CME: Improved Mortality in Late 2015 Offset Earlier Turkey Losses

US - Young turkey slaughter in December was down 3 per cent from a year earlier, write Steve Meyer and Len Steiner.Turkey hatchery output for the summer months was down 7 per cent from the summer of 2014, which normally projects closely to percentage declines in late year slaughter.

Turkey slaughter during the last quarter of the year was down 3.8 per cent from the same quarter of 2014.

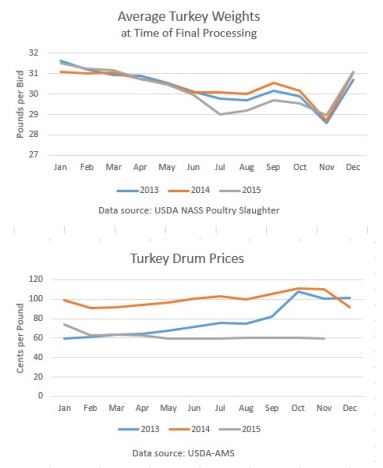

Turkey production for 2015 was down 2.3 per cent. Lighter average bird weights at final processing time contributed to the decline (see top graph).

Annual young turkey slaughter was down only 1.8 per cent, helped largely by winter quarter 2015 harvest that was up 6 per cent.

The first quarter 2015 slaughter provides a high base of comparison for turkey output in early 2016.

Turkey slaughter in the first quarter of 2016 could be down close to 10 per cent from last year.

The difference between a 7 per cent decline in hatchery output during the summer (hatchery output was also down 4.6 per cent during the spring quarter) and a 3.8 per cent decline in slaughter during the last quarter of the year implies that mortality rates on turkey grow-out farms was less than normal during the second half of the year.

This helped to offset the impact of Avian Influenza in the Upper Midwest last spring. According to USDA-APHIS data on Avian Influenza-related turkey losses in the Upper Midwest during the spring of 2015, 7-8 million birds were destroyed or lost.

Based on USDA-NASS slaughter data over the September-December period, improved (i.e. reduced) mortality offset 3-4 million of bird losses due to Avian Influenza (HPAI).

Turkey in cold storage at the end of December total 200 million pounds, up 3 per cent from a year earlier.

This was a surprise, as frozen inventories at the end of October were down 10 per cent from twelve months earlier.

Whole bird frozen inventories at the end of the year fell 10 per cent from a year earlier while parts and meat inventories were up 9 per cent. Much of the upward swing in frozen inventories is due to declining export volumes, which turns out to be meat and parts, as opposed to whole birds.

Turkey exports in November (latest reported month) were down 42 per cent from November 2014 and most months since mid 2015 have been down 45-50 per cent from 2014.

Prices for popular turkey export items have been depressed due to lack of overseas buyer interest due to HPAI-induced market closures. HPAI remains a major uncertainty in 2016.

Turkey drumstick prices during the last quarter of 2015 were 60 cents per pound, compared to $1.04 in the last quarter of 2014. Low prices for turkey drums, wings and thigh meat in late 2015 should pique overseas meat buyer interest in 2016, leading to a rebound in turkey exports, depending on HPAI.

Preliminary estimates of 2015 domestic turkey consumption show use down only 3 per cent from the prior year, even though wholesale prices for whole turkeys were up 10 per cent.

Monthly data for the late year holiday quarter pegged October usage up 2 per cent from twelve months earlier and November usage down 4 per cent.

October is typically the month that turkeys are moving through distribution channels to grocery stores for Thanksgiving. Similarly, November data reflects distribution channel volume movement for Christmas.