Food Outlook Global Market Analysis - Poultry Meat

By FAO. Rebounding demand together with tight supplies and rising production costs sustain meat prices in 2007Prices

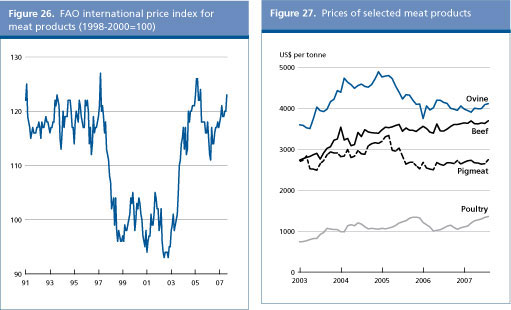

FAO's meat price index recovered from the low value of 112 in March 2006 to 123 in August 2007 (1998-2000=100), reflecting higher prices for all the three major groups of meat, i.e. bovine, pig and poultry meat. With increased costs of production in major producing countries, the rise in prices can be expected to continue. In August, beef prices were almost 6 percent above year earlier levels, sustained by a strong import demand and limited export supplies, especially in Australia. Despite a slight tendency for pigmeat prices to firm over the year, by August 2007 the FAO's pigmeat price index stood at only 99 points; up from 96 in August 2006. Much of the growth reflected developments in China where low domestic supplies have converted the country from a net exporter to a net importer. Currently, the main source of the increase in FAO's global pigmeat index is a gain of around 12 percent in the wholesale price of pork loins from the United States between January and August of 2007. On the supply side, the price pattern was also influenced by rising feed and energy costs. From January to August 2007, average poultry export prices in Brazil and the United States had increased by 21 and 30 percent, respectively, compared with the same period in 2006. The export price strength largely reflects the continued recovery of global poultry import demand in 2007, despite a recurrence of avian influenza in different parts of the world and sharply higher feed and energy costs. These specific market developments were captured in the FAO poultry price index, which strengthened considerably since January, reaching 136 points in August 2007, the highest level observed in the last ten years.

| Table 8. World meat markets at a glance | |||||

| 2005 | 2006 estim. | 2007 f'cast | Change: 2007 over 2006 | ||

|---|---|---|---|---|---|

| million tonnes | % | ||||

| WORLD BALANCE | |||||

| Production | 269.3 | 275.7 | 278.3 | 1.0 | |

| Bovine meat | 64.5 | 66.2 | 67.1 | 1.3 | |

| Poultry | 82.9 | 83.7 | 86.2 | 3.0 | |

| Pigmeat | 103.7 | 106.9 | 105.8 | -1.0 | |

| Ovine meat | 12.9 | 13.6 | 13.8 | 2.1 | |

| Trade | 20.6 | 21.1 | 21.4 | 1.5 | |

| Bovine meat | 6.6 | 6.8 | 7.0 | 2.5 | |

| Poultry | 8.2 | 8.1 | 8.2 | 1.3 | |

| Pigmeat | 4.8 | 5.0 | 5.0 | 0.7 | |

| Ovine meat | 0.8 | 0.8 | 0.8 | -0.3 | |

| SUPPLY AND DEMAND INDICATORS | |||||

| Per caput food consumption: | |||||

| World | kg/year | 39.5 | 40.0 | 40.0 | 0.0 |

| Developed | kg/year | 58.6 | 59.0 | 59.3 | 0.6 |

| Developing | kg/year | 31.0 | 31.6 | 31.6 | -0.1 |

| FAO Price Index | (1998-2000=100) | 121 | 115 | 1201 | |

| 1 Jan-Aug 2007 | |||||

Despite the recurrence of Avian Influenza (AI), global poultry consumption continues to grow

Global poultry meat production in 2007 is projected at 86.2 million tonnes, 3 percent higher than last year. Growth is expected in all regions, except in North America. United States' production will stagnate, because of higher feed and production costs, which fostered a slight downsizing of the sector for the first time. Canada's situation will greatly depend on the outcome of the measures taken to contain its recent AI outbreak, but the country is expected to increase its output. Production is also likely to increase in South America. Argentina and Brazil are showing the highest growth amongst producing countries reflecting, as in the case of pigmeat, a relatively favourable feed situation and competitive production systems. Thailand's poultry production is forecast to increase at a slower pace this year, as the market was burdened by large supplies carried over from 2006. This year, despite recurring outbreaks of AI, China is anticipated to increase its poultry output through measures that improve feed conversion into meat. The outbreak of AI at the beginning of the year had little impact on Japan's poultry sector, with output expected to increase slightly. All the other major poultry producers, namely Australia, Colombia, India, Indonesia, the Islamic Republic of Iran, the Russian Federation, South Africa and Turkey, are expected to increase their poultry production in 2007, largely in response to improved domestic demand.

In Africa, overall output is anticipated to increase slightly, mostly reflecting higher production in South Africa and a recovery in Egypt from AI, which had strongly depressed the sector in 2006. Despite the resurgence of AI in parts of the European Union, prospects for poultry production in 2007 remain relatively optimistic. Competitive prices, with respect to other meats, consumer preference for white meat and increased use in food preparations have favoured poultry meat. The accession of Bulgaria and Romania at the start of 2007 had only minor impacts on European Union poultry sector since their combined output contributes only 4 percent, or close to 500 000 tonnes, of the EU-27 poultry production.

Trade in poultry meat is projected to rise by 1 to 2 percent to 8.2 million tonnes, sustained by increased import demand, but limited by scant export supplies in the United States. Much of the import growth is expected to originate from Asia, especially China, Singapore and Viet Nam, where consumers have mostly substituted broiler meat for pork after the first outbreak of PRRSV in May 2006 in China and the subsequent spread to other parts of the region. Imports by Angola and Cuba are also forecast to rise, principally sourced from United States . Likewise, imports by Turkey are anticipated to recover from the AI-related contraction in 2006, reflecting a return of consumer confidence. By contrast, imports by Japan are set to decline, due to some AI-related concerns amongst consumers and high poultry meat stocks built up in 2006. A tightening in sanitary import requirements by the Russian Federation along with increased domestic production is also expected to result in smaller shipments to that destination.

As for exports, larger sales of chicken meat by Brazil are expected to account for most of the expansion in poultry trade. Exports from the country are now anticipated to surge by 11 percent, to 3.0 million tonnes, in response to strong import demand from countries in the Far East, the European Union, Venezuela and Near East countries, such as Kuwait and Saudi Arabia. Thailand's exports of poultry are set to rise strongly, as the country benefited from the recently introduced European Union import quota on salted poultry and cooked chicken meat. By contrast, despite larger sales to China, the export forecast for the United States points to a 5 percent contraction from last year's 2.9 million tonnes reflecting growing competition from Brazil, especially on the Asian market.

Further Reading

|

|

- To view the full article, please click here. |

November 2007