CME: Grain Markets Await Plantings & Stocks Report

US - Grain markets are anxiously looking at the upcoming USDA reports on plantings and grain stocks, write Steve Meyer and Len Steiner.Trade continues to simultaneously asses the amount of rationing

that will be needed through the end of August and the supply of

new corn that will come to market this fall. Corn futures have

been trading in a narrow range as both bulls and bears have

been unable to make a convincing case so far. That could change

on Friday (reports are issued at 7.30 am Chicago time).

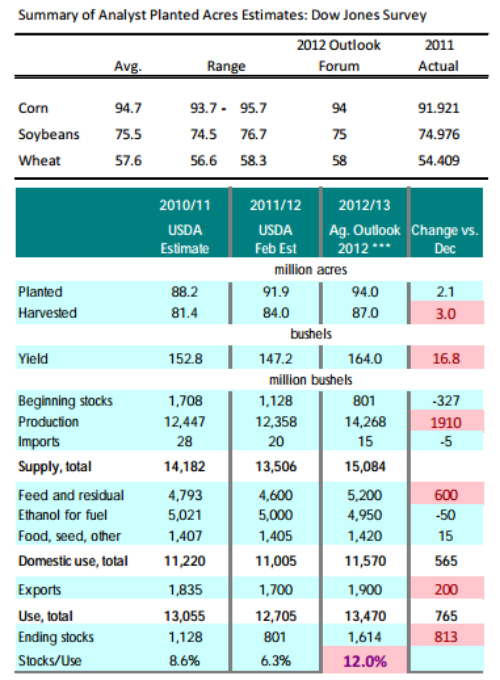

A survey of analysts conducted by Dow Jones indicated that on average they expect total plantings of 94.7 million acres, 2.8 million

acres or 3% more than a year ago and higher than the 2012

USDA outlook forum estimate. There is a significant spread in

the analyst projections, with some pegging total corn plantings to

be well over 95 million acres. Excellent weather in many areas

has encouraged some producers to get an early start, a somewhat

risky proposition given the risks of an April freeze. Still, early

planted corn offers significant rewards as it reduces the risk of a

yield loss in late July and early August. It also allows farmers to

bring their crop to market a little early and benefit from the

price spread between old and new crop. July corn is currently

priced at $6.42/bushel while Sep stands at $5.79 and Dec is

$5.55. Early plantings also could pull more acres away from

beans although this supply could be marginal.

We have included the last supply/demand corn table

that showed the preliminary (and unofficial) USDA estimates for

the upcoming corn crop. Based on 94 million planted acres,

USDA projected ending corn stocks for 2011/12 at 1.6 billion

bushels or 12% of use, a dramatic improvement over the current

year that projects ending stocks at just 800 million bushels or

6.3% of use. An additional million acres of plantings could yield

an extra 150 million bushels of production. Should this kind of

volume materialize, it could push prices below the $5 threshold.

But it is a big if and market participants remain unconvinced.

On the production side, there is no guarantee that an early

planting window will boost yields, it just reduces the chance that

yields will collapse. Short term drought conditions in Northwest

Iowa and points north and west bears watching. The increase in

corn acres comes at a price. Some of the acres will be corn on

corn, which reduces yields. Also, more acres will come from marginal land, which again tends to negatively affect yields. Expecting 164 bushels per acre (USDA adjusted trend) could prove to be illusory. On the demand side, trade continues to struggle with

projected export demand (China), livestock and poultry use (they

can’t eat just DDGs, can they?) and the ethanol blend wall. In

the short term, however, the corn market will remain focused on

planted acres for the new crop while March stocks could help (or

further confuse) where we stand with old crop supplies. Either

way, it is shaping up as another interesting Friday.