CME: Chicken Supplies Trending Downwards

US - Chicken supplies have been trending down in recent months and data from the US Department of Agriculture indicates that the situation is unlikely to improve anytime soon, write Steve Meyer and Len Steiner.Faced with sharply higher feed costs and softer foodservice demand, broiler producers have embarked on another round of cutbacks, similar to what we saw following the recession and bankruptcy of the top broiler producer at the time, Pilgrim’s Pride.

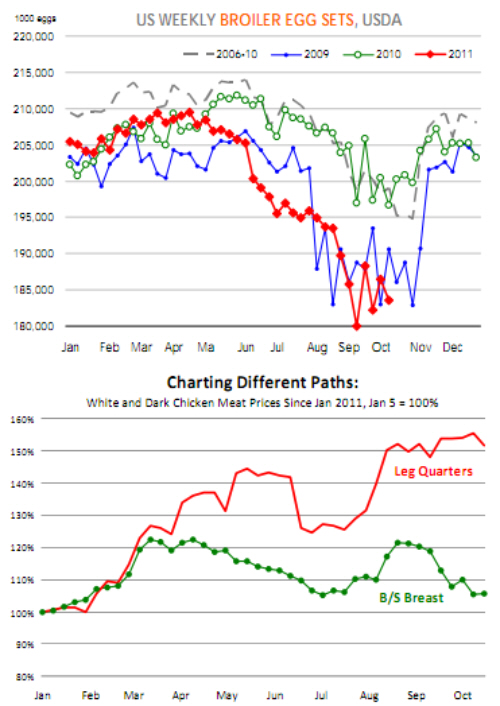

The latest data on egg sets shows that for the week ending 21 October, producers placed about 183.5 million eggs in incubators, 8.3 per cent less than the same time a year ago and 5.9 per cent less than the five year average.

Since early July, egg sets have averaged about sven per cent lower than year ago levels. The lower egg sets have translated into fewer chick placements and a significant reduction in the number of broilers coming to market.

USDA reported that monthly broiler slaughter in September was 723.1 million birds, down 4.2 per cent from a year ago. Some of this reduction in numbers has been offset by the trend of bringing heavier birds to market.

Heavier weight birds provide efficiency gains in an environment of high feed costs but they also blunt efforts to rein in production.

As a result, total broiler production in September was reported at 3.178 billion pounds, 1.8 per cent lower than a year ago. The heavier birds coming to market also have the side effect of bringing a disproportionately larger supply of breast meat to market, since the larger birds are normally bred to produce more breast meat tonnage.

In the last few months, the performance of breast meat prices has been very disappointing for broiler producers and likely a boon for retailers looking to feature inexpensive protein choices.

Also negative for producers has been the slowdown in foodservice business, which in recent years has accounted for a good portion of industry growth, particularly with regard to breast meat demand. Broiler producers often have long term contracts with foodservice chains and the contracts generally call for covering a percentage of business at a given price.

If foodservice sales decline, broiler producers suddenly are faced with excess supply that needs to be sold in the spot market.

Heavy weights and slow sales have created a glut of chicken breast raw material that will take time to work through.

On the other hand, leg quarters have benefited from a resurgence in export demand with the latest export data showing August chicken shipments up 183 million pounds or 36% from a year ago.

Leg quarter prices are now 50 per cent higher than at the beginning of the year while chicken breast prices are trading only a couple of per cent higher than last January