CME: Lack of Growth for US Chicken Businesses

US - In a year full of surprises, one that has gotten a bit lost is the lack of growth in the US chicken business. Most analysts went into 2014 expecting US chicken companies to quickly ramp up production to take advantage of lower grain costs and their price advantage in the market?place, report Steve Meyer and Len Steiner.Chicken having a price advantage is nothing new but the situation this year set up perfectly for higher output and lower but still profitable prices which would provide an even larger than normal advantage against high priced beef and well priced pork.

Beef and pork have more than held up their end of that deal but chicken output growth has been a non-starter. But even those tighter than expected supplies — and thus availability/consumption — have not been able to light a fire under retail chicken prices.

What gives? Let’s go all the way back to 2011 and 2012 when livestock and poultry companies were paying through the nose for feed ingredients. Any thoughts of growth were canned as were, we understand, a large number of orders for breeder birds at the three major broiler genetics companies, Cobb Ventress (owned by Tyson), Hubbard and Aviagen. Those companies quite understandably reduced production capacity.

Fast forward to the winter of 2012-2013 when US companies were still paying huge prices for feed ingredients and Mexican broiler farms broke with avian influenza. Depopulation of Mexican breeder flocks created an opportunity for US breeders to sell genetics — primarily in the form of fertilised eggs, we understand — south of the border.

The reduction of breeder egg supplies continued well into 2013 even as the 2013 crop developed well, causing some optimism that exorbitant feed costs were behind us. The combination of cutbacks in the breeder flock and selling eggs to Mexico resulted in an aged flock as cost conditions changed.

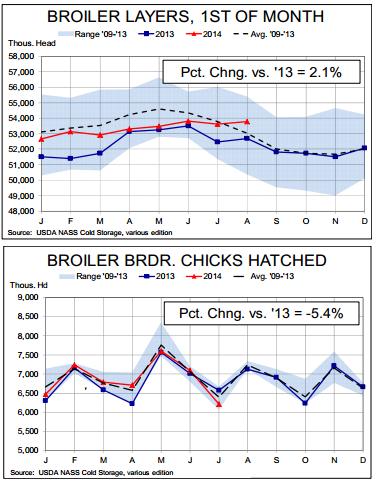

We expected US chicken companies to begin ramping up their breeding flocks in mid-2013 just in case crops turned out large and costs fell. They were slow to do so but did increase flocks by over four per cent, year-on-year every month form August through November last year.

Then the wheels came off. US breeder flock growth slowed to about three per cent in December through February and then slowed even further this year as breeding companies ran into a number of production difficulties in associated with that aging flock. The result was significantly lower numbers of chicks placed versus eggs set.

Beginning of month broiler breeding flock inventories have begun to grow again, exceeding year?ago levels by 2.2 and 2.1 per cent in July and August. But those growth rates may be short lived as the number of broiler breeder chicks hatched fell to just 6.212 million in July, over 300,000 and 5.4 per cent fewer than one year ago. Lower numbers of breeder chicks will make it more difficult to support the renewed growth of the breeder flock which, in turn, will limit egg sets and placements of the actual broiler chicks that are grown for slaughter.

USDA’s August World Agricultural Supply and Demand Estimates has 2014 US broiler production growing by 1.5 per cent. Poultry production through 16 August is virtually unchanged from last year.

With two thirds of the year in the books at zero growth, September-December production would have to grow by 4.5 per cent to get the annual number to 1.5 per cent. We think that is very doubtful even though there are signs of improvement on the productivity front. After spending virtually all year within 1 per cent of year?ago levels, egg sets have grown by 2.1 per cent, on average, over the past four weeks.

Chick placements, which had been down fractionally versus last year for most of this year, have grown by 1.8 per cent and 1.2 per cent, year on year the weeks of 9 and 16 August. Those figures will not get the industry to +4.5 per cent but they represent improvement. USDA’s forecast for 2015 broiler output is 38.894 billion pounds, read?to?cook weight, an increase of 2.4 per cent from 2014.

BOTTOM LINE: US broiler companies have been profitable but have had their expansion efforts scuttled by production challenges. They are solving those problems and will move back to growth this fall and into 2015 but that growth will likely be slow by historical standards.