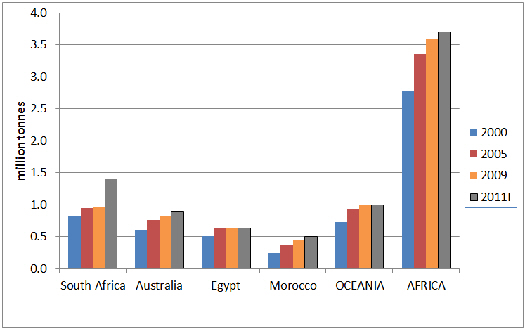

GLOBAL POULTRY TRENDS - Africa to Produce 4MT of Poultry in 2011

Africa is forecast to produce four million tonnes of chicken meat in 2011, according to seasoned industry watcher, Terry Evans, as he turns his attention to the trends in the broiler industries of Africa and Oceania. In Australia and New Zealand, annual growth in output is expected to continue but to be modest.Poultry meat production in Africa will likely exceed four million tonnes for the first time in 2011, which will equate with a chicken meat output of around 3.7 million tonnes, or about 93 per cent of the total. Since 2000, chicken meat production in this region has expanded by about one million tonnes, showing an average annual growth rate of some 2.6 per cent. The total currently represents just over four per cent of world production estimated at 90.5 million tonnes. For 2012, global chicken meat (table birds plus culled layers) will come close to 93 million tonnes.

Although there are over 50 countries in the region, more than 40 produced less than 50,000 tonnes in 2009 (table 1). Thus it is clear that in common with the other regions covered by these reports, the bulk of production comes from just a handful of countries. In this case, in 2009, seven countries, each producing more than 100,000 tonnes a year account for some 77 per cent of total output, while the largest three – South Africa, Egypt and Morocco – supply some 57 per cent. While sadly, production has not grown over the past decade in 10 to 12 countries, a handful of the smaller nations have managed to double production since 2000. Estimates for 2011 point to the 'Big Three' accounting for possibly two-thirds of the total.

In South Africa, the poultry sector is the country's largest individual agricultural industry, contributing almost 18 per cent to agriculture's gross domestic product. This is easily the leading producer with slaughterings in 2010 amounting to 969 million birds producing some 1.3 million tonnes of meat or four per cent more than the 931 million birds or 1.25 million tonnes yielded in 2009. However, for 2011, slaughterings are expected to rise by just one per cent to 980 million with output rising to almost 1.32 million tonnes. In 2009, the growth rate slowed to less than one per cent as a result of significantly higher production costs coupled with the impact of the economic recession on consumer demand. Fortunately, South Africa's economy recovered in 2010 and domestic demand for poultry products increased again. In addition to broiler output, slaughtering of breeders and culled layers boosted chicken meat output by some 24,500 tonnes and 28,670 tonnes respectively, bringing the total for chicken meat in 2010 to a little over 1.3 million tonnes.

The broiler industry is dominated by two large concerns namely Rainbow (with a 24 per cent share) producing some 4.4 million birds a week and Astral (22 per cent) averaging four million per week. The third largest, Country Bird, grows 1.3 million broilers a week taking seven per cent of the market. These three plus four other medium-sized companies, each with slaughterings of more than 800,000 birds per week, represent 73 per cent of total production.

Prior to last year, increases in feed costs had not been offset by higher selling prices putting profit margins under pressure. However, lower maize and soya prices brought about a 10 per cent reduction in the cost of broiler rations in 2010. Production efficiency continues to improve such that birds now average 1.85kg live weight in 35 days compared with 1.79kg in 42 days back in 1998.

On the disease front, recent years have witnessed greater emphasis on precautionary measures, disease surveillance and control. Furthermore, the poultry sector has funded a long-term disease reduction programme that should be rolled out during the next three years.

One forecast indicates that between 2010 and 2015, the industry could expand by some 32 per cent. However, America's Food and Agricultural Policy Research Institute (FAPRI) projects a more moderate near 18 per cent expansion as broiler output rises to exceed 1.5 million tonnes.

Although Egypt is the second largest producer in the region, according to data (table 1) produced by the Food and Agriculture Organisation (FAO), output having expanded to top 700,000 tonnes in 2007, has since contracted to 625,000 tonnes in 2009 and, according to FAPRI estimates, 2010 witnessed a further decline to 548,000 tonnes, presumably as a result of outbreaks of avian influenza which first appeared in Egypt in 2006. Indeed, Egypt has been the most affected country by this disease outside of Asia. Now, a recovery appears to be underway with forecast production climbing towards 700,000 tonnes again in the foreseeable future as demand is boosted by increases in the population and in gross domestic product (GDP per person).

Morocco is the third largest producer output having grown steadily and is currently likely to be close to 500,000 tonnes, which means that the industry will have doubled production since 2000.

Production in Oceania represents only a little more than one per cent of the global total (Table 3). Over the period 2000 to 2009, the annual rate of growth averaged around 3.5 per cent although, in 2008, output contracted slightly recovering to a record high in 2009 of almost 990,000 tonnes. Primarily as a result of the 2008 cut-back, expansion since 2005 has averaged only a little more than one per cent a year. Nevertheless, total production this year should exceed one million tonnes. Developments in Oceania are almost totally dependent upon what happens in Australia, which accounts for some 84 per cent of the regional total.

The Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) has forecast that poultry meat production in Australia will expand by around 2.6 per cent a year in the near future, pushing the total to more than one million tonnes by 2015. On the assumption that chicken meat will continue to account for around 93 per cent of the total, it looks as though chicken output will climb towards to 950,000 tonnes by 2015.

Two large fully-integrated companies – namely Ingham's Enterprises and Baiada Poultry Pty Ltd – supply almost 70 per cent of all broilers. A third company, Turi Foods, accounts for just under 10 per cent, the balance being shared among six medium-size integrated processors each supplying between three and nine per cent of the market, and a number of small processors.

Free-range production is estimated to account for between 15 to 20 per cent of the market, according to Greg Hargreave of Baiada Poultry. Although the average live weight at slaughter is around 2.5 to 2.7kg, production of conventional broilers is split between three weight ranges: small birds for the KFC market, birds for barbecuing of around 2.5kg, and larger 3.6-kg chickens used for deboning. The split in demand for these three sizes has lent itself to the growing of single-sex flocks.

Having risen quite quickly from around 105,000 tonnes in 2000 to a peak of 157,000 tonnes, chicken meat production in New Zealand has since declined somewhat to around 135,000 tonnes in 2009. Last year, however, witnessed a small recovery back to around 145,000 tonnes. Looking ahead, it appears that growth is unlikely to exceed two per cent per year, pushing output to around 160,000 tonnes by 2015. In contrast to Australia, only a little over one per cent of chickens are grown on free range.

Earlier this year, it was reported that Affinity Equity Partners with offices in Hong Kong, Jakarta, Seoul, Singapore and Sydney, had been given permission by New Zealand's Overseas Investment Office (OIO) to acquire Tegel Foods, the country's largest broiler producer with a market share of more than 50 per cent.

The second largest player in the New Zealand poultry market is Ingham's Enterprises (NZ) Pty Ltd, a fully-integrated operation owned by Ingham's Australia.

November 2011