CME: Forecasts Revised as Droughts Damage Crops

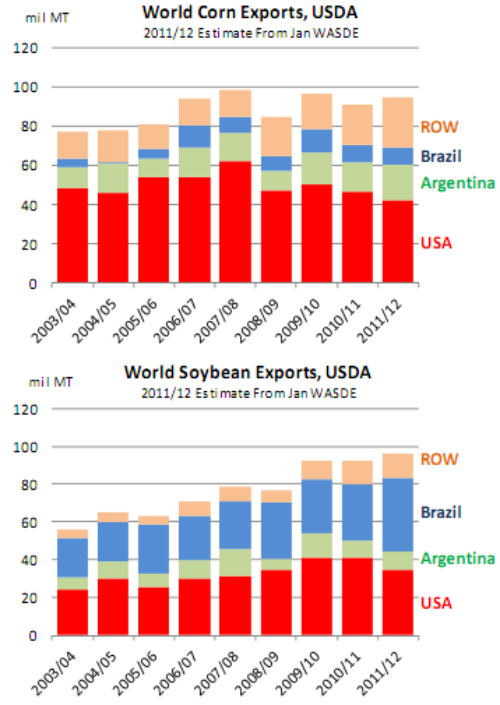

US - As US farmers get ready for plantings this spring, they are keeping a close eye on the developing crops in South America. And for good reason, write Steve Meyer and Len Steiner. Brazil and Argentina have developed

during the last two decades into two of the biggest agricultural

commodity suppliers in global markets. Today we’ll look at just

corn and soybeans.

In the early 1990s, Brazil and Argentina

accounted for about 7% of global corn exports (vs. US at 75%)

and 27% of global soybean exports (US at 60%). By 2003/04,

however, the situation had changed dramatically and the two

countries increased their share of corn exports to 20% while the

US share fell to 65%.

The shift in soybean trade was even more

dramatic, with Argentina and Brazil accounting for about half

of the global trade in soybeans and the US share down to 43%.

The January USDA forecasts of Argentine and Brazilian exports in the 2011.12 marketing year expected further

gains in their relative position in global corn and soybean trade.

Combined they were expected to export about 27 million MT of

corn (about 1.06 billion bushels), roughly 28% of world exports.

Soybean exports from S. America suffered last year but this

year higher production levels were supposed to bring S. American supplies back to about 50% of world export demand.

These

forecasts will likely be revised significantly lower later

this week as drought conditions in Argentina, and to a

lesser extent Brazil, appear to have significantly damaged crops. Much of the drought damage appears to have

happened in Argentina and analysts polled by Dow Jones ahead

of the USDA report now expect the Argentine crop to be about

21.65 million MT, about 4.35 million MT (~170 million bushels)

lower than the January forecast. Indeed, some analysts believe

that the damage to the Argentine crop could be even more extensive and wire reports indicate farmers that planted early

likely had to abandon their crops or re-plant with soybeans.

The Brazilian corn crop is pegged by analysts at 59.2 million

MT, about 1.8 million MT (71 million bu.) lower than the January forecast. With a combined production potential lowered by

almost a quarter of a billion bushels, there are plenty of questions as to corn availability in exports markets this spring and

summer. And while US corn supplies are expected to improve

by Q4 on account of higher acres and, fingers crossed, better

yields, in the short term US corn supplies remain limited. If these estimates materialize, higher prices will be

required to buy more corn from other suppliers, largely the US

and ration demand in countries that are large net corn importers (Japan, S. Korea, Mexico). For cattle and hog feeders and

packers, the drought in S. America represents one more threat

to their margins, squeezed by rising input costs as well as

pushback from end user down the supply chain.