CME: Corn Prices for 2012/13 to be Almost 20% Lower

US - USDA expects farmers to plant about 94 million acres of corn this spring, 2.1 million acres more than the previous year, write Steve Meyer and Len Steiner.Before looking at the upcoming USDA cattle on feed

report, a few words are in order about the USDA Outlook forum

currently under way in Washington DC.

USDA is expected to

issue its unofficial projection of grain supplies for 2012/13 during the outlook presentations and markets are paying close attention to some of their initial assumptions as they will influence the official estimates that will be released in May. In his

presentation, the USDA chief economist Joseph Glauber will

note that USDA expects farmers to plant about 94 million

acres of corn this spring, 2.1 million acres more than the

previous year. Combined wheat, corn and soybean acres are

expected to increase by 5.6 million acres. Ethanol use also is

expected to slow down and USDA now pegs ethanol demand for

2012/13 at 4.95 billion bushels compared to the current year

estimate of 5 billion bushels. Increased acres, stagnant demand

for ethanol and limited feed use (compared to prior years) will

likely cause USDA to bolster its estimates for corn ending stocks

in 2012-13. USDA now estimates corn prices for 2012/13

at $5 per bushel, down almost 20% from year prior. There

is plenty that could go wrong this year and pressure prices higher but this will be first salvo in what promises to be another

volatile year considering uncertainty about the size of current

corn stocks, escalating energy prices and dry conditions in key

corn production areas.

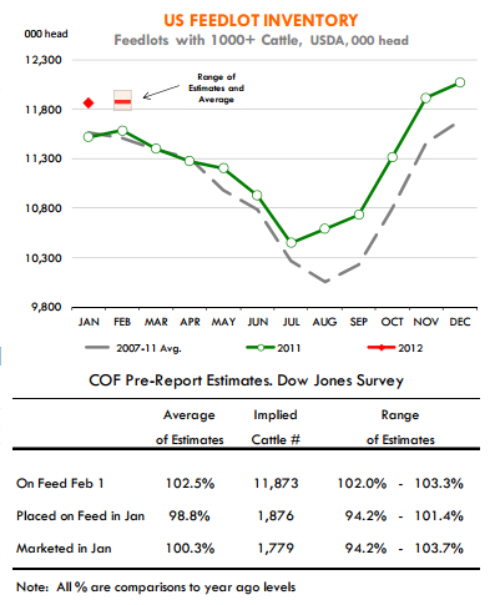

The upcoming cattle on feed report is expected to show

that on feed supplies will likely be steady compared to

the previous month although about 2.5% higher than a

year ago. Despite the higher feedlot inventories, cattle prices

continue to escalate as a larger portion of those cattle have yet

to reach market weights. The supply of feeders outside of feedlots is tight and this is reflected in feeder prices which continue

to hit record highs on a daily basis. The CME Feeder Cattle

index closed on Wednesday at a new record high of $156.57/cwt,

21% higher than a year ago.

Feeder supplies are expected to

remain tight in part because producers are expected to hold

back a few more replacement heifers. As usual, analysts polled

ahead of the report show a wide range of opinions regarding the

number of cattle placed in January (see table). On average, they

expect placements about 1.2% below year ago levels. Despite

strong cattle prices outfront, feedlots are cautious about placing

$160 feeders with $6+ corn. Cattle futures have surged higher

in recent days (although they were down yesterday) as packers push through higher prices. The big question mark, however, is

the outlook for cattle and beef prices after April 15. Will current

record high beef values scare away retailers and force them to

limit beef features into the grilling season? Last year cattle

broke sharply in May and memories of those loses are still fresh.

As for marketings, the analyst survey showed they expect feedlot sales about steady with a year ago. The steer and heifer

slaughter data for January shows slaughter was only slightly

lower than a year ago.