2020: A BBQ summer like no other - what did we learn?

With the impact of Covid-19 and an earlier than usual peak in hot weather, this year’s summer has been like no other.As the government introduced a UK-wide lockdown between March and July, we saw the closure of foodservice outlets, leading to a significant increase in meals eaten in-home. This trend continued throughout the summer, even as restrictions started to ease, resulting in consumers spending more in supermarkets and, therefore, increasing total grocery spend throughout summer by 15.2% year-on-year (Kantar, 20 w/e 06 Sep 2020). One area which excelled this summer was barbecues, highlighting many opportunities for AHDB sectors.

Key opportunities for 2021:

- Due to the chance of earlier peaks in hot weather, it is vital to ensure BBQ products are available at the right time

- BBQs are a time for treating and enjoyment – areas where meat, dairy and potatoes excel. Therefore, ensuring they feature strongly in point-of-sale support and inspiration is important

- Find ways to ensure consumers are confident about cooking steaks on BBQs and find innovate offerings for potatoes

We barbequed more, but differently…

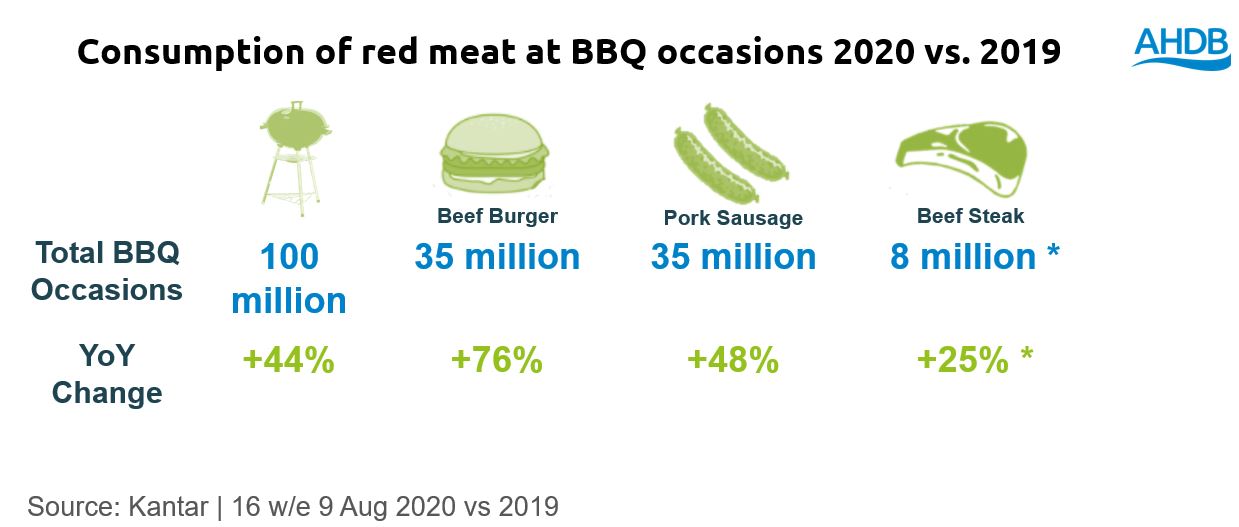

With more people staying at home due to lockdown and new ways of working, we saw significant growth in BBQ’s this summer, with 100 million occasions between April and August, up 44% year-on-year and 18% higher than the scorching summer of 2018. Due to warmer weather starting earlier in the year, we saw 21 million BBQ occasions in April alone, a rise of 391%. BBQ’s reached their peak in May, with 31 million occasions. The trend started to slow in July as restrictions eased and consumers gained more confidence to return to local pubs and restaurants, fuelled by the government funded ‘Eat-Out-to-Help-Out’ scheme. Overall, the increase in occasions and spend, boosted the BBQ market by £12.4 million, according to Kantar (16 w/e 9 Aug 2020).

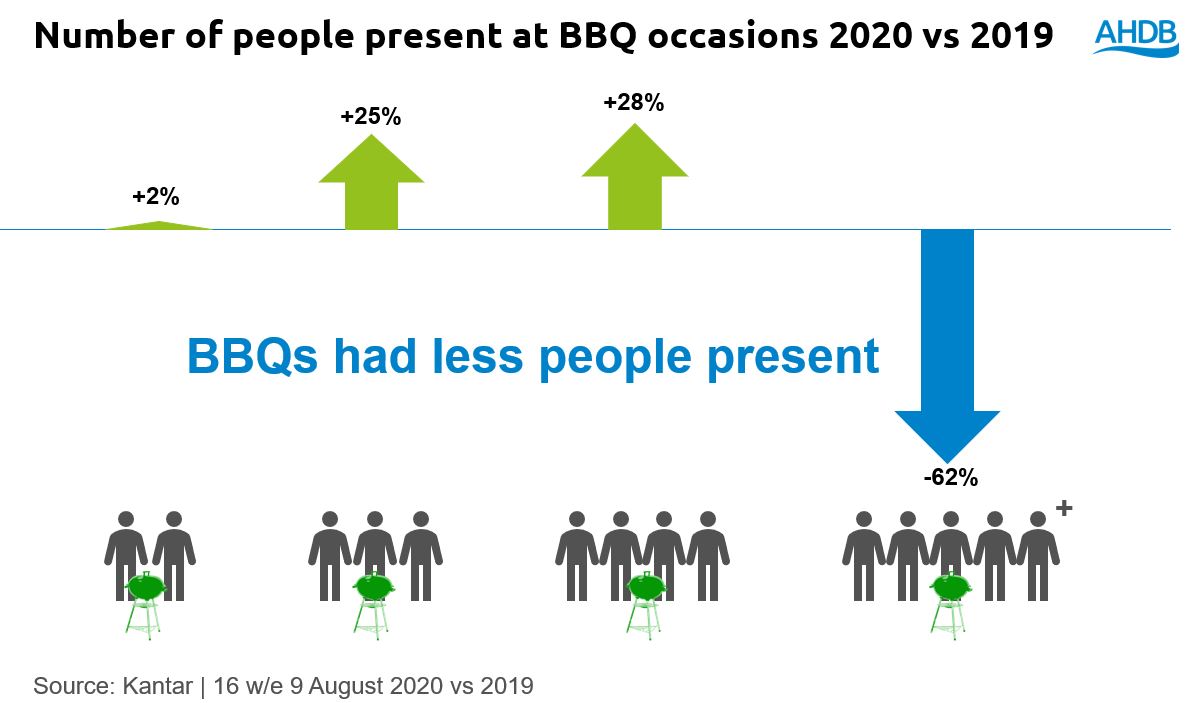

Due to government restrictions on socialising, fewer people were present at BBQ’s this year. Like previous years, weekends proved most popular for BBQ’s, accounting for 49% of all occasions, but weekday occasions saw growth as people were asked to work from home. Key drivers behind this increase were consumers wanting a change, as well as many seeing BBQ’s as a treat or reward.

Meat, Fish and Poultry featured at more BBQ’s this year

According to Kantar, in the 16 w/e 9 August, the number of Meat, Fish and Poultry (MFP) BBQ occasions increased by 49% on 2019, ahead of total BBQ occasions which was up 44%. In terms of value, this was an increase of 3%.

In contrast, meat-free usage at BBQs lost share. In 2019 2.3% of meat-free occasions were at BBQ’s compared to only 1.5% this year.

Burgers boomed

Burgers, the traditional BBQ favourite, helped drive significant growth in the beef category, featuring at an additional 15 million BBQ occasions – up 76% year-on-year (Kantar, 16 w/e 9 Aug 2020). The increase in consumption of burgers was driven by consumers who ‘wanted a treat’. While steak consumption rose by 25%, the overall increase in BBQ occasions highlights an opportunity exists to grow this market share by inspiring more consumers to buy into steaks.

Sausages sizzled

Total pork consumed at BBQ occasions was up 56% on the previous summer. The number of sausages consumed at BBQs rose 48%, with ‘taste’ being a key driver.

Added Value gained volume this summer

From a total grocery perspective, not necessarily at BBQ occasions, marinades, which are common at BBQs, increased 16.6% in sales volume over the summer compared to 2019. Beef and pork marinades did particularly well, with the uptake of lamb marinades, a smaller category, following a similar trend. The key drivers behind the increase in demand for marinades were consumers who wanted more variety on their BBQ.

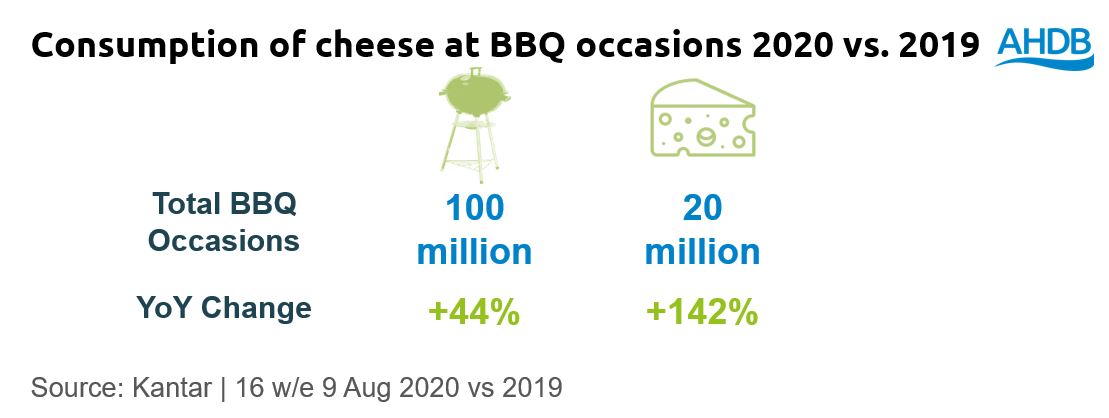

Cheese at BBQs boosted dairy

Total dairy BBQ occasions grew by 52% (an additional 12 million occasions) compared to summer 2019. The volume of cheese consumed at BBQ’s increased significantly throughout summer 2020, with an additional 12 million occasions – up 142% (Kantar 16 w/e 9 Aug 2020). This was driven by ‘summer’ cheese products such as cheese slices, Halloumi and Feta.

At a total grocery level, not necessarily at BBQs, total cream volumes increased 33.4% on summer 2019, with clotted cream almost trebling its percentage share of total cream occasions (an additional 11.3 million occasions). In July alone, 448,000 litres of clotted cream were consumed, which could be the result of more homemade and shop-bought puddings being consumed at BBQ’s.

In addition, total ice-cream sales were up 22.6% on summer 2019 (Kantar 19 w/e 6 Sep 2020), with sales reaching their peak in May (+51% year-on-year), reflecting the good weather. In contrast, sales of ice-cream throughout July dropped back on 2019 figures (-8% year-on-year).

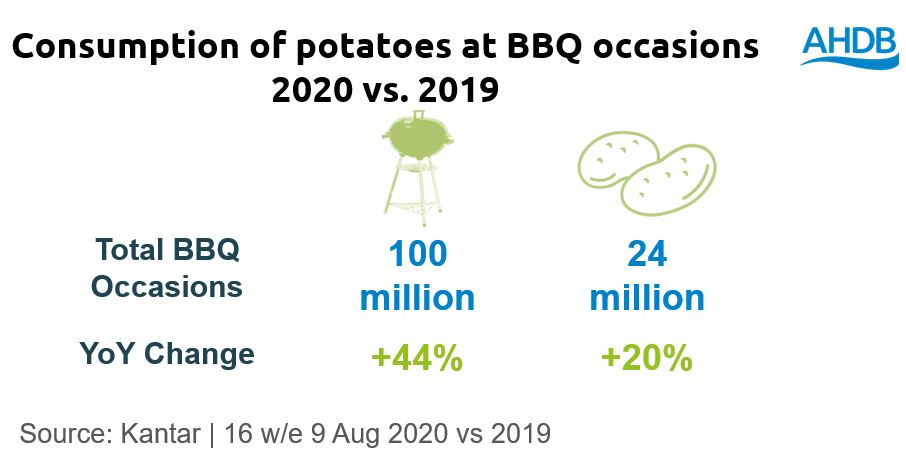

Potato sales simmered but did not reach the boil

This summer, shoppers purchased larger volumes of potatoes. However, despite there being 20% more potato occasions at BBQs (an increase of 4 million occasions), it was not to the same level of total BBQ growth, therefore potatoes lost out on share of BBQ occasions overall. This may suggest that by providing potato-based recipe inspiration in food retailers, the purchase and consumption of potatoes at BBQ’s could increase.

* represents a low sample size