CME: Broiler Exports Increased in January

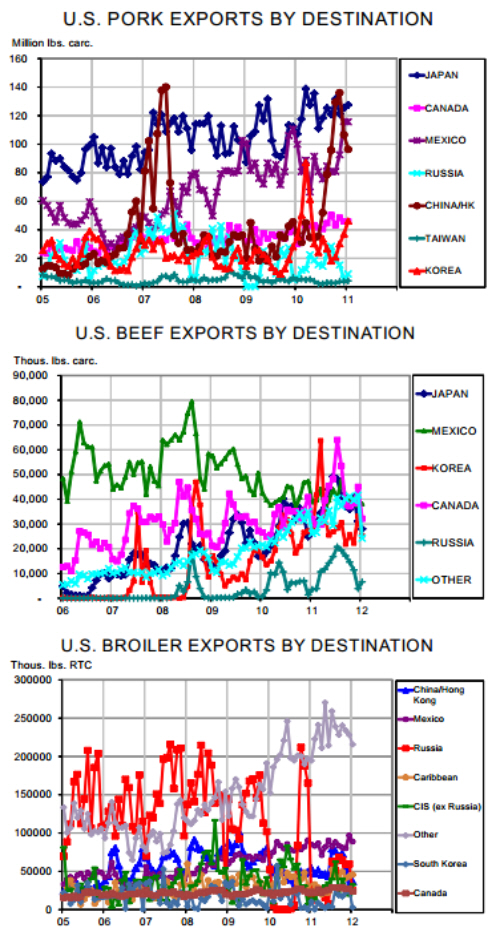

US - US pork exports began 2012 right where they left of 2011 — on the positive side of the ledger — while beef exports fell slightly in quantity versus January 2011 but grew in value and broiler exports increased over 9% versus year-ago levels.All-in-all, not a bad start to the year, especially amid concerns that a stronger dollar might negatively impact U.S. meat and poultry exports. The charts at right show exports to key markets for each species on a carcass/ready-to-cook weight basis. Some highlights of the data released by USDA’s Foreign Ag Service (product weight and value) and Economic Research Service (carcass weight data) are:

Pork exports remained stellar in January, posting their second highest monthly volume ever (second only to November 2011) and their third highest value on record. Carcass weight equivalent exports jumped 36% versus one year ago with shipments to China/ Hong Kong leading the year-on-year growth at +156%. The 96.318 million pounds, carcass weight, shipped to this market was 9.6% lower than in December and continues the downward trend from the near-record monthly high reached in November so there is still some concern about how far monthly sales to China/Hong Kong may fall before stabilizing.

China was not the only growth area for pork — shipments to Japan were +19% vs. January 2011. Canada was +51%, Korea was +31% and Mexico was +16%.

On a product-weight basis, shipments of pork, pork variety meats and sausage casings were 28% larger than one year ago. The value of those shipments was up 43% from last year and accounted for nearly $60 for each hog slaughtered in January.

Beef exports were 4.4% lower than in January 2011 on a carcass weight equivalent basis. That is the first year-on-year decline for monthly beef exports since September 2009. Slightly tighter supplies and cutout values that were over 10% higher than last year were the primary reasons for the decline.

The year-on-year decline for beef exports cannot be blamed on any one market. As can be seen in the chart, there is no clear cut leader among markets for U.S. beef as four different countries were the largest destination for beef exports at some point in 2011. Mexico was our largest customer in January but shipments there were actually 2% smaller than last year. Canada was the #2 market and the 32.1 million pounds, carcass equivalent, sent there in January was a slight increase on 2011. Shipments to Japan were 3.5% higher. And in the “numbers can be deceiving” category: Beef exports to Russia were 87% larger but Russia only accounted for 3.6% of total U.S. beef exports in January.

On a product weight basis, beef and beef variety meat exports were virtually even with 2011 while the value of those shipments grew by 14% according to the U.S. Meat Export Federation.

“Other” countries remain a critical part of chicken exports, accounting for 40% of the total. Among these, Taiwan was our second largest customer in January while Cuba was #3. The United Arab Emirates and Vietnam also ranked in the top 10 while all of the second 10 U.S. markets are included in the “Other” category.