Nutriad Comments on US Poultry Industry

US - As the US is moving from a turbulent 2016 into a new year with an uncertain political outlook, it is important for the poultry industry to understand the various scenarios that may unfold in the near future and possible changes in global trade agreements, currency exchange rates, regulations and overall cost of production.Using insights from industry experts within the Nutriad group and input from external consultants, the multinational feed additives producer reviews several possible scenarios and shares its vision to the year ahead.

Political Scenario

The election of President Donald Trump, will most certainly bring changes in the overall trade and currency panorama. The outlines of some of those changes can already be seen in his first days in office. The US withdrawal from TPP will leave a vacuum to be filled by China. This nation will assume greater importance in Asia and the Pacific Rim. However, the U.S. may establish bilateral trade deals with Philippines, Malaysia, Indonesia and Thailand.

According to USDA, close to 18 percent of the total poultry production in U.S. is exported, what makes the U.S. poultry industry extremely sensitive for currency fluctuations, trade negotiations, and economic growth in importing markets.

The renegotiation of NAFTA can also disturb current trades with Mexico and Canada, and the threat to overtax Mexican products in 20%, might have a direct effect on bilateral trade. In 2015 Mexican poultry imports from US - not counting eggs- reached over US$ 1 billion.

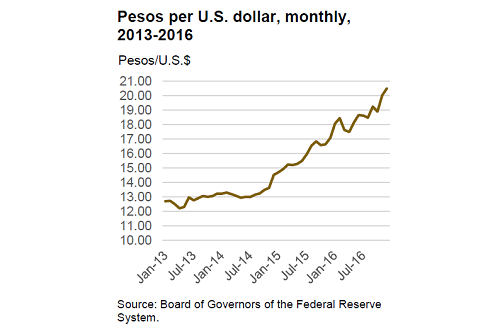

The devaluation of the Mexican Peso versus the USD might benefit Mexican imports from South American countries such as Argentina, Chile and Brazil over the United States. In January 2017, the value of the peso fell almost 20 percent compared to January 2016.

Regulations and welfare

The appointment of Scott Pruitt as head of EPA and possible increased industry focused policies, including an ease on regulations imposed by the past government, might have a positive impact on poultry producers. However, the consumers driven requirements are still leading the way retailers and fast food chains select their suppliers.

The enigma currently faced by producers is to decide on which aspects of welfare should be followed. The reduction in density, having smaller scale operations and using non-GM ingredients will demand a greater need for land and resources, consequently negatively affecting its sustainability.

The new Veterinary Feed Directive (VFD) might also have an impact on operation procedures and costs, as companies adjust to the withdrawal of antibiotics growth promoters and adapt to natural alternatives.

Sanitary barriers and the Avian Influenza

Avian Influenza outbreaks throughout the Asian countries and the European Union will play an important role on trade of U.S. poultry. According to USDA, the egg export forecast has increased in 30 million dozen eggs following an AI outbreak in South Korea.

The dissemination of recombinant HPAI strains by migratory birds will alter trade patterns affecting the outlook for Asia, Europe and Africa. Even with strains such as H5N8 possibly being eradicated in the EU, and H5N6 being controlled in a few more months in South Korea and Japan, there will be potential re-introduction of other strains.

The dissemination of AI, and its endemic situation in wild birds, can have a long-term impact on global market conditions. AI creates business risks to companies which are required to adjust their business model, paying high attention to biosecurity and close involvement with local government.

Commodities

The 2016 harvest is projected to break records in yield and total production, according to the World Agricultural Supply and Demand Estimates (WASDE) report.

In U.S. the average yield of 11,000 metric tons per hectare (175.3 bu/ac) and about 35.1 million hectares (86.8 mil ac) harvested, will translate into an estimated crop of 386.8 mmt (15,226 mil bu), which would be the largest U.S. corn crop on record.

Argentina and Brazil also follow a strong trend and should reach record numbers on corn production due the prospect of favorable returns and good weather conditions. Brazil is estimating a harvest of 215 million tons of grains, being over 108 million tons of soybean, which means an 8.7% increase in production compared to last year. Argentina, even with recent reports of floods, is estimating 36 million tons of corn and 55 million tons of soybean.

The elevated production numbers, combined with China’s high stock, will pressure the commodities prices in the national and global market. Overall prices should maintain close to the current $3.58/bu for corn and $10.32/bu for soybeans.

The poultry market and forecast

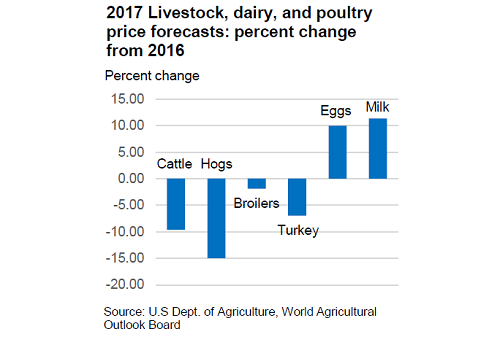

Both broiler and turkey production was short in the last quarter of 2016. Broiler production is expected to increase in the first quarter of 2017. The forecasts for 2017 prices were increased slightly for broilers and lowered for turkey as indicated by the USDA.

As of January 2017, broilers had a slight increase in price, reaching 87 cents per pound with a forecast for the year of 80 to 86 cents per pound for the whole bird.

The turkey production is estimated to have an increase of 245 million pounds on year-ending stock increasing previous expectations. This leads to an expectation of an increased year-ending stocks for 2017 to 275 million pounds.

On the egg market, prices are maintained to a level of 73 to 76 cents per dozen, after a common drop in the couple of weeks following the holidays. With over 307 million hens in production and a record number of 100 eggs produced per hen it should maintain high stock level on dried-egg and frozen egg products. Expectations for the first quarter range from 78 to 82 cents per dozen.

Overall, the poultry market should have a positive year with steady prices and maintained or slightly reduced feed costs. Commented Grady Fain, Senior Vice President for Nutriad in U.S.: “Nutriad is confident about the 2017 outlook for the poultry industry in the U.S. Through the market ups and downs, Nutriad will continue to working with customers across the country, to deliver additive solutions that positively impact their bottom line."

Nutriad delivers products and services to over 80 countries through a network of sales offices and distributors. These are supported by four application laboratories and five manufacturing facilities on three continents. Find out more at nutriad.com