Increase in Stored US Chicken Highlights Industry Vulnerability

US - According to the USDA-NASS monthly Cold Storage report, inventories of frozen chicken at the end of August were up 25 per cent from a year earlier, write analysts Steve Meyer and Len Steiner.At the beginning of the summer quarter, frozen inventories were 21 per cent larger, so the inventory problem is not something that has developed in recent weeks.

Still, summer has traditionally been the best season for chicken consumption and yet no progress has been made in reducing product in cold storage.

A breakdown of the inventory by parts or meat showed a 66 per cent increase in thighs and thigh quarters, a 40 per cent increase in legs and a 47 per cent increase in thigh meat. These are all primarily export items.

The absence of business with Russia and China and other countries due to concerns about avian influenza highlights the vulnerability of the chicken industry to international trade conditions.

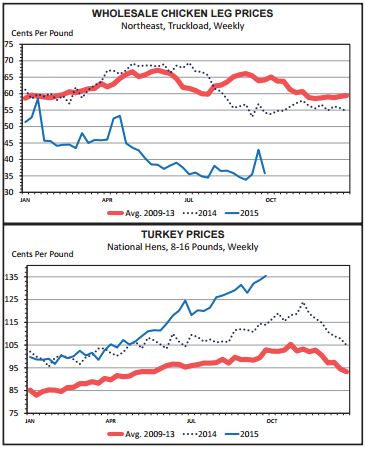

Frozen breast and breast meat inventories were up 21 per cent from a year ago. Pricing of leg parts in wholesale markets reflects the ample availability of chicken products. Leg quarter prices this summer were down 45-50 per cent from last summer.

Preliminary estimates of chicken consumption during August show a 9 per cent increase from a year earlier. Normally, a 9 per cent increase in consumption would lead to a reduction in frozen inventory, but chicken production during August was up 7 per cent while exports are expected to have lagged a year ago by 3 per cent.

In July, chicken exports were 22 per cent less than the previous July. The gain in chicken production was accomplished by way of 4 per cent more birds slaughtered at heavier weights than in August 2014.

The big decline in prices this summer plays a role in encouraging more consumption and should also prompt some moderation in future chicken production. Chicken hatchery output in August was up 1 per cent from last year, signifying a of moderation on the supply side of the chicken market.

Chicks hatched per hen in the hatchery supply flock declined by 3 per cent from the prior August and was the second month (along with July) to show a decline relative to a year ago. Chicken production this fall (autumn) is forecast to be up 4 per cent from the same quarter in 2014.

This compares with a 6 per cent increase during the summer. More than half of that increase comes from heavier birds. Chicken slaughter, which is driven by current quarter hatchery output, should only be up about 2 per cent.

With peak consumer chicken demand season waning with the end of summer, chances of a significant recovery in chicken prices is not likely. The turkey industry is struggling to get back on track after Avian Influenza problems of last spring.

Turkey hatchery output during August was down 6 per cent from a year earlier, the same decline that was registered in July. Worries about a recurrence of the disease this fall as migratory fowl retrace their path southward from Canada is keeping some production facilities in the Midwest idle.

The shortfall in turkey hatchery output in August could result in a frozen turkey inventory at year end that is record low. Total turkey hatchery output this year is on track to be down 8 million birds from last year.

The toll of diseased birds in the Mississippi Flyway last spring due to Avian Influenza was estimated to be 7-8 million birds. The lack of a recovery in production during the second half of this year raises questions about the potential to increase production next year.

Turkey breast meat prices have shown the biggest impact from lost production this year. Breast meat prices this year are set to average $4.30 per pound, compared to a $3.40 average last year and $1.70 during 2013.

Turkey exports are also likely to be down 30 per cent this year due to lack of available production and international market closures.