CME: Pork, Beef, Poultry Production up from Previous Year

US - While we continue to debate the impact of higher feed costs on meat supplies, combined beef, pork and poultry production for the week was up almost two per cent from a year ago.That growth in production was a result of

decisions that were made months ago, especially in the pork sector. Hard as producers will try, it will take time, and continued

losses, to bring meat production levels in line with feed availability.

US meat supplies have increased since summer, in part

because producers have accelerated marketings but also because

for some species (hogs, turkeys) there are more animal units than

a year ago. In August (the month for which we now have both output and trade data) combined beef, pork and poultry production

was 1.2% higher than a year ago. Higher pork and turkey supplies

more than offset reductions in beef and broiler production. Despite the increase in pork availability (+5.7% increase in

production), exports were lower than the previous year.

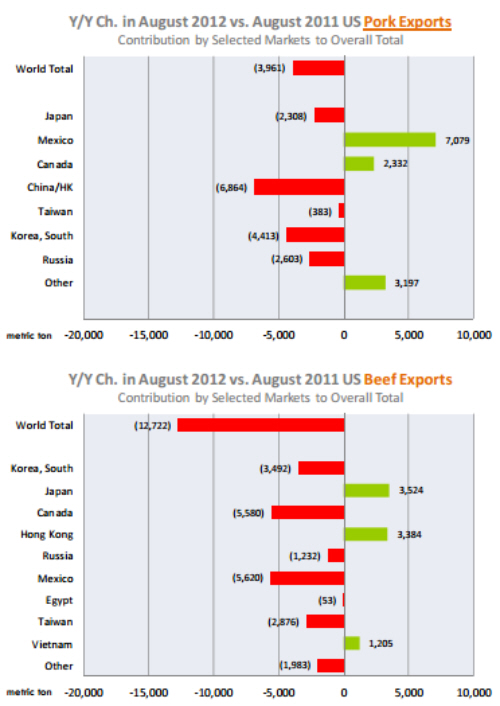

Total pork exports in August, on a product weight basis,

were down 3,961 MT or 3% from a year ago. Exports to Asian

markets were generally lower, led by a sharp decline in exports to

China/Hong Kong. Exports to this market in August were 6,864

MT or 27%% lower than a year ago. The lower prices did provide

opportunities for exports buyers that could react quickly, such as

Mexico and Canada. Shipments to Mexico jumped by 7,079 MT or

23% compared to a year ago. Pork prices, especially the price of

hams, declined notably in August, providing Mexican buyers with

buying opportunities, often at the expense of other proteins. Demand from China/Hong Kong has declined dramatically, as domestic pork supplies there have recovered. Pork exports to Russia

remain weak, with total shipments in August down 2,603 MT or

34% from a year ago.

US beef and veal exports have been soft all year, a

casualty of the surge in prices for many beef export items.

Total beef and veal exports in August were 73,981 MT, down

12,722 MT or 15% from a year ago. The reduction in beef and veal

exports has been broad based as world buyers respond to the sharp

increase in US beef prices. The only bright spot in US beef and

veal shipments was Japan, which has now emerged as the top

market for US beef. Total shipments to Japan in August were up

3,524 MT or 28% from a year ago. August exports to Canada and

Mexico, the other two top markets, were down 30% and 37%, respectively. Significantly lower pork prices in August may have

negatively impacted export beef demand, particularly in North

America. Mexican buyers are especially price sensitive and the

sharp break in pork prices likely shifted some purchases to lower

priced pork. Broiler exports also were down fort the second consecutive month. Total shipments of fresh/frozen chicken were

pegged at 288,363 MT, 19,578 MT or 6% from a year ago.