CME: Chicken Price Picture Looks Bleak

US - One of the key issues for livestock and poultry markets the rest of this year and into 2012 will be chicken prices — and the picture is still not very pretty at this point, write Steve Meyer and Len Steiner.While wholesale leg quarter and wing prices have both been at doubledigit increases versus 2010 levels for some time, breast meat has languished.

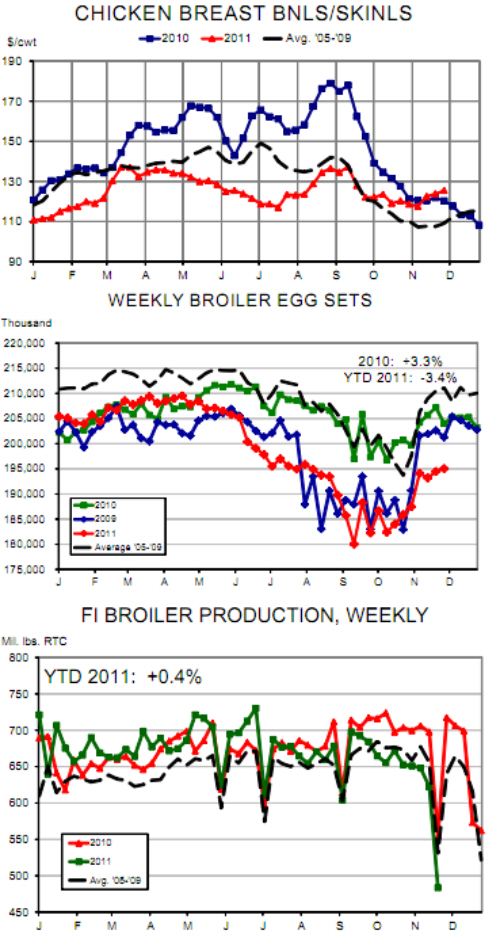

And don’t let the +1.6 per cent figure in Monday’s Production and Price Summary table fool you — that 1.6 per cent increase is a comparison to abysmal prices on year ago (see charts below). We find some rays of hope, though, in the fact that average chicken weights have actually been lower than one year ago in some recent weeks, breaking the + three per cent to + five per cent year-on-year pattern that first emerged in late 2010.

But that may be reaching for straws as the recent declines fit a pretty normal seasonal pattern, perhaps dashing our hopes that they indicate some reduction in the number of large birds destined for boning — the ones that have placed so much breast meat on the markets since late last year.

We still show slightly negative broiler margins but the –2.5 cents/lb. for Thanksgiving week is the closest they have been to breakeven levels since May — and the third lowest weekly loss estimate of 2011.

Total numbers are falling, though, and we have to believe that will eventually have some impact on breast meat prices. Broiler egg sets continued to run sharply lower than one year ago last week with only 195.037 million eggs placed in incubators. That sounds like a very large number but it is 4.4 per cent lower than last year and follows a number of weeks in which sets were six, seven and eight per cent lower than one year earlier.

Year-to-date, egg sets are 3.4 per cent below the level of 2010 and are very close to the levels of 2009, completely negating last year’s expansion. Since egg sets first moved below year-ago levels in early May, US broiler companies have place 5.6 per cent fewer eggs than last year.

The reduction in sets since May has logically pushed chick placements lower since June. That reduction is 5.4 per cent and brings the year-to-date number down by 2.6 per cent versus 2010.

Placements, too, have seen some very large year-on-year declines in more recent weekly data with every week from 1 October though mid November seeing reductions of 6.8 per cent or more with the peak being the week ended 1 October at – 9.3 per cent.

Lower placements since May have led to lower slaughter since July — by 5.8 per cent versus 2010. And those numbers grew even more negative during November with the figures for the weeks of 19 and 26 November being – 10.2 per cent and – 12.8 per cent versus last year.

The year-on-year numbers will moderate a bit in coming weeks but those are pretty astounding reductions for the chicken business.

But all of these reductions did not result in lower broiler output until September due primarily to larger birds. Since 9/1, though, production has fallen by 6.2 per cent versus last year with doubledigit declines in the most recent two weeks for which data are available.

When will these restrictions finally push breast meat higher? That’s the big question but we think it will indeed happen — and push pork and beef demand higher when it does!