CME: Varying Future for US Poultry and Meat Exports

US - USDA’s Agricultural Projections to 2021 — also known as the USDA Baseline — that was unveiled at the USDA Agricultural Outlook Forum in February paints varying pictures for the future of US meat and poultry exports to the end of its title time horizon, writes Steve Meyer and Len Steiner.

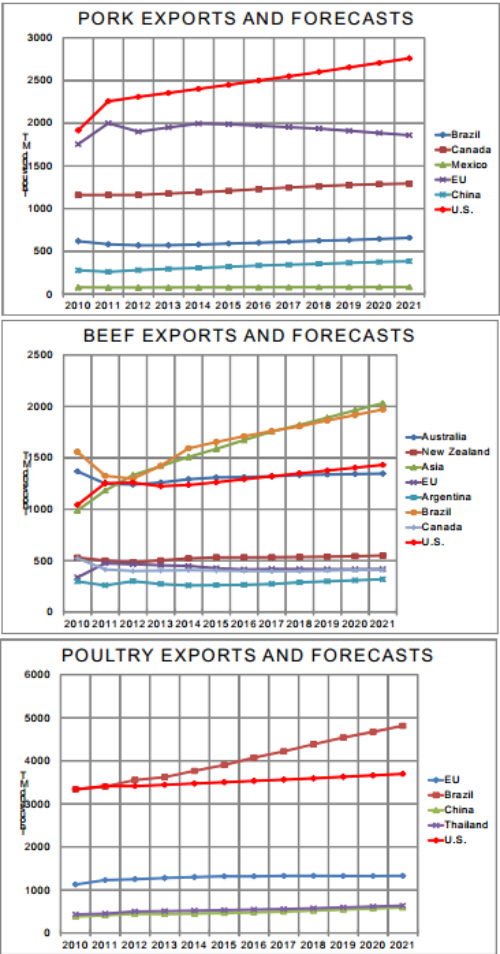

The charts below show total exports for the major players

in world pork, beef and poultry trade. Data for 2010 are final esimates

while 2011 numbers are preliminary. 2012-2021 are forecasts generated by the USDA model. Note that the U.S. is depicted by the bright

red line in each chart. Note also that USDA includes both chicken

and turkey in the poultry numbers but chicken dominates the category. In 2011, turkey accounted for 9.1% of total chicken-turkey exports.

USDA assumes that the U.S. population will continue to

grow at a rate of 0.9% but that the rate will slow 0.8% beginning in

2015 and continue at that rate until the end of the forecast period.

That assumption may, in fact, be a bit rosy since recent population

figures show the US growth rate slowed to just 0.7% for the year ended last July. Slower immigration and a lower birth rate contributed to

the slowdown and both can be attributed to the recession. The birth

rate fell by one-third during the Depression years.

In addition, the value of the U.S. dollar was projected by

USDA to fall during the forecast period. USDA did not include a any

worsening of the Eurozone debt crisis in this forecast. Should that

happen, the decline of the U.S. dollar would be slowed to some degree. The U.S. agricultural trade-weighted dollar index was forecast

to fall from roughly 85 (2005=100) in 2011 to about 79 in 2021. We

say “roughly” and “about” because the report did not include actual

numbers and those figures are read from a graph in the report.

USDA projects growing exports for all three major species

with pork being the largest winner. The projected increase of 503,000

metric tonnes for U.S. pork exports is over twice the increase of the

other five listed exporters combined. The U.S. accounted for 35.6%

of the total exports of the six listed exporters in 2011. That share increases to 39.2% by 2021 in the USDA forecasts. Note that pork

exports by Canada, Brazil and China also increase during the period

but at a much slower rate.

U.S. beef exports are also forecast to increase over the forecast period, gaining 14.2% from their levels of 2011. That increase

would be more impressive if the U.S. industry did not have to backfill a

projected significant reduction in beef exports in 2013 when lower

cattle numbers will limit the amount of product available for both domestic consumption and export. The key story for beef trade, though,

is quite obviously the continued dominance of Brazil and Asia — with

India being the primary driver of the Asian numbers. USDA expects

Asia to actually be the world’s largest beef supplier this year before a

rebound in Brazilian output puts them back in their number one position in 2013. Both Asia and Brazil are forecast to see increases of

52% in beef exports by 2021.

Finally, USDA expects Brazil to separate itself from the U.S.

and become the clear leader in poultry exports this year and for each

year through 2021. Brazil’s poultry exports are expected to increase

by 41.5% while those of the U.S. grow by 8.3% to 2021. Interestingly,

China’s poultry exports are forecast to grow by 44.4%.