Philippines Poultry and Products Market Trends and Developments 2008

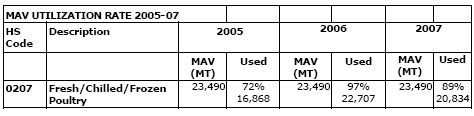

By Pia Abuel-Ang, USDA FAS GAIN Report.Utilization Rates: Data from the Minimum Access Volume (MAV) Management Committee of the Philippine Department of Agriculture (DA) shows that in 2007, fresh/chilled/frozen poultry meat MAV utilization dropped from 97 percent in 2006 to 89 percent last year. Despite uniform in and out-of quota duties for most poultry products, the Philippines maintains a Tariff-Rate-Quota or MAV system for poultry. Annual MAV utilization for poultry meat for the last three years has averaged around 86 percent, the highest for all MAV products. The majority of all the country’s chicken meat imports (except mechanically deboned or separated poultry) still fall under the MAV.

Source: MAV Secretariat

<WTO Commitments: Since 2005, the DA has continued to maintain 10th or final-year MAV levels under its Uruguay Round commitments. For poultry HS 0207, the final-year MAV was 23,490 MT. The DA previously stated that it will continue to do so until such time as a new WTO agreement is reached. In October 2007, the DA announced that it would defer the distribution of 2008 MAV licenses, while it undertakes a review of MAV distribution guidelines. According to the DA, the review is being undertaken in order to allow new entrants and more entities to participate in the MAV system. On January 17, 2008, the DA released the MAV allocations for 2008, pending completion of the review, which temporarily disrupted trade for about 3 months. The review is expected to be completed in the first quarter of 2008.

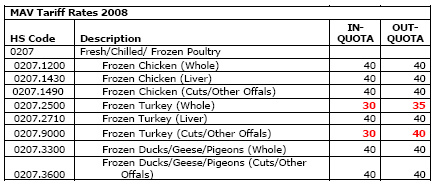

Tariff Rates: In-quota and out-of-quota tariff rates for MAV commodities have not changed since 2005. Tariff rates for poultry are as follow:

Source: Executive Order NO. 574 (2007)

<Special Safeguards: In 2002, the GRP imposed a price-based special safeguard duty (SSG) on chicken under H.S. 0207.1400 (frozen chicken cuts and offal) as well as H.S. 0207.1200 frozen whole chickens. This has doubled the effective rate of protection for all out-of-quota imports of the said products. All in-quota imports of chicken under the MAV are exempt from SSG application. Last year, the United States exported over $18 million worth of poultry meat to the Philippines, majority of which are chicken leg quarters and other chicken cuts. The imposition of the SSG in 2002 was mainly the result of intense political pressure from the domestic poultry industry to keep low-priced chicken imports out. Importation of chicken meat under the MAV is expected to remain strong, as long as the special safeguard (SSG) on chicken remains in place.

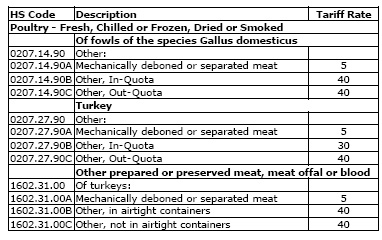

Executive Order No. 627: In June 2007, the Philippines lowered the tariff on mechanically deboned meat (MDM) of chicken and mechanically separated turkey (MST) to 5 percent, exempt from MAV (see GAIN RP7056), as a result of concessions granted by the Philippines for the continued use of quantitative restrictions on rice. Executive Order No. 627 (EO 627) issued on June 2007, reduced the tariff rates of the following poultry products:

Source: EO 627

Prior to this exemption, about 40 percent of all poultry imported under the MAV were made up of MDM or MST. Lowering the tariff rates and exempting MDM chicken and MST from the MAV system allows more high-value poultry products (i.e., chicken leg quarters and other cuts) to enter under the lower tiered tariff and exempt from SSG.

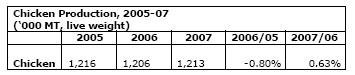

Production: After two year of contraction, the domestic chicken industry experienced a marginal expansion in production of 0.63 percent last year. The decline in production experienced in 2006 was a result of damages to the poultry industry caused by several super typhoons.

Source: Bureau of Agricultural Statistics

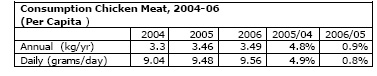

Consumption: The Philippine population is roughly 90 million and growing at a rate of 2.36 percent per year. According to the Bureau of Agricultural Statistics, annual per capita consumption of chicken meat at 3.49 kg., grew by less than 1 percent in 2006, the growth in per capita consumption likely remained the same last year.

Source: Bureau of Agricultural Statistics

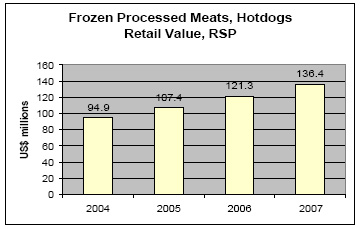

Meat Processing: The demand for mechanically deboned or separated meat of poultry meat for use in hotdog and sausage production has been growing rapidly. Over the last three years, local hotdog/sausage production is estimated to have grown by 12.4 percent annually and is expected to continue to expand at double digit rates. Imports of sausage casings, as well as pork fats have also grown significantly, indicating a growth in production of processed meat products. Currently, the Philippines does not produce any MDM/MST and sources most of its supply from the United States, Brazil, Australia and Canada.

Source: Packaged Foods: Euromonitor trade sources/national statistics

In 2004, San Miguel Corporation, the largest food and agri-business company in the country in a joint venture with Hormel Foods (USA) opened the largest hotdog plant in Asia, with a capacity of up to 320 MT per day. According to industry sources, other local companies have likewise expanded their hotdog and sausage operations in order to meet the growing demand for processed meats in the region.

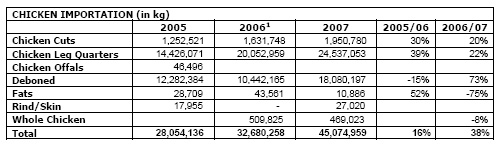

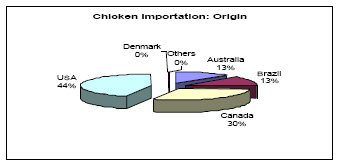

Importation: In 2007, the Philippine imported a total of 45,075 MT of chicken products, 44 percent of which was sourced from the United States, mostly composed of chicken leg quarters (68 percent) and mechanically deboned chicken meat (26 percent). Imports of chicken cuts and leg quarters from all countries increased by 20 and 22 percent, respectively, while imports of mechanically deboned chicken increased by 73 percent.

Source: Bureau of Animal Industry, National Veterinary Quarantine Service (BAI-NVQS)

Source: Executive Order NO. 574 (2007)

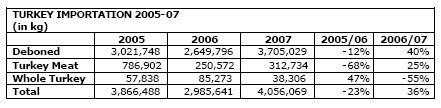

In 2007, total turkey importation grew 36 percent over the previous year, over 91 percent was made up mechanically deboned turkey. Majority of which was supplied by Canada (50 percent) and the United States (38 percent). There is no SSG applied on turkey imports and thus majority comes in outside the MAV. In-quota tariff for turkey cuts is 30 percent while out-of quota tariff is 40 percent. For whole birds, in-quota duty is 30 percent while out-ofquota tariff is 35 percent.

Source: BAI- NVQS

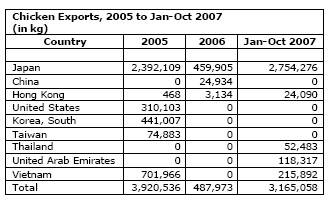

Exports: From January to October 2007, the Philippines exported about 3,165 MT of processed chicken meat, mostly yakitori sticks (skewered chicken sticks) for the Japanese market. Several local processing companies have successfully used lower-priced U.S. chicken leg-quarters as raw materials for this yakitori product. The Japanese market was temporarily closed for 10 months after an unconfirmed report of avian influenza in the Philippines. The Japanese government lifted the ban on Philippine poultry in May 2006.

Source: Executive Order NO. 574 (2007)

Currently, companies located in export processing zones are allowed by law to import raw materials duty-free provided that the product is further processed and re-exported to another country.

Further Reading

| - | You can view the full report by clicking here. |

February 2008