GLOBAL POULTRY TRENDS – Africa & Oceania Imports Climb

Worldwide, the quantities of fresh/frozen chicken meat exported amount to around 11 million tonnes but the volumes traded in Africa/Oceania are small. The total imported into Africa in 2009 amounted to 763,000 tonnes or about seven per cent of the global figure, while Oceania imported a mere 43,000 tonnes, according to Terry Evans in his analysis of broiler meat trade in these two regions.Purchases by African countries are growing and are likely to reach one million tonnes shortly, while a forecast for 2020 stands at 1.3 million tonnes.

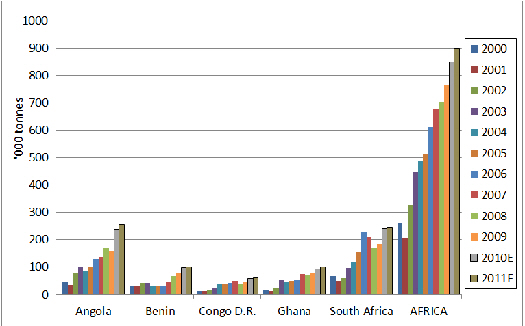

Five countries dominate the import trade, namely Angola, South Africa, Ghana, Benin and the Democratic Republic of the Congo, these accounting for some 72 per cent of the total for Africa in 2009, though this proportion could have risen to as much as 84 per cent in 2011.

While for most of the past decade South Africa has been the leading importer in the region, the latest estimates by USDA economists indicate that Angola could take over the number one spot this year with purchases of more than 250,000 tonnes (see Figure 1), the bulk of which will have been bought from Brazil and the US.

Over the past decade, some 2.2 million tonnes of poultry meat have been purchased by South Africa, of which around 87 per cent was chicken meat, the remainder being almost entirely turkey meat.

Broiler meat imports into South Africa are primarily driven by exchange rates. According to a USDA Gain Report, imports last year shot up by more than 17 per cent to exceed 240,000 tonnes following a 15 per cent increase in the value of the rand. With the rand continuing strong in 2011, imports could reach 300,000 tonnes, which would approximate to some 20 per cent of domestic production.

Poultry meat imports in 2010 increased for the third year in a row to reach almost 266,000 tonnes, though this was still below the 2006 record of some 295,000 tonnes. Of the total in 2010, broiler meat and products accounted for some 91 per cent or 241,000 tonnes.

Regarding broiler meat imports, Brazil was easily the leading supplier shipping 178,000 tonnes or 74 per cent of the total while Argentina took second place with some 27,000 tonnes or 11 per cent. Canada supplied almost 15,000 tonnes (six per cent), the UK 6,300 tonnes (three per cent) while only 3,300 tonnes (one per cent) was purchased from the US.

In volume terms, mechanically deboned meat (MDM) was the largest category, accounting for more than 101,000 tonnes or 42 per cent although in value terms, MDM represented only 20 per cent. Second largest category by volume was frozen bone-in portions (including chicken leg quarters), at almost 77,000 tonnes or 32 per cent by volume but 44 per cent by value. Frozen boneless portions made up nine per cent by volume but 21 per cent by value. Whole frozen chickens and frozen offal represented nine per cent and eight per cent by volume, respectively, and combined around 15 per cent by value.

Of the 194,000 tonnes (17 per cent more than in 2009) of poultry meat purchased from Brazil in 2010, almost 47 per cent was MDM while some 26 per cent was bone-in portions.

South Africa's imports are expected to increase again this year although the Southern African Poultry Association (SAPA) is looking into Brazilian trade practices before deciding to seek anti-dumping duties on chickens for unfair competition. Under World Trade Organisation (WTO) rules, member states can impose import duties against dumping when companies sell goods abroad at below cost or at less than the prices in their home markets. However, it can take as long as a year to assess if a submission is valid or not.

As a result of an anti-dumping duty imposed against US poultry products, shipments to South Africa have slumped sharply from more than 50,000 tonnes in 1997 although they recovered a little in 2010 to around 8,000 tonnes.

If the local demand for chicken becomes restricted, imports will play an even bigger part in trade as they and in particular, Brazilian products enjoy a price advantage stemming from economies of scale.

In 2010, South Africa exported almost 16,500 tonnes of broiler meat (up 30 per cent on the year) with Zimbabwe the main customer taking 64 per cent, followed by Mozambique with 26 per cent. But in 2010, exports look to have declined and will likely not have exceeded 10,000 tonnes as a result of Zimbabwe introducing import restrictions and in the first quarter of 2011, Mozambique became the leading buyer of South African chicken meat with 2,000 tonnes (49 per cent of the total) followed by Zimbabwe with just under 1,900 tonnes (46 per cent).

Of all the African countries, purchases by Ghana have exhibited the most rapid annual increases over the past decade, imports rising from just 14,000 tonnes in 2000 to the current estimate for 2011 of 100,000 tonnes.

Oceania

Trade to and from Oceania is small, with annual imports in 2009 at around 43,000 tonnes, just about exceeding exports of some 33,000 tonnes.

On the import front, French Polynesia was the major buyer in 2009 taking 12,300 tonnes, with the US supplying some 10,500 tonnes. Other leading buyers were New Caledonia and Samoa.

Just two countries account for Oceania's chicken meat exports – Australia shipping some 29,000 tonnes in 2009 and New Zealand with a little less than 4,000 tonnes. In 2010, Australia exported 26,000 tonnes with the forecast for 2011 standing at 30,000 tonnes. Main customers are Hong Kong, South Africa, the Philippines and Papua New Guinea.

December 2011