GLOBAL POULTRY TRENDS - Asia Takes a Bigger Share of Global Output

Despite some discrepencies in reporting and disease challenges, it is likely that the Asian region will account for an even larger proportion of global chicken meat production this year, writes industry watcher, Terry Evans in this, the first part of his analysis of the chicken industry in Asia in 2011.World poultry meat production in 2011 will grow by some 2.3 per cent to a record 100.2 million tonnes, according to a Food Outlook Global Market Analysis prepared by the Food and Agriculture Organisation (FAO) of the United Nations.

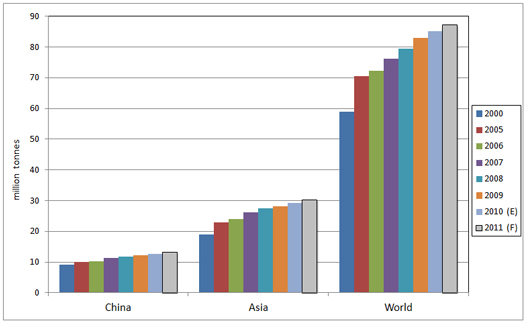

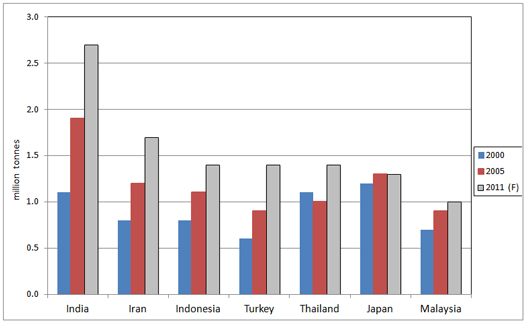

However, it should be noted that, in making this assessment, it is assumed that production in India will be around 2.7 million tonnes. But, at the time of writing, the latest data provided by the Indian Agricultural Ministry to FAO's statistical recording body, FAOSTAT, chicken meat production in India has been drastically revised downwards such that for 2008, as an example, annual output is put at just 650,000 tonnes compared with the figure provided a year or so ago of almost 2.5 million tonnes. The latest figure for 2009 shows a slight increase to just over 680,000 tonnes. Such a drastic cut-back of around two million tonnes means that not only has India's annual production been sharply reduced, but this also impacts negatively on the total for Asia and the world. If these revised figures prove to be correct, then the poultry meat total for 2011 would just exceed 98 million tonnes, while chicken meat production would amount to around 85.2 million tonnes. However, from contacts in India it looks as though the latest FAOSTAT figures are greatly understated and so the data from the old series has been retained in table 1, which puts this year's chicken meat total at around 87.2 million tonnes.

Disease continues to have a major debilitating influence on production, with highly pathogenic H5N1 avian influenza endemic in Bangladesh, China, Egypt, Indonesia and Viet Nam and outbreaks were reported in India in September 2011.

Concerns over rising feed costs might abate a little in the short term, as there are some indications that the production and availability of grains is now increasing in response to higher commodity prices, which could result in lower feed costs in 2012. However, the longer-term view is for raw material prices to continue to rise by between 20 and 30 per cent between now and 2020.

Worldwide chicken meat output represents some 87 per cent of global poultry meat production but around 85 per cent of the Asian total and just 72 per cent of China's poultry meat output as currently this country produces around five million tonnes of duck and goose meat a year. During the past decade, global chicken meat output has expanded by a little less than four per cent a year. However, currently growth is a little over half this amount and this latter situation will likely persist at least in the short term as a result of the impact of high feed costs and also disease, which continues to be a problem in several Asian countries. Nevertheless, while between 2000 and our estimate for 2011, global growth has averaged 3.6 per cent, for Asia the increase has been almost 4.4 per cent. As a result, this region's share of the volume of chicken meat has risen from 32 per cent to almost 35 per cent, or more than a third of the world total (table 1). In 2012 chicken production (table birds and culled layers) will approach 90 million tonnes.

China is clearly the leading producer in the region (table 2), accounting for some 45 per cent of the total. According to the USDA, China should produce some 13.2 million tonnes of chicken this year, considering that rising broiler prices resulting from a strong domestic demand have more than offset higher feed costs stimulating an increase in output. Production is reported to be shifting towards larger-sized commercial operations with more company-owned operations as well as an increase in contract growing. Looking ahead, the Food and Agricultural Policy Research Institute (FAPRI) in the US forecasts China's broiler production climbing to around 16.8 million tonnes by 2025. It should be noted that these output figures relate to Mainland China. Again, highlighting problems reviewing the published data, estimates for the combined production for China and Taiwan differ by as much as one million tonnes!

The rate of growth in China has been less rapid than elsewhere in the region, hence this country's share of the total has slipped from around 48 per cent in 2000 to an estimated 43 per cent or so for 2011. Estimates of production can vary greatly depending on the source, hence as we have often said in these regional reports, greater attention should be paid to the trends than the absolute levels quoted.

The latest cut-backs in the estimates for India mean that from being ranked second in the region, this country would plummet to the number 12 position. However, considering that the estimate for 2011 of some 2.7 million tonnes is more realistic, this would keep India in the number two spot (table 2). Nevertheless, whichever series of figures you look at, it is clear that India's broiler industry has expanded rapidly in the past 10 years and most observers consider that it will continue to do so with economic growth driving demand.

Although among the leading producing nations, output in Japan is best described as 'steady', the annual figure having changed little since 2006, fluctuating around 1.3 to 1.4 million tonnes. Difficult economic conditions appear to have favoured the chicken meat sector as consumers have switched from the more expensive alternatives. Nevertheless, long-term projections anticipate a slight reduction in domestic production towards 1.2 million tonnes a year.

A large expansion in production capacity in Thailand has led to an estimated eight per cent increase in output as the industry continues to recover from the 'low' of less than 900,000 tonnes in 2004. At that time, it was hit severely by outbreaks of highly pathogenic avian influenza (HPAI), and also by the ramifications that the trade bans by importing countries had on exports. According to a USDA GAIN report, in addition to the increase in capacity, the new facilities are equipped with evaporative cooling systems. These changes, coupled with genetic and other management improvements, are giving rise to heavier finishing yields. At least four integrated producers – Betagro, Saha Farm, the GFPT Company and the Thai Food Industry Company – have also expanded their processing facilities. All integrated operations are implementing strict biosecurity measures from the farm to the processing plant, with several also investing in or improving, their cooking facilities. Forecasts to 2025 by FAPRI point to continued expansion of production at around 2.5 per cent a year to reach almost two million tonnes.

The chicken industry in Malaysia has recorded good growth throughout the review period, such that annual output now exceeds one million tonnes. The country is self-sufficient, and as a result, producers are concerned that imports, although currently not large at around 30,000 tonnes a year, will apply a brake to future growth.

The year 2010 witnessed a four per cent increase in chicken meat output in the Philippines and a three per cent rise is envisaged for 2011, though it is doubtful if production will break the 900,000-tonne barrier until 2012.

An increase in chicken purchases by a growing number of health-conscious consumers has boosted demand in the Republic of Korea (South Korea), allowing producers to expand output to an estimated record near 660,000 tonnes. Looking ahead however, it appears that further increases in consumption may, to a marked extent, be met through higher imports.

With regard to Pakistan, another series of output estimates, included in table 1, which take into account all the setbacks the industry has experienced in the past few years, show a significant reduction on the FAOSTAT data.

According to the Iraqi Poultry Producers Association (IPPA), the past couple of years have witnessed almost a revolution in the poultry sector in Iraq, as formerly abandoned poultry farms being brought back into production, with the result that production has risen rapidly to an estimated 230,000 tonnes in 2010, while the 2011 forecast anticipates a further increase towards 250,000 tonnes.

October 2011