CME: Mixed Picture for Meat Protein Supply

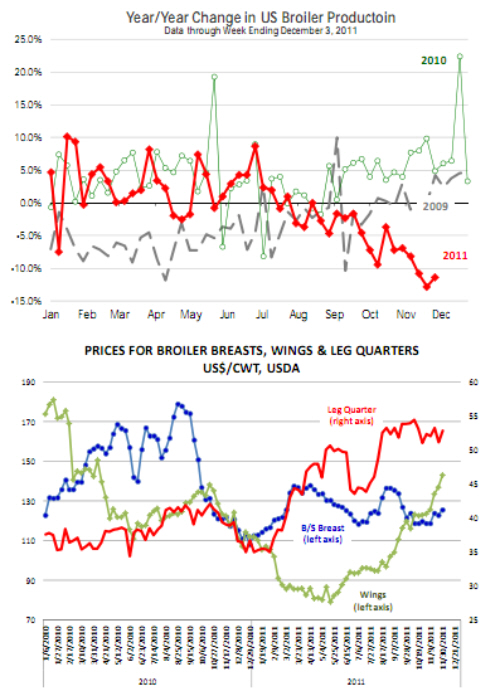

US - The supply picture for meat protein remains mixed, with more pork coming to market compared to a year ago but smaller beef and chicken supplies, writes Steve Meyer and Len Steiner. Combined beef, pork and poultry output (carcass wt. basis) for the week

ending 3 December was 1.553 billion pounds, 83 million

pounds or 5.1 per cent lower than the same week a year ago.

The primary reason for the smaller supplies is the reduction in broiler

production. As we have noted for sometime, broiler producers

have been cutting back, both in terms of the number of birds

coming to market and bird weights.

The broiler slaughter data

is reported with a one week lag (see table on page 2- Full Report) and for the

latest reported week total slaughter was down almost 13 per cent.

Early estimates for the week ending 3 December shows total

slaughter could be down as much as 10 per cent from last year. These

kind of cutbacks are not a two week anomaly, since October

weekly broiler slaughter has averaged 8.3 per cent below year ago levels.

Broiler egg sets and chick placements also continue to run

below year ago levels, implying lower slaughter for at least the

next three months. In addition to the lower slaughter weights,

producers also appear to have contained the ever steady gains

in broiler weights.

Current weights are running at about the

same level as a year ago, compared to two to three per cent growth in weights

through the summer months.

The cutbacks in bird weights are

significant as they allow producers to reap the full impact of the

smaller slaughter numbers. There are signs that prices have

finally started to respond to the reductions in supply. Breast

meat prices have been very weak for much of this year but they

have showed some counter-seasonal improvement in recent

weeks.

We continue to think that broiler breast prices have

been negatively impacted by the slowdown in foodservice business and will be hampered by the ongoing weakness in demand.

As we noted in the DLR this week, foodservice operators may

be indicating better same store sales but a larger portion of

them are also saying that foot traffic is lower than a year ago.

Everyone tends to look at same store sales but if you are a poultry producers looking to move volume, foot traffic matters a lot.

Other broiler items have benefited more by the reductions in

slaughter.

Broiler wings, a favorite staple during football season, are up 15 per cent compared to a year ago and now priced some 20

cents over the price of breast meat.

Leg quarter, a ubiquitous

export item, are 34 per cent higher than last year. With corn prices

down almost $2 per bushel since late August and higher prices,

broiler producer margins are improving. The question is, how

quickly does greed replace fear. The answer will have an impact on where beef and pork prices go in 2012.

Further Reading

| - | You can view the full report by clicking here. |