GLOBAL POULTRY TRENDS - Europe's Share Boosted by Russia's Growth

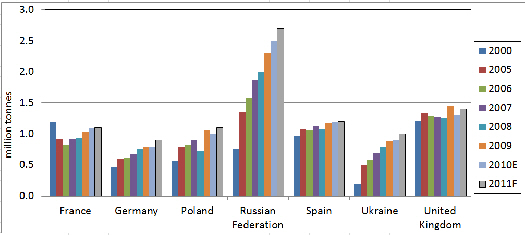

Chicken meat output for the whole of Europe has grown slightly ahead of the world average but the region's national industries continue to develop at different rates, according to experienced industry watcher, Terry Evans. Strong growth in production in Russia and the Ukraine, for example, contrasts with modest increases or even contraction in some EU member states.Between 2000 and our estimate for 2011, world chicken meat production expanded by 48 per cent from 59.0 to 87.2 million tonnes. Over the same time period, production in Europe increased at a slightly faster rate of 52 per cent to reach an estimated 14.3 million tonnes. The latter growth rate contrasted sharply with the picture for the European Union, where chicken meat output rose at less than half this amount at 22 per cent to reach an estimated 10 million tonnes. As a result of these changes, while Europe has managed to increase its share of global production to more than 16 per cent, the EU has seen its contribution slip from almost 14 per cent to around 11.5 per cent.

High feed prices are applying a brake to the rate of growth and at least one forecast projects an annual average increase in poultry meat for the EU of only 0.7 per cent per year between now and 2020. The poultry sector is adjusting to higher production costs as a result of the new EU broiler welfare rules, and it is also going to have to learn to live with becoming a net importer of poultry in 2016 when imports are forecast to reach 845,000 tonnes, while exports are likely to have contracted to around 810,000 tonnes.

That Europe has maintained its status in the global picture is primarily because of a massive 250 per cent or so expansion that has occurred in Russia since 2000, when production totalled less than 800,000 tonnes. The current forecast for both broilers and culled layers in 2011 of some 2.7 million tonnes represents some 19 per cent of our estimate of the total for the region.

Table chicken production represents around 95 per cent of commercial poultry meat output in Russia. The industry is dominated by large enterprises, some 600 or so of which are considered to account for almost 90 per cent of the total output. In a USDA Gain report, the Russian Union of Poultry Producers (RUPP) is reported as saying that nearly 30 per cent of output comes from just five concerns: Prioskoliye (15 per cent), Cherkizovo (seven per cent), Belgrankorm (six per cent), Prodo-Trend (six per cent) and Belaya Ptitsa (three per cent), while just 32 enterprises account for some 63 per cent.

Higher feed cost impacting adversely on profits are expected to slow the rate of expansion in 2011. However, several measures have been taken to reduce the impact of feed costs and by June 2011, grain prices had fallen by around 20 per cent from the January levels, and according to the Ministry of Agriculture, grain stocks were considered to be sufficient for the remainder of the year. With an increase in grain supplies anticipated over the next 12 months, there should be sufficient to support continued significant expansion in chicken meat output to around 3.0 million tonnes in 2012. Apart from asking for government assistance in controlling grain prices, the RUPP is also calling for more protection from imports through stricter tariff and non-tariff barriers. To cope with the anticipated increases in output the Ministry has announced a development programme to 2020, which envisages the renovation and construction of processing facilities.

The second largest producing country in Europe outside the European Community is the Ukraine. Its chicken meat industry has shown rapid growth with annual output in 2010 of 965,000 tonnes showing an eight per cent increase on the year. According to a USDA Gain Report, production is highly concentrated with just two vertically integrated companies, Mironovsky Hleboproduct (MHP) and Agromars, dominating the market accounting for more than 70 per cent of output. The former concern is planning to double its production capacity by 2017. Although the Ukraine's economy was one of the hardest hit in Europe during the recession of the past few years, it had limited impact on poultry consumption as it is considered to be the cheapest form of protein. Boosted by import restrictions and high prices for red meats, it is anticipated that the poultry sector will continue to expand for the foreseeable future, though not as rapidly as in the past decade.

After experiencing almost three per cent growth in 2010, stimulated by a strong export demand and lower imports, the chicken industry in the European Union is expected to record a smaller gain in 2011, pushing total output to around 10,000 tonnes. The leading producing countries of the UK, Benelux, Spain, France, Poland, Germany and Italy are all likely to expand output though some of the smaller producers and in particular, Hungary and the Czech Republic, will produce less. Four EU member countries – the United Kingdom, Spain, France and Poland – each produce more than one million tonnes of chicken meat a year. Output in Germany is in the region of 900,000 tonnes, while both Italy and the Netherlands post around 800,000 tonnes. These six account for more than 60 per cent of the EU total.

The UK is the leading producer in the EU although output this year will likely show hardly any increase at around 1.4 million tonnes, primarily because of the impact of high feed costs; having to conform to the EU Broiler Welfare Directive may also have forced some producers to reduce stocking densities. Even by 2015, it seems unlikely that UK production will exceed 1.5 million tonnes.

While the industries in both Spain and France have expanded since 2009, the volumes involved have been minimal the increases amounting to no more than 50,000 tonnes.

In contrast, growth in Poland has been dramatic, production having almost doubled since 2000 to the current level of more than one million tonnes. In recent years, this country has expanded its exports particularly to neighbouring countries and is expected to become increasingly active in this area in the near term, which will stimulate further growth in domestic production.

Slow growth is expected in the other EU member countries. While increases in consumption are expected to be the key factor stimulating future production, nevertheless between now and 2020, it is anticipated that total EU output will not increase by more than seven per cent.

For the production ranking (table 2) the latest official FAOSTAT data have been used rather than the estimate or forecast figures shown in table 1. While more recent data might show some changes in the ranking among the lower order, there is unlikely to be a significant movement among the top 10 countries, which account for more than 80 per cent of the European total.

November 2011