CME: How Will the Latest US Bird Flu Outbreaks Affect Trade?

US - There is a lot of interest about how this most recent bird flu outbreak progresses for at least a couple of reasons, write Steve Meyer and Len Steiner.First, there is some concern that this may be the beginning of larger bird flu outbreak that could stretch into the spring.

However, the flu strain in question appears to be a North American strain and many of the farms were affected by a low pathogenic form of the virus.

The fear this past fall was that wild birds which had migrated to the arctic region over the summer would bring back new strains of the disease.

That does not appear to be the case in this instance. Still, the most recent outbreak underscores the risk for the poultry industry in the short term.

The second concern has to do with the impact that new outbreaks will have on US poultry supplies. The farms affected by the most recent outbreak were all turkey farms.

Turkey supplies are still quite tight and some turkey prices are near record levels. Still, turkey meat is a very small portion of the overall US meat supply and thus has no impact on the price paid for other proteins.

All along, the true risk was widespread infection in key broiler producing regions. So far that has not been the case and the risk may be lower than some think given industry experience with the disease, enhanced biosecurity measures and the very aggressive containment practices that in the past have shown great success (the experience of Holland is an excellent example).

At this point we are more concerned about the bearish impact that new cases of bird flu may have on chicken and red meat prices.

The outbreak of bird flu last year caused significant damage to US chicken trade, leaving more product to be absorbed in domestic market channels - and at significantly lower prices.

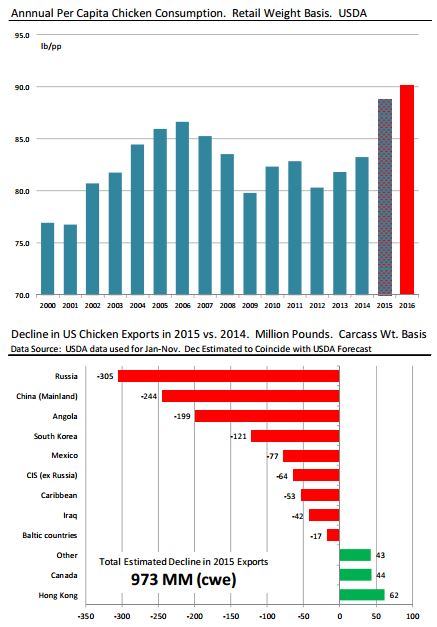

The last USDA forecast estimated 2015 US chicken exports at 6.326 billion pounds, 973 million pounds less than the previous year. The chart shows how that decline breaks down by country.

For 2016 USDA expects US chicken exports to gain back a little over half a billion pounds of the exports lost in 2015 but at 6.85 billion US chicken exports still will be quite a bit lower than what they were in 2014.

US broiler production in 2016 is forecast to increase a modest 2.2 per cent due to a combination of heavier bird weights and higher slaughter numbers. That increase represents an additional 856 million pounds of product.

When combined with all the chicken already accumulated in refrigerated around the country, this implies that in 2016 there will be an additional 1 billion pounds of chicken looking for a home.

At this point only half of this supply is expected to be absorbed by the higher exports.

USDA and industry have worked very hard with some countries to regionalise bird flu related bans on US poultry exports. That will help. It is disappointing to hear, however, that South Korea has once again imposed a ban on US chicken.

Low feed costs around the world are encouraging expansion in a number of countries. Global demand is not growing as fast as hoped and countries will look for ways to limit the flow of very competitively priced US chicken. Bird flu outbreaks are an excellent excuse to do just that.