CME: Energy Markets Cause Concerns

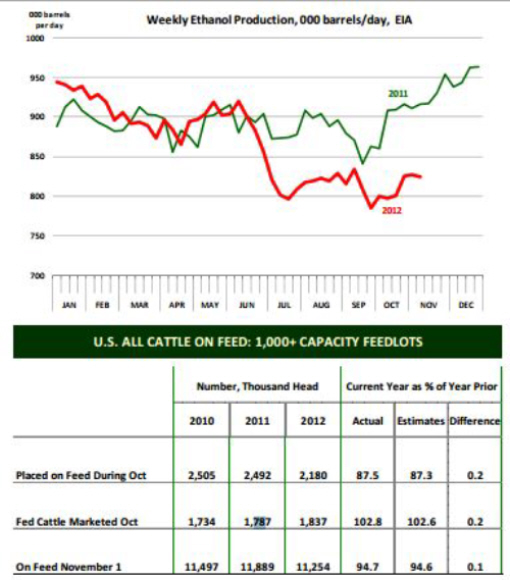

US - Livestock and poultry producers, meat packers and food retailers were holding out some hope that EPA might consider waving, lowering, or modifying the ethanol mandate until corn supplies recovered next harvest.Those hopes were dashed on Friday as the

request was denied since, according to the EPA news release,

“waiving the RFS mandate would have minimal impact on

ethanol demand.”

At this point, livestock and poultry producers

can do little but hope that energy markets remain depressed

enough to limit ethanol demand for corn until next harvest. It is

not a comfortable place to be. So far, ethanol production has averaged about 8.5 per cent below year ago levels since September and it is

currently running about 10 per cent below year ago levels.

In part this

reflects the impact of high grain prices but even more so it is a result of slowing gasoline demand (and hence lower need for ethanol

blending), the use of ethanol credits and lower overall crude oil

prices. USDA currently projects ethanol use for the 2012-13 marketing year to decline some 10 per cent from a year ago. If current conditions persist, that projection may be achievable. However, if crude

oil prices move sharply higher (say because of a conflict in the Middle East, or improving global demand), then ethanol output would

likely follow crude prices higher.

What the ethanol mandate has

done is inextricably tie grain, livestock and energy markets. The

problem is that while ethanol producers can quickly cut off production and then start again in a week, the cattle and hogs liquidated

today will take months and years to rebuild. Moreover, the farms

that are forced to sell may not be able to sustain the economic hit

and eventually go out of business.

The final result is a US meat

industry that is substantially smaller, meat prices that are substantially higher and US producers that will find it increasingly

difficult to compete in global markets.

On the same day that EPA rejected the request for waiving the ethanol mandate, a USDA survey of feedlots showed

further dramatic reductions in the number of cattle placed

on feed. The survey results came in very close to pre-report estimates and will likely have a limited impact on futures markets.

Feedlot placements have been declining steadily since feed prices

rocketed higher in June. Accumulated placements since June are

down 1.3 million head. The survey indicated that as of November

1, there were 11.254 million head of cattle on feed, 293,000 head or

5.3 per cent less than a year ago.

October placements were 2.180 million

head, 12.5 per cent lower than last year (pre-report estimates were looking

for a 12.7 per cent decline). The current pace of placements is consistent

with the forecast for a notable decline (-5 per cent or so) in cattle slaughter in Q1 and likely Q2 of 2013.

The expectation is for placements to

continue to decline in the next two to three months as feedlots

struggle with margins. It is notable, however, that despite fewer

cattle coming to market, overall beef production has held up relatively well, in large part because of big gains cattle weights.

Consider that for the period Jul - Sep, steer slaughter per marketing

day was on average 1.5 per cent lower than a year ago but beef production was up 0.3 per cent (note this is adjusted on a per marketing day

basis). Steer weights are currently running around 873 pounds

per carcass, 2 per cent higher than a year ago. This has helped offset

some of the slaughter reductions and keep beef prices in check.

The key risk to the market is if/when carcass weight gains slow

down. Winter weather is always a wild card, more so today when

feedlot supplies are especially tight.