CME: Hatchability Ratios

US - The broiler industry has had to deal with some issues that negatively impacted the breeder flock but there are signs that the industry is taking steps to mitigate the issue, report Steve Meyer and Len Steiner.Cheap grain makes cheap meat...so goes the old adage. The quickest way to convert the mountains of corn expected to crop up across the Midwest this fall would be through increased chicken production.

After all, it takes only about three weeks for a broiler chick to hatch after the egg is set in an incubator and then another six weeks to reach market weight.

For hogs, the gestation time for a litter of baby pigs is about four months and then another five months or so to get those baby pigs fed to market weight. And for cattle, the mother cows need a full nine months for gestation and then another 18-21 months for one calf to reach market weight.

But when talking about expansion in the broiler industry, there is no question as to what comes first - without a larger breeder stock it is very difficult to increase the number of birds that make it market.

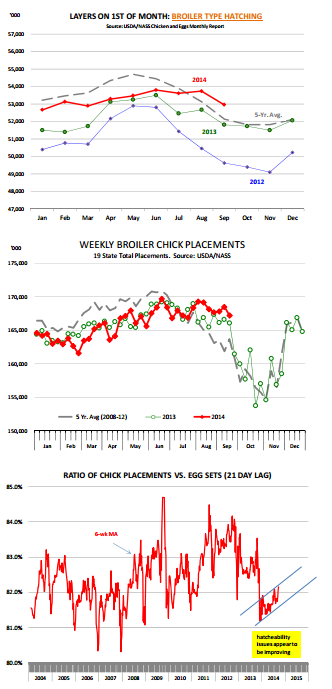

So even as corn prices drop to near $3 per bushel and margins in the industry are in great shape by most measures, the first thing to consider is the number of layers set for broiler type hatching. The numbers are reported by USDA each month based on a survey of producers.

USDA makes every attempt to contact each known contractor and independent producer who has at least 30,000 hatchery supply layers, while those that have less than that number are estimated using statistical models.

As of 1 September, the hatchery supply of broiler egg layers was pegged at 52.963 million, 2.2 per cent higher than the previous year. Number seasonally decline in the fall and it appears this year will be no different.

However, producers appear intent on expanding the hatching flock and the expectation is for the number of layers to remain near the 53 million mark through the end of the year and then increase over 54 million in Q1 of 2015.

This expectation is based on the fact that placements of broiler-type pullet chicks for future domestic hatchery supply flocks were 4 per cent higher in August compared to a year ago. Similar kinds of increases are expected for September and October.

As we have noted in the past (see DLR dated 27 August), the broiler industry has had to deal with some issues that negatively impacted the breeder flock but there are signs that the industry is taking steps to mitigate the issue.

The ratio of chick placements vs egg sets three weeks prior has been steadily improving. There is a lot of noise in this ratio so the chart to the right shows a six week moving average to better illustrate the trend.

This ratio is an important indicator, as it shows how many of the eggs placed in incubators end up being placed on feed. For instance, the number of weekly broiler eggs sets since 1 July has averaged about 2 per cent above year ago levels but chick placements during that time frame have only increased 0.5 per cent.

We expect the hatchability ratio to improve. This improvement should drive higher production levels in 2015. In the very near term (i.e. next three months), it will be difficult to ramp up broiler production despite the cheaper corn and meal prices.

The hope among US retailers and food service operators is that strong profits and robust consumer demand will convince producers to expand production and better supply the US domestic and export markets with chicken. For livestock producers, chicken expansion will mean a loss in competiveness in 2015.