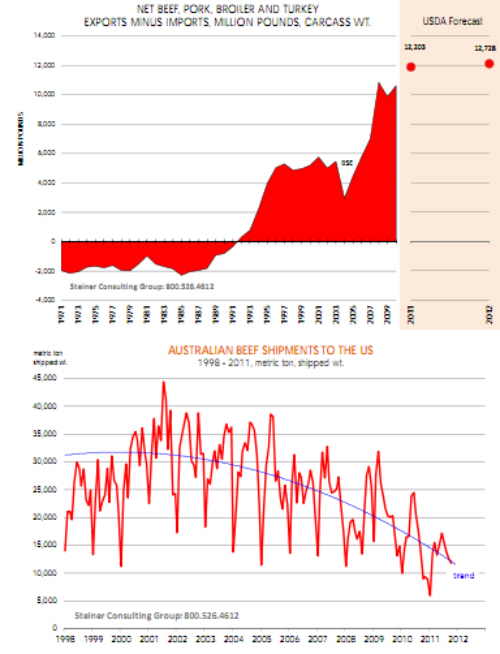

The top chart illustrates the long term view in US meat protein trade. It always struck us as disingenuous the argument against US beef imports considering that US farmers and meat producers benefit considerably from open markets and higher trade.

In 2011, the beef, pork and poultry trade surplus will exceed 12 billion pounds.

Over time, US producers have become increasingly efficient and a lower dollar has encouraged higher exports and a reduction in imports. USDA currently expects total US beef, pork, chicken and turkey exports to reach 14.9 billion pounds by the end of 2011.

Our own forecasts are that exports could actually break past the 15 billion pound mark. Total US beef, pork, broiler and turkey production for 2011 is currently forecast by USDA to be 91.7 billion pounds.

The rest of the world now purchases over 16 per cent of overall US output compared to just four per cent in 1990 and even less before then. And as exports have exploded, imports have actually drifted lower.

Beef accounts for about 70 per cent of all the meat protein imported in the US and beef imports have been trending lower in recent years.

Two major factors have impacted US beef import trends. The first is the US currency, which has made the US market much less attractive compared to other markets.

One example is striking. The price of 90CL beef trim, extra lean beef that goes into hamburgers and ground beef, has more than doubled since 2000.

However, if you were an Australian producer selling 90CL beef in the US market, hardly anything has changed since almost the entire gain in price has been erased by the depreciation in the value of the US dollar.

According to our calculations, the price of 90CL beef in Australian dollar equivalent today is about the same as it was back in 2000.

As the bottom chart shows, Australian beef shipments to the US have gone from about 35,000 MT a month back in 2000-2001 to around 10-15,000 MT today. The second driver behind lower imports is economic growth in emerging markets and booming meat protein demand in Asia, Russia and Brazil.

The US is a global leader in meat protein production. It enjoys significant agricultural resources, high levels of production efficiency and vertical integration and a favorable exchange rate.

This at a time when the global population has increased by one billion people (16.6 per cent) in the past decade. It’s a bull market in protein and the US is at the center of it all.