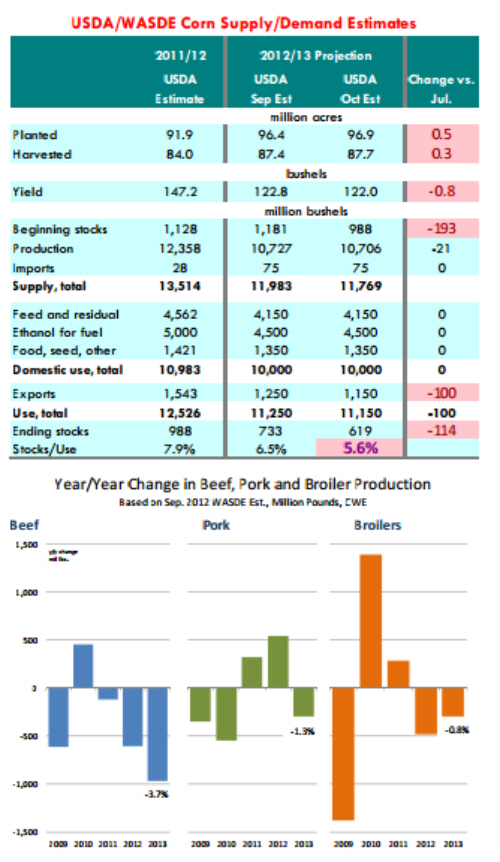

CME: WASDE Report Holds Little Relief for Producers

US - The latest USDA WASDE report offered little relief for livestock and poultry producers, write Steve Meyer and Len Steiner.Key corn supply numbers

came in below pre-report estimates. More importantly, the report

dispelled an expectation that was building in recent weeks that

yields would be higher than earlier projected. Some analysts were

pegging the yield as high as 127 bushels per acre, about 5 bushels

higher than what USDA reported. The October yield was pegged at

122 bu/acre, which in itself implied a 70 million bushel reduction in

output. However, USDA increased the number of planted acres

and harvested acres (per FSA certified data), leaving output down

just 21 million bushels from the September forecast. One of the

biggest changes in the report was one which was already known.

Carryover stocks are down 193 million bushels, reflecting the latest

data from the quarterly grain stocks survey. USDA offset some of

the reduction in available supply by lowering its estimate of US

corn exports by 100 million bushels. Currently USDA projects US

corn exports for 2012/13 at 1.150 billion bushels, 25.5% smaller

than a year ago.

USDA did not change its estimated ethanol and feed demand from the September report. Feed use is still expected to be

down 9% from the previous year while ethanol use is expected to be

down 10%. It remains to be seen if current corn prices are

enough to force these kinds of cutbacks in livestock and

energy demand for corn. At this point, USDA projects reductions

in the production of all three main meat proteins. Beef production

for 2013 is currently pegged at 24.726 billion pounds, 3.7% lower

than a year ago. US beef production for the period Q4 2012 - Q3

2013 (corresponding to the corn marketing year) is projected to be

down 3.3% from the previous year. Pork production for all of 2013

is projected at 23.017 billion pounds. This is about 95 million

pounds larger than what USDA projected in September but down

1.3% from a year ago. The upward revision came despite reports

that producers may be aggressively reducing their breeding herds.

Indeed, for the period Q4 2012—Q3 2013, USDA pork production is

down just 0.2% from the previous year. Broiler production is expected to decline further, down 0.8% from a year ago following a

1.3% reduction in 2012. Still, looking at output projections for Q4

2012 - Q3 2013 USDA expects broiler production to decline 1.3%.

Those that hold a more bullish view of the corn market point to

these kinds of reductions in meat production and conclude that feed

demand may not decline as much as what the USDA balance sheet

indicates. And with current corn ending stocks at minimum pipeline levels, something will have to give. Ethanol could decline further but that will likely require lower crude oil prices. There is

talk of higher corn imports, which could end up hitting 100 million bushels but still too small to make a dent. In the end, livestock producers could be squeezed further in order to force bigger

production cutbacks.