Drought scare over but volatile prices remain

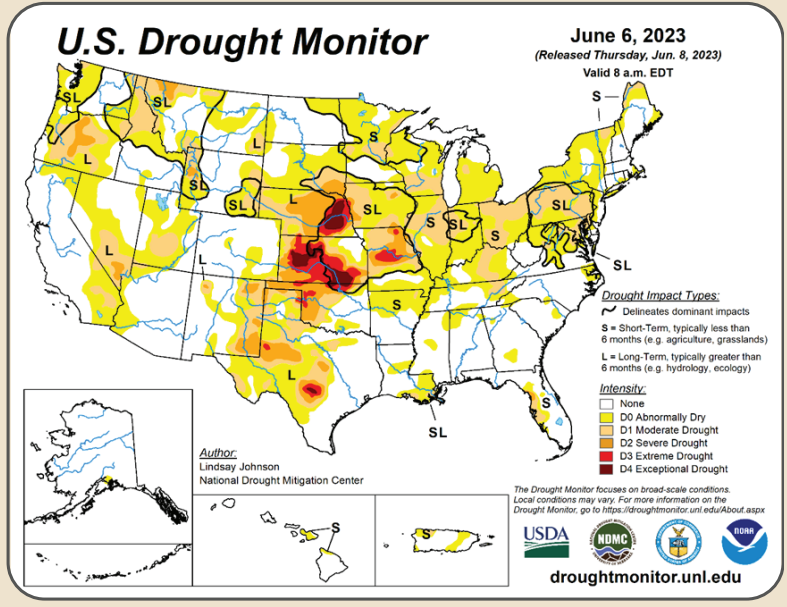

Broiler Economics by AviagenAfter crops were planted this year in the US Corn belt, the rain was late to start falling. Some areas had their driest spring ever. As a result, a drought scare sent prices soaring. Prices eased in the last two months as enough rain arrived to avert a disaster.

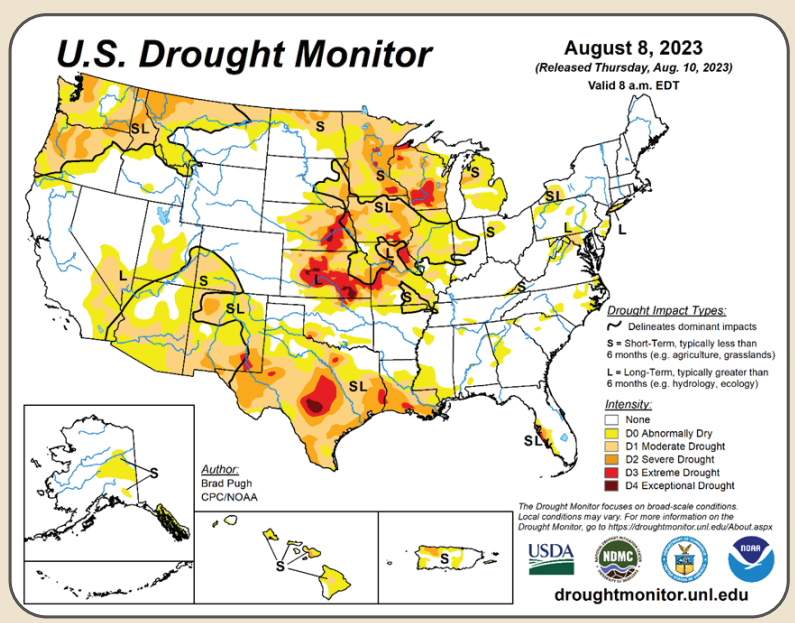

As can be seen on the US Drought monitor comparing June to August, conditions improved significantly during the summer particularly in the Eastern Corn Belt. Although all is not perfect, a relatively good-sized crop can be confidently expected.

Apart from the perennial danger of drought, a broader question is one of volatility. Volatility is likely to be greater now than in the past because of the combination of recent unusual disrupting events.

Those events include Russia pulling out of the Red Sea grain deal and targeting grain supplies in the Ukraine; extreme weather events such as droughts in Argentina, India and Indonesia this year as well as heat waves in the US, Europe and China; and the banning of the export of critical foods such as the ban on the export of non-basmati rice from India.

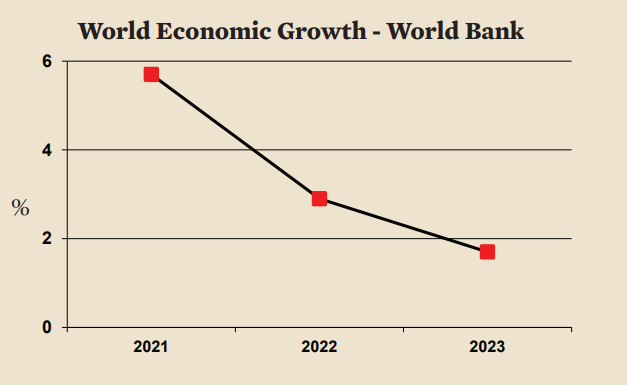

Of course, even without these recent disruptions, feed and food prices can be highly variable. However, it is increasingly likely that the prices of feed and food will not only be more variable but also more challenging to predict. Nevertheless, here is a prediction; grain prices are likely to move downward over time. Grain use will be tempered by a slowing world economy and grain supply will benefit from the shift from “La Niña” to El Niño in the Pacific. As for the war, predictions are bound to be wrong, but it is possible that the situation will be no worse next crop year compared to this crop year.

Corn

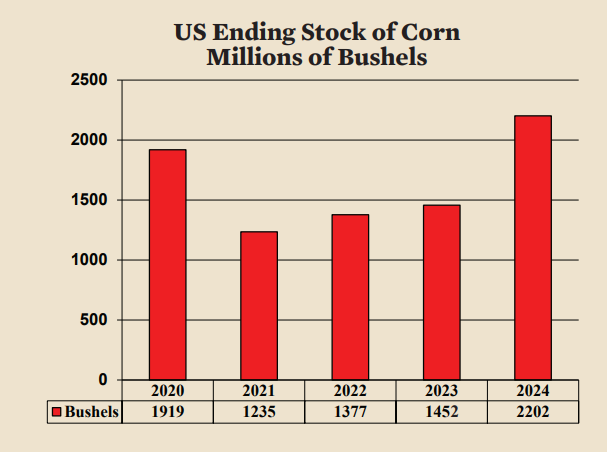

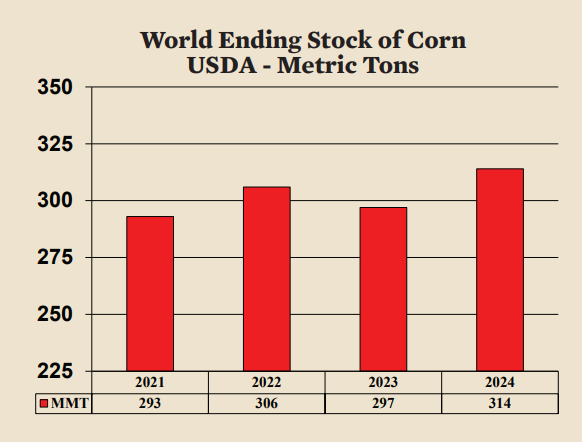

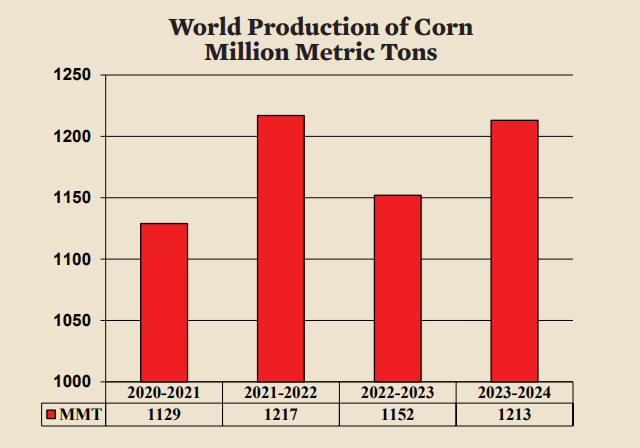

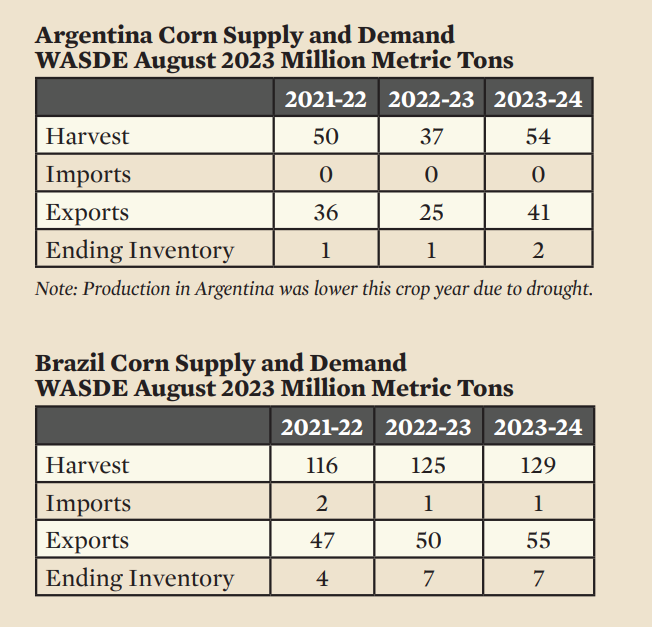

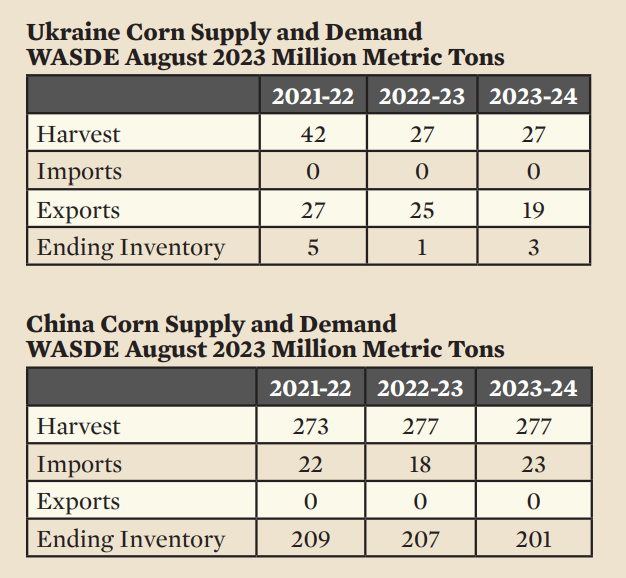

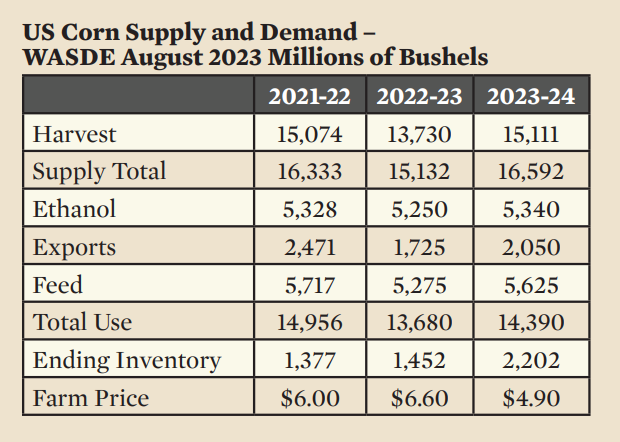

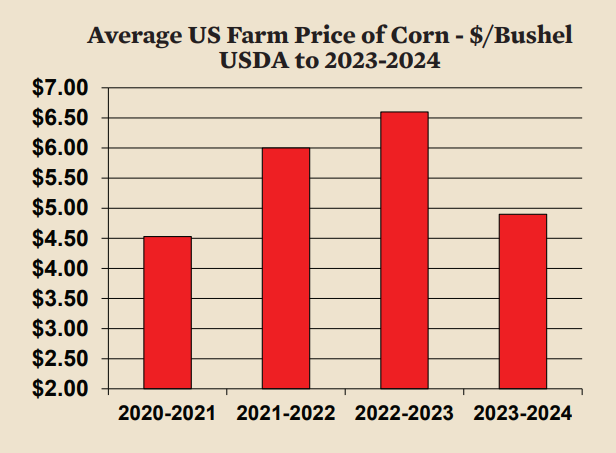

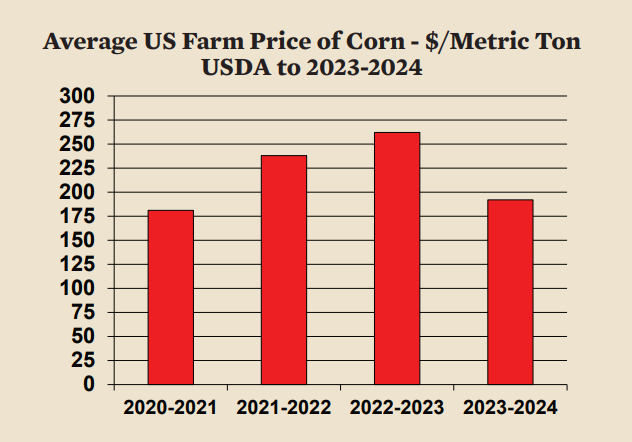

World corn production fell this crop year due to decreases in the US, Ukraine, and Argentina. Despite lower production, world ending corn inventory numbers for this crop year were down only slightly which indicates that demand was falling along with supply. If the next crop rebounds, a likely if not certain scenario, prices will move lower.

The average price of corn this crop year in the US was higher than last crop year. However, lower average prices in crop year 2023-2024 can be expected.

Soybeans

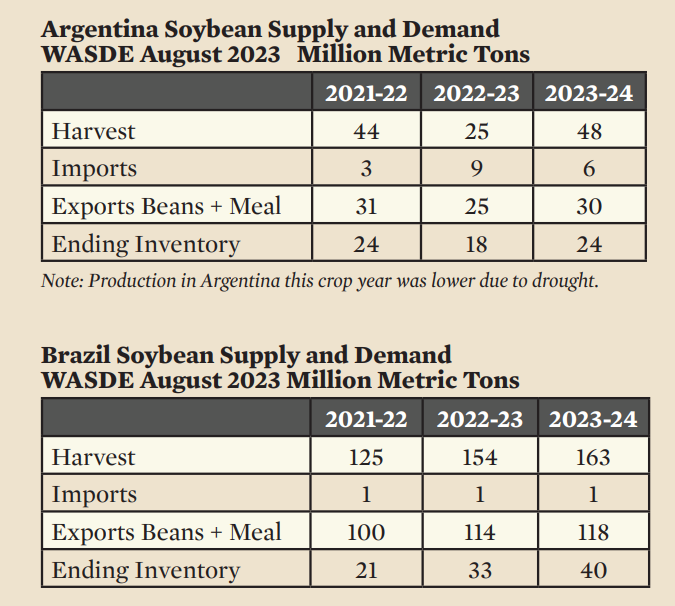

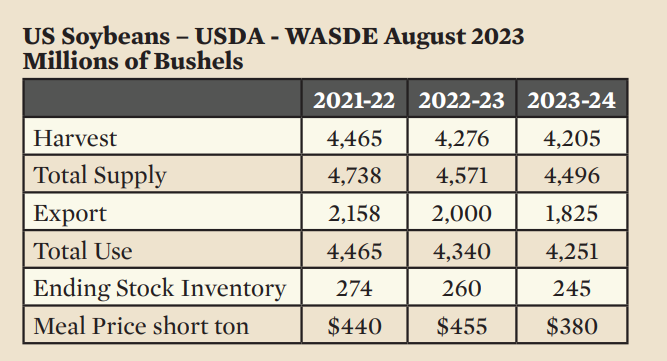

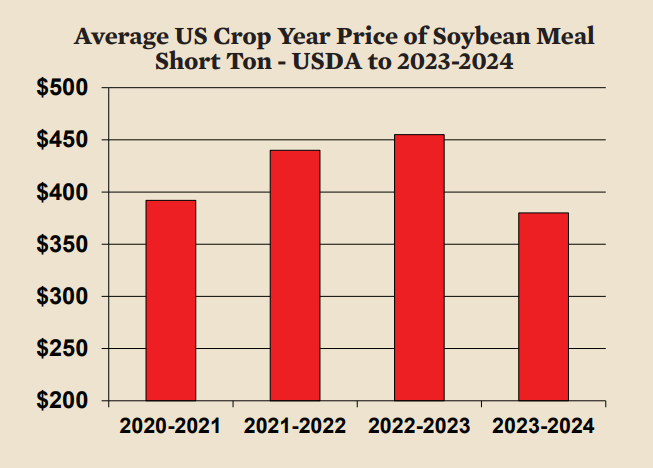

Soybean meal prices were less affected by the war and more affected by drought and floods in Argentina and Brazil. Production in South America dropped by 15 MMT last crop year but bounced back 10 MMT this crop year despite a drought in Argentina. Next crop year could see even greater production increases perhaps as much as 30 MMT (20 in Argentina and 10 in Brazil). The enormous capacity for Brazil to increase soybean production negated the effect of a serious drought in Argentina this crop year.

Given the prospects for an “El Nino” weather scenario, crops in South America are likely to be large and growing over the next few years. Over time, the US is diminishing in importance with respect to soybeans and therefore the effect of the US crop on price is diminishing while the influence of South America is rapidly growing.

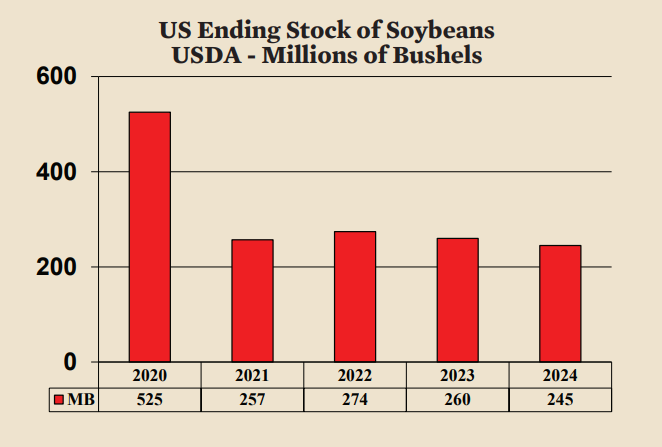

US ending stock fell somewhat this crop year while world ending stocks were remarkably stable in the light of the severe drought in Argentina. Lower prices next crop year 2023-2024 is a reasonable expectation given the likelihood of increased production in the Brazil and Argentina and the resulting higher world inventory.

Chicken Industry

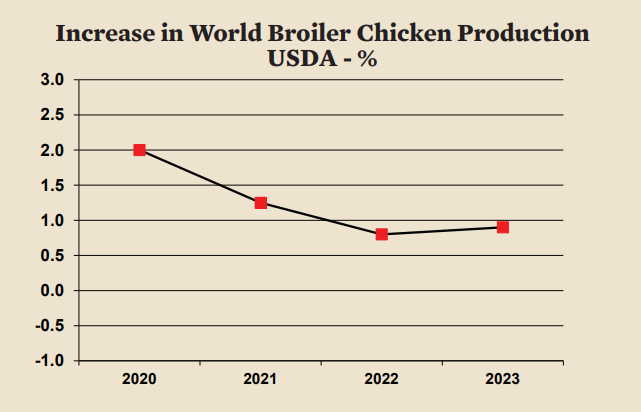

The world chicken industry expanded just 0.8% last year and slow growth is projected to continue this year. The latest USDA estimate puts world chicken growth at just 0.9% this year. The slow acceleration in production growth is due to a slowing world economy and recent relatively high grain prices in addition to some losses due to avian influenza. Normal growth in the world chicken industry is about 2% per year.

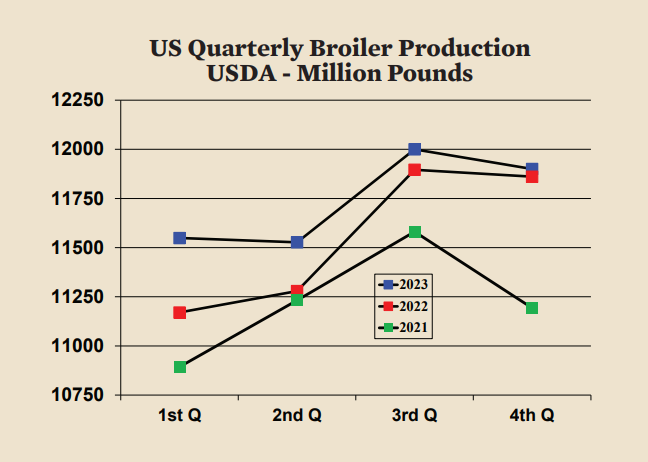

US production accelerated in the last half of 2022 leading to a sharp decline in wholesale prices. The increase year over year between August and November of 2022 reached 5.8%, an unusually high number. Low prices are causing production increases to slow. For all of 2023, production in the US is expected to increase 1.7%. Slowing growth is particularly notable in USDA projections for the 3rd and 4th quarter of this year. Next year, the USDA production is for just 1% growth.

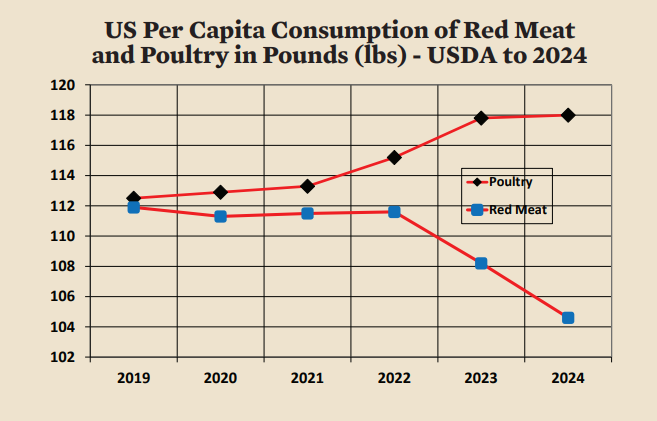

Poultry per capita consumption in the US increased recently while red meat per capita declined. This year, red meat per capita consumption is expected to fall by five pounds (2.3 kilos) while poultry consumption rises by two pounds (one kilo). Next year, poultry consumption is not expected to increase at all while red meat continues to bfall another three pounds (1.4 kilos) per capita. In 2024 the beef industry will be at the bottom of the beef cycle. Therefore, production and per capita consumption of beef can be expected to increase starting in 2025.

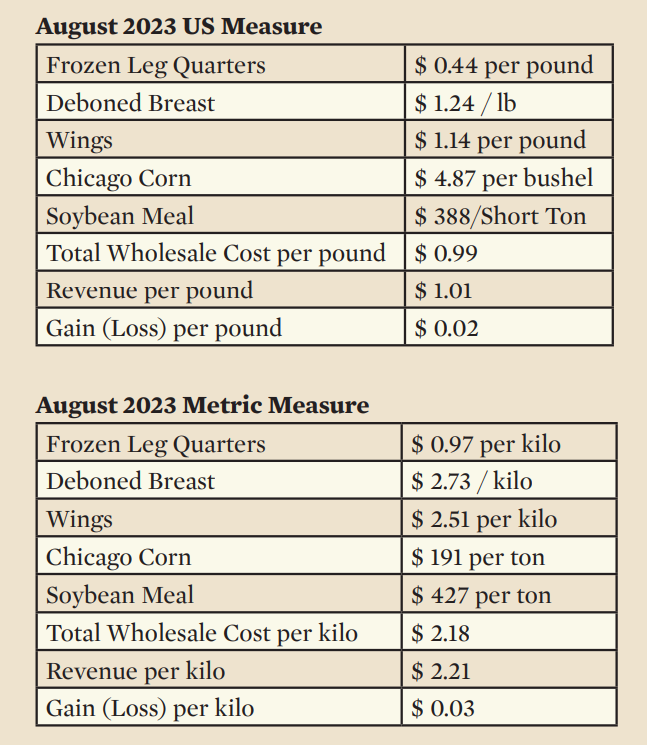

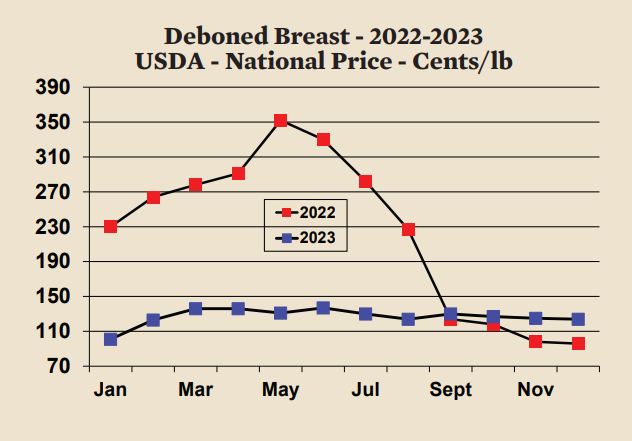

Deboned Breast

Deboned breast meat prices fell sharply in the last half of last year with increased supply and barely recovered in recent months. Prices are now around $1.25 per pound ($2.75 per kilo), 50% lower than one year ago. By September year-to-year price comparisons will be the same. Overall, 2023 prices will average significantly less than in 2022.

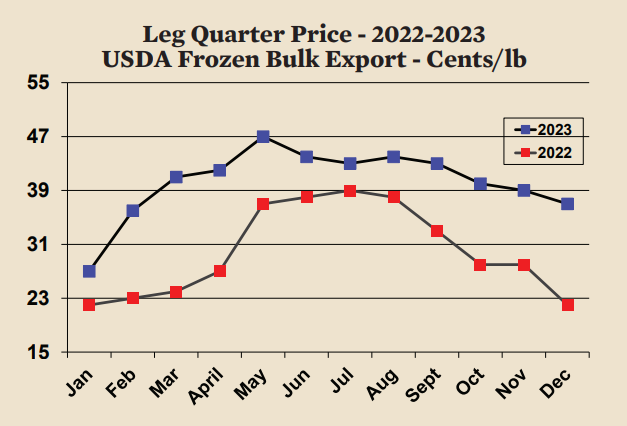

Frozen Leg Quarters for Export

In contrast to deboned breast, leg quarter prices are higher this year compared to last year. One year ago, frozen leg quarters for export were 39 cents ($0.86 per kilo). Now the price is 44 cents (97 cents per kilo). Robust international demand for frozen leg quarters sent prices higher. Overall, the average price in 2023 will be higher than that of 2022.

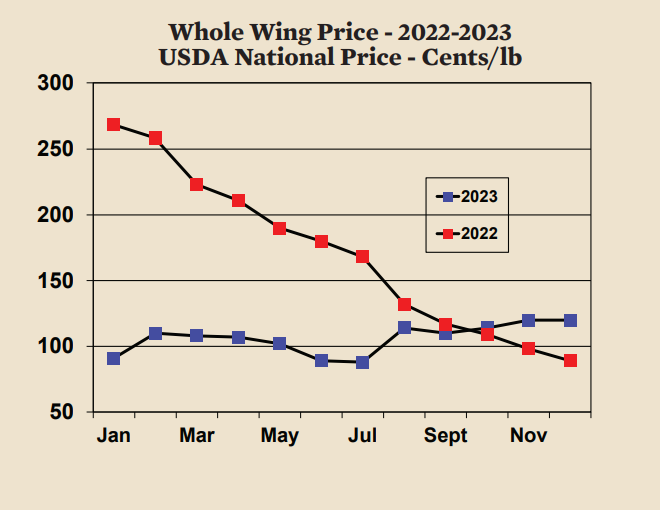

Wings

The falling price of wings early last year was a harbinger of declines in the other chicken prices that came later. Now a year has gone by and the wholesale price is roughly the same now as it was a year ago. Overall, the average price of wings, like deboned breast is lower this year compared to last year.

Chicken production in the US has been unprofitable for much of the last year due to high grain prices and low chicken prices. Thanks to the recent decline in the price of corn the industry may now be breaking even. Barring any grain price surprise and the continued shortage of red meats, the industry could remain marginally profitable through the winter.