GLOBAL POULTRY TRENDS – Brazil and the US Ship 70 Per Cent of All Chicken Exports

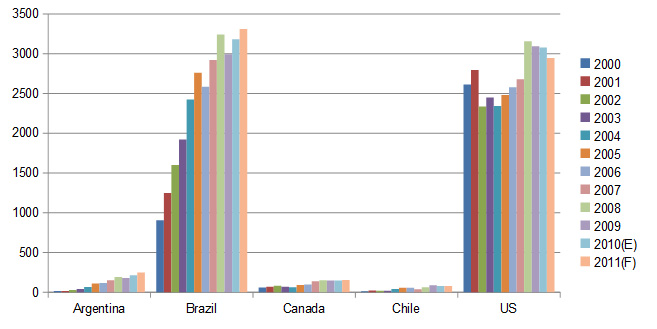

An overview of the trade in chicken meat to, from and within the Americas by industry watcher, Terry Evans.Both of the world's leading exporters of chicken meat are found in the Americas. The two, Brazil and the USA, account for more than 70 per cent of the global total (table 1), which excludes sales between European Union member countries and also of chicken paws. Worldwide the trade in chicken meat is expected to slow in 2011 to a moderate 1.4 per cent, which contrasts starkly with a gain of more than six per cent a year recorded over the decade 2000 to 2010.

The expansion in Brazil's exports has been most dramatic the total (excluding paws) rising three and a half times (251 per cent) during the past decade from just over 900,000 tonnes in 2000 to the latest estimate for 2010 of almost 3.2 million tonnes.

Prior to 2004, the US was easily the world's leading chicken meat exporter but since then, Brazil has taken on this mantle with shipments in 2011 forecast at more than 3.3 million tonnes, while the US total will likely be below 3.0 million tonnes. If the trade in all forms of chicken meat including paws is included, then Brazil's exports in 2010 will have amounted to some 3.8 million tonnes. Future gains in exports seem likely to stem from increased sales of whole birds in general and chicken parts, particularly to China and Hong Kong.

In 2010, the Middle East was the most popular destination for Brazilian chicken sales totalling more than one million tonnes with Saudi Arabia the leading buyer (taking more than 550,000 tonnes) followed by the United Arab Emirates with 208,000 tonnes and then Kuwait (175,000 tonnes), Iraq (105,000 tonnes), Jordan (51,000 tonnes), Qatar (49,000 tonnes) and Oman and Iran both purchasing some 45,000 tonnes. However, according to a USDA Gain report, there appears to be some concern with regard to terms of payments, import logistics and an increase in the cost of insurance on shipments to this region.

Key buyers in Asia were Hong Kong (332,000 tonnes) and China (122,000 tonnes). During 2010, Brazil's trade with China (including paws) rose by more than 400 per cent and, at the time of writing, officials were negotiating to increase the number of certified Brazilian processing plants to export to China from 24 to 44. China is seen by the Brazilian Poultry Union, UBABEF, as a most promising destination as annual chicken meat sales have expanded by some 300 per cent since 2009 when Brazil first entered this market.

Russia and Egypt were also important customers taking 144,000 tonnes and 125,000 tonnes, respectively. In 2010, Brazil accounted for an estimated 19 per cent of Russia's total poultry imports. Although the European Union bought almost 282,000 tonnes, the quantities shipped to this area have declined and fairly recently changes in the EU marketing standards for broiler meat have given cause for concern for Brazilian and other exporters to this market. Under a European Commission regulation, poultry meat which has been frozen must be sold in this state or used in preparations marketed as frozen or quick-frozen. So the ruling prevents chicken meat from Brazil being thawed and used to make fresh ready-meals as it is considered that this would mislead consumers and distort competition between fresh poultry meat and fresh poultry meat preparations. Such meals would be required to be sold as frozen. While the proposals do not ban the sale of frozen poultry, they restrict the use of the term 'fresh'. According to trade sources, Brazil is preparing to take this issue to the World Trade Organization's dispute panel.

Africa will continue to be a major market for Brazilian exporters as South Africa and Egypt took 182,000 tonnes and 125,000 tonnes, respectively, last year. Malaysia and Indonesia are also being targeted.

The United States occupies the number two spot behind Brazil in the ranking of the world's leading chicken meat exporters. The latest forecast for 2010 (table 1) indicates that US exports (excluding paws) almost reached 3.1 million tonnes despite trade problems with Russia and China, previously America's two biggest customers. A reduction of 55 per cent in sales to Russia at 332,000 tonnes and a massive 83 per cent slump in purchases by China at 56,000 tonnes were offset to some extent by increased trade with Hong Kong, Angola and Mexico. Exports to Hong Kong rocketed by 150 per cent to 197,000 tonnes and purchases by Angola shot up by 95 per cent to reach 148,000 tonnes, while shipments to Mexico at 439,000 tonnes rose by 19 per cent. Significant increases were made in business conducted with South Korea, Taiwan, Georgia, the Congo, Viet Nam and Japan. Combined chicken meat exports to the top five markets in 2010 – Mexico, Russia, Hong Kong, Angola and Cuba – amounted to some 1.3 million tonnes or nearly 42 per cent of the total. Nevertheless, in 2010, US chicken meat exports represented only about 35 per cent of world trade compared with 50 per cent 10 years earlier. However, if the US dollar remains weak then US chicken products will continue to be competitive in overseas markets.

US exports of chicken paws in 2010 fell by 35 per cent to 307,000 tonnes. Of this total, 244,000 tonnes (+184 per cent) went to Hong Kong. Hence, total chicken meat exports (including paws) came close to 3.4 million tonnes last year, about five per cent down on 2009. Cumulative exports (including paws) for the first two months of 2011 at 497,000 tonnes showed an eight per cent gain on the year. For broiler meat (excluding paws), the total was 443,000 tonnes (+6 per cent) and for paws 54,000 tonnes (+30 per cent).

Russia continues to increase protection of its domestic industry from imports and its tariff rate quota (TRQ) for poultry for 2011 is 350,000 tonnes, having imported only 79 per cent of its TRQ for the previous year of 780,000 tonnes.

For 2012, US exports (excluding paws) are projected at almost 3.1 million tonnes.

Argentina has expanded its exports dramatically during the past 10 years or so from a mere 17,000 tonnes to an anticipated 214,000 tonnes in 2010. Additionally, some 40,000 tonnes of paws were sold. In 2010, some 141,000 tonnes were whole birds, with Venezuela (69,000 tonnes) and Chile (27,000 tonnes) the leading buyers. For 2011, exports (excluding paws) are predicted to climb further to 250,000 tonnes.

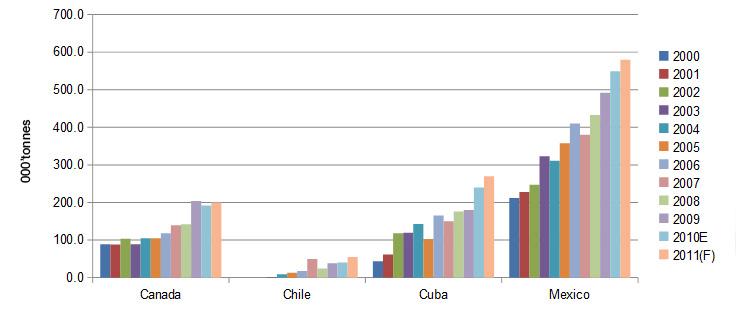

Increased demand in Asian markets and some African countries as the recovery picks up after the recession is the driving force behind exports from Canada for 2010 and 2011 which are expected to be around the 150,000-tonne level.

The only other significant exporter in the region is Chile. Here the quantities sold have grown from less than 14,000 tonnes in 2000 to a peak of 87,000 tonnes in 2009. Estimates since then point to a cutback to some 80,000 tonnes a year. The main customer is Mexico.

The Americas is not a significant chicken meat-importing region, the total amounting to around one million tonnes a year. Mexico is easily the leading buyer, purchasing some 550,000 tonnes in 2010. In that year, Mexico was the USA's largest export market. Imports in 2011 are expected to rise by some five per cent to 580,000 tonnes.

September 2011

.jpg)

.jpg)

.jpg)