CME: Relationships that May Impact Corn Prices

US - Writing in a recent Markets column for FarmweekNow.com, friend and noted analyst Dale Durchholz of AgriVisor pointed out some very interesting price relationships that may be impact corn prices in coming months, write Steve Meyer and Len SteinerThe dominant

force in the corn (and thus all grain and soybean) markets the past

few weeks has been growing weather challenges in Argentina.

Hot,

dry conditions in the primary corn growing country in the southern

hemisphere have driven corn futures anywhere from 60 to 80 cents

per bushel higher, depending on which contract you look at, since 15

December.

News reports and forecasts this week indicate that

conditions may be improving but the rally has moved corn futures

prices well away for that December trough — at least for the time being.

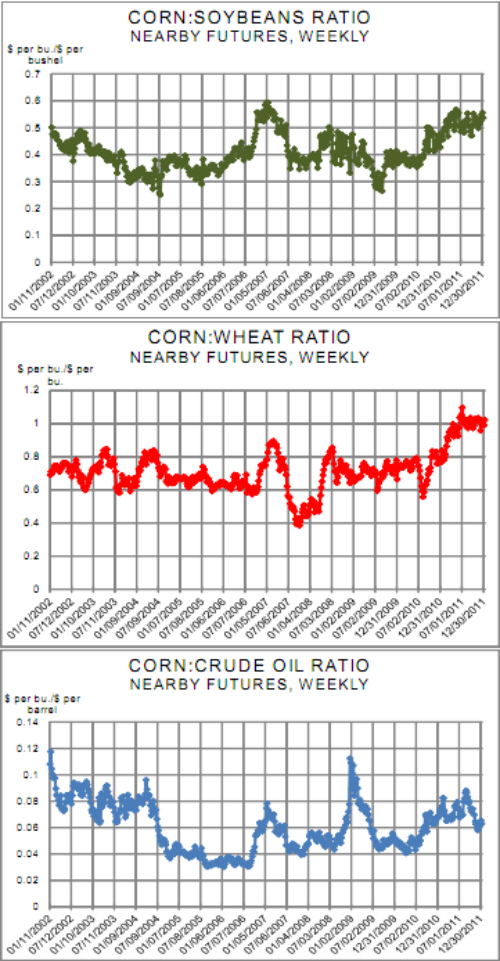

Mr Durchholz contends, though, that there are significant factors that will pressure corn prices as we go into the spring and summer and offers the ratios of corn price to wheat and soybean prices as

prime evidence. The charts of those two ratios, using weekly data in

order to include a longer historical period, appear at right and the

sources of Dale’s argument are clear: Both ratios are very near alltime highs.

We find the situation worthy of attention because these two

ratios measure corn relative to two major competitive situations.

The

first is value-in-use as livestock feed. Expensive corn will encourage

wheat feeding, pushing wheat prices higher and lowering this ratio.

It will also ration corn supplies and push corn prices lower in the future.

The second competitive situation is the Corn:Soybean ratio’s

implications for the value-in-use of land. It is clear that corn is going

to compete VERY well on a price basis with soybeans and every estimate we have seen of projected returns above cash costs for US

farmers suggest that this price ratio strength will translate into a peracre profitability advantage. The result will be more corn acres, more

corn (assuming weather is good) and lower corn prices re. soybeans.

But we also read Dale’s column and said “Yes, but what

about OIL?” The advent of corn-based ethanol has added a new value-in-use proposition to the corn market in recent years and has tied

corn prices to the prices of oil and gasoline. The bottom chart shows

that this measure of relative corn value is not quite as negative for

corn prices as are the others.

The 12/31 price ratio of .065 is very

close to the middle of the Corn:Crude Oil ratios observed since mid-

2006. It does not suggest price pressure in any direction for corn at

this time and would, in our mind, be more supportive to corn prices

than would either of the other two ratios. The ration does, though,

allow plenty of room for corn prices to fall without creating an unusual

relationship with crude oil. Not supportive of corn but not definitive.

We think two issues are vitally important. First, are there

any compelling reasons to think that the relative values of the crops in

question have changed more-or-less permanently? Second, which

price in each ratio is more likely to move and thus change the relationship? It certainly may be, as Durchholz states, corn but the U.S. accounts for a smaller world share of both wheat and soybean output

than it does corn. Growers in other countries will hold much more

influence on those prices.