Higher US Broiler Production Forecast

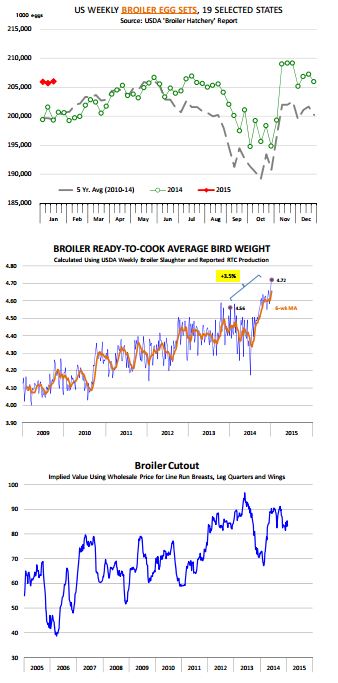

US - Broiler supplies have been steadily increasing in the last few months and the latest data points to higher production levels in February and March, write Steve Meyer and Len Steiner.Production growth is expected to come through both higher slaughter numbers and a notable increase in broiler weights. The latest hatchery data showed that producers in the 19 key production states set 206 million eggs in incubators for the week ending January 17, 3.3 per cent more than the same period a year ago.

For the last six weeks egg sets have averaged 2.7 per cent higher than the previous year. Chick placements for the week were 169.1 million, 2.8 per cent higher than a year ago.

Based on egg set numbers from three weeks ago and the current chick placement numbers the hatchability ratio currently stands at a little over 82 per cent, better than the 81-81.5 per cent we saw in the first half of 2014 but still well below 2011-2012 when the ratio was consistently over 83 per cent.

The ratio has been steadily improving, however, an indication that the industry is slowly recovering from the productivity problems related to bird genetics that cropped up in late 2013 and 2014. In addition to placing more chicks (which will drive slaughter a few weeks from now), producers also have dramatically increased bird weights.

The latest average ready-to-cook broiler weight (week ending January 10) was reported at 4.72 pounds, 3.5 per cent higher than a year ago. For the last six reported weeks, broiler RTC weights average averaged 4.65 pounds, 4.3 per cent above year ago levels. Adding up a 3 to 3.5 per cent increase in slaughter (higher placements) and a 4 per cent increase in broiler weights implies a weekly production growth of 7 per cent or so in February and March.

Broiler supplies have been increasing since fall of last year but so far prices have held up better than many expected. Breast meat prices are lower than the peak last summer but in line with the seasonal decline. Compared to a year ago breast meat prices (as reported by USDA) are tracking about 14 per cent above year ago. Wing values have dramatically improved, in part because end users put them back in their menus after the debacle of last year.

High prices for hamburger raw materials mean that bar menus have few other good options to promote going into the Super Bowl weekend and March Madness. The latest USDA price report quotes whole wings at around $2 per pound, about double the going price for line run breasts. The gains in breast meat and wing prices have certainly helped offset the drop in the price of leg quarters (down 11.8 per cent vs last year).

Our calculated broiler cutout value (weighted average price for breasts, wings and leg quarters) currently stands at $0.83 per pound, 14 per cent higher than a year ago. Demand for broiler meat certainly has benefited from the record high beef prices. End users, be this fast food operators, family restaurants or the local grocery store, certainly are finding out that promoting chicken for now offers consumers good value.

The two challenges for chicken going forward will be: a) What happens with exports and how big of an impact will this have on leg quarters. The recent drop in price may be an isolated incident or a sign of weak pricing power into spring. b) How much will wing prices decline (they always do) after March. For now producer margins remain in good shape and, as long as they do, the chicken train will keep on coming.