Overview of the U.S. Poultry Industry

By Mississippi State University, taken from the Economic Impact of the Mississippi Poultry Industry — 2007.The U.S. poultry industry serves many markets. The first major market segmentation is between the domestic market and the export market. The American market prefers white meat, leaving most of the dark meat for export. The export market may be affected by conditions such as oil prices, wars, natural disasters, currency fluctuations, and other worldwide issues such as avian influenza (bird flu) that are beyond the control of the poultry integrator. Prices received in the domestic market are largely a function of poultry supplies, prices of competing meats, and the condition of the U.S. economy.

The broiler industry in 2006 faced low prices and a relatively slow growth in the production sector. In the two years before 2006, the broiler industry experienced increases in production by 3% to 4% in both 2004 and 2005. Although production was up at the end of 2005, demand began to fall as reports of bird flu surfaced in Asia and other parts of the world. Worldwide fear caused a drop in demand. With a decrease in demand, frozen poultry stocks increased and prices began to creep lower, forcing the broiler industry to slow production. In 2006, production expanded by a little less than 2.2%. This was the slowest rate of growth since 2003, when the industry was recovering from the Russian export crisis of the previous year. However, the USDA projects the export market to grow by 3.4% in 2007, nearly 2% greater than the increase from 2005 to 2006. Major U.S. export markets include Asia, Russia, and Mexico. Gains in these markets reflect those countries’ strong economic growth and rising consumer demand for meats. Producers will face strong competition from other major broiler-exporting countries, particularly Brazil. Poultry exports from countries affected by avian influenza, such as Thailand and China, are expected to be limited to fully cooked products.

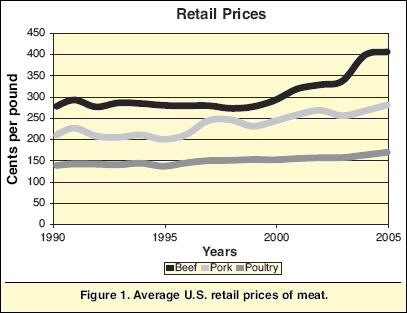

The increase in the export demand along with slower domestic production should provide improvement in the coming year prices. However, all of the increase in prices will not be due to increase in demand. Increases in feed costs will surely affect industry profits. Corn and soybean prices are at their highest level in a decade. With the expansion of the U.S. ethanol industry, corn prices have surged higher. Higher corn prices in turn pull soybean prices along as less corn is available for livestock feeding. Domestic demand for poultry remains strong due to its lower cost relative to beef and pork. Figure 1 exhibits the relationship between average retail prices paid for beef, pork, and poultry products over the last 20 years. Poultry retail prices have remained almost constant, while beef and pork have experienced steady increases. Poultry remains a good value for the consumer.

Per-capita consumption of poultry products has steadily increased every year since 1995. In 2005, the per-capita consumption of total poultry products reached an all-time high of 103 pounds. Per-capita consumption for all meats in the U.S. totaled 214 pounds in 2005. Consumption of poultry represents 48% of all meats consumed in the domestic market.

The U.S. market is further segmented into the demand for chicken to be consumed in the home and the demand for chicken to be consumed in restaurants, schools, and other institutions. Most of the white meat must be further processed. Away-from-home meals and snacks captured 48% of the U.S. food dollar in 2005, up from 44% in 1990 and 39% in 1980. The poultry integrators must provide further processed products specifically tailored for each market segment.

To view the full report, Economic Impact of the Mississippi Poultry Industry — 2007 - click here.

July 2007