GLOBAL POULTRY TRENDS – Europe to Become a Net Chicken Meat Importer

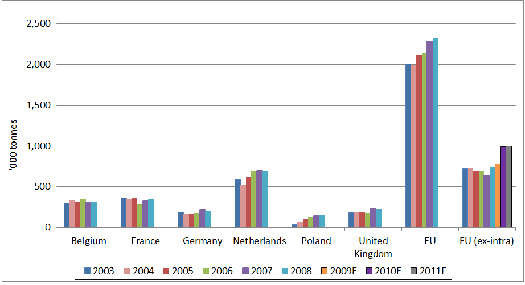

The weakness of the Euro is helping to boost chicken meat exports from the European Union and, while the volumes are no longer increasing, Russia is one of the countries of the region that imports the most product, according to Terry Evans in the latest in his series of articles exclusively for ThePoultrySite.While exports of chicken meat from Europe account for more than one-fifth of the global total of some 10.4 million tonnes, nearly all are from European Union member countries (table 1). Furthermore, of the 2.3 million tonnes sold in 2008, almost 1.6 million tonnes or nearly 70 per cent went to other EU countries. Indeed, prior to 2010, annual exports to countries outside the Community failed to exceed 800,000 tonnes. However, according to a USDA Gain report, this figure is likely to have risen to more than 900,000 tonnes in 2010, primarily as the result of a strong demand from Russia where they partly replaced US broiler exports. In addition, sales to Hong Kong doubled though a proportion of these are likely to have been re-exported to China. EU exports of whole birds to the Middle East, particularly Saudi Arabia and chicken parts to sub-Saharan Africa also rose sharply in 2010, sales benefitting from the weakness of the Euro against the Brazilian Real. According to the report, most EU exporters were able to pass production cost increases on to their customers for the sales of whole birds.

It had been considered that EU chicken exports would contract to around 940,000 tonnes or so in 2011 as a result of Russia lowering its poultry tariff rate quota (TRQ) to 350,000 tonnes, excluding whole birds from the TRQ and removing the country-specific allocations. This has meant that all exporters can compete for the TRQ. However, it is now anticipated that trade to Hong Kong, Saudi Arabia and sub-Saharan Africa (taking low-priced wings and legs) will offset a cut-back to Russia. Indeed, in recent months, EU shipments to South Africa have risen steeply. Total EU exports to third countries could reach one million tonnes this year, though little if any increase is anticipated in 2012.

The Netherlands is easily the leading European exporter, selling roughly double the quantities traded either by France of Belgium.

While the volumes involved are relatively small, it is worth noting how Poland's exports have accelerated since joining the Community in 2004 to more than 150,000 tonnes in 2008 with the Czech Republic, the UK, Germany and France the biggest customers.

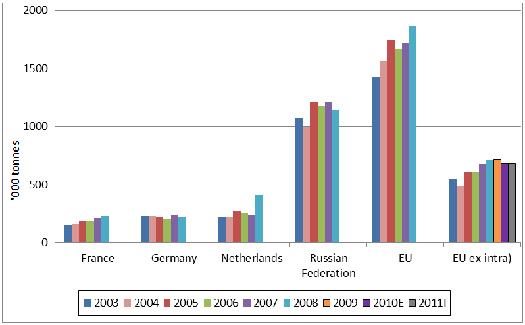

Russia in Europe's No. 1 Chicken Importer

In contrast to the export picture, imports of chicken meat into the EU in 2008 represented only a little over 55 per cent of the total for Europe, primarily because of purchases by Russia of some 1.1 million tonnes. If intra-EU country trade is excluded, then imports into the Community, having peaked at 719,000 tonnes in 2009, then contracted by six per cent to around 680,000 tonnes in 2010, mainly because Brazilian exports to the EU slumped by 11 per cent. According to a USDA FAS report, this reduction came about as a result of a strong Real against the Euro, incorrect use of the new EU licensing system and because the EU would not allow frozen chicken to be sold as fresh after defrosting.

Brazil and Thailand are the leading exporters to the EU followed by Chile and Argentina. However, since 2008, purchases of prepared poultry from China have increased and could amount to around 15,000 tonnes this year.

A European Commission report has noted that the dip in EU imports in 2010 was partly due to the recession since the product mix revealed a switch from more expensive breast meat to cheaper cuts. Looking further ahead to 2020, the report asserts that exports will decline to less than 740,000 tonnes, while imports will expand to exceed 890,000 tonnes. Indeed the EU is expected to become a net importer of poultry by 2016 with net imports rising steadily to reach 155,000 tonnes by 2020.

An EU-South Korea Free Trade Agreement (FTA) which came into force on 1 July 2011 is expected to dramatically cut both tariff and non-tariff trade barriers during the next five years which looks likely to benefit EU exports of agricultural products, hopefully including poultry. However, in relation to the role which Europe will play in world trade in chicken meat, these changes pale into insignificance when compared with the impact of the projected decline in purchases by Russia.

Total imports into Russia in 2010 are expected to have slumped to around 620,000 tonnes. This decline was the result not only of a reduced TRQ but also because of a ban on imports for three-quarters of the year of chlorine treated meat from the USA. Consequently, Russia imported less than 80 per cent of the TRQ of 780,000 tonnes. That the TRQ was slashed to 350,000 tonnes for 2011 is likely to bring about another sharp cut in imports. And a further small reduction in imports is envisaged for 2012 when the TRQ will be lowered to 330,000 tonnes. For the first time, the TRQ has been broken down into two categories – 80,000 tonnes of mechanically-deboned meat (MDM) and 250,000 tonnes of other cuts. As in 201l, whole birds are excluded from the TRQ as they are seen to be in direct competition to domestic production. Hence, they have virtually disappeared from the market.

Half way through 2011, Russia imposed a ban on imports from some 25 poultry concerns in three Brazil states for not being able to introduce a system for fulfilling customs requirements. Brazil accounted for 19 per cent (121,000 tonnes) of Russia's poultry meat imports in 2010.

During the first half of 2011 Russia's broiler meat imports totalled 164,000 tonnes, with some 53 per cent coming from the USA, 25 per cent from Brazil and almost 19 per cent from the EU. Frozen halves and quarters represented 61 per cent of the total and frozen de-boned meat 22 per cent. While chicken leg quarters and MDM dominated the trade, processed/prepared poultry products have increased representing five per cent of the total. These are not subject to the TRQ and are primarily targeted at the fast-food business.

Some reports state that Russia plans to be 85 per cent self-sufficient in 2012 and totally so in 2013, by which time imports will be tiny. However, the distinguished US economist, Dr Paul Aho, argues that it would be a mistake to attempt to achieve this. He takes the view that not only could Russia's industry benefit from importing the cheaper cuts by introducing chicken to those on low incomes but, as a relatively low-cost chicken producer, Russia's broiler industry could also benefit from looking to export opportunities, particularly to neighbouring countries. To date, Russia's exports, which are small, mainly comprise chicken paws destined for Hong Kong and Viet Nam. In 2010, exports are believed to have totalled 15,000 tonnes but the Russian Poultry Producers Union is optimistic that this figure can be increased three or four times in 2011, with China and Kazakhstan key buyers.

However, Russia is endeavouring to gain access to the Community as the EU has agreed in principle to open its market to Russian poultry products as inspectors appear to have been satisfied with the levels of production technology and compliance with EU veterinary requirements.

Negotiations on the EU-Mercosur FTA have been delayed until later this year but EU poultry meat producers have again voiced their concerns on how this could impact adversely on chicken production in Europe.

November 2011