Grain prices will eventually retreat

Aviagen's Broiler EconomicsHigh grain prices in crop year 2022-2023 have been a huge burden for the poultry industry. When will grain prices settle down to more normal levels? Although no one can say for sure what will be the direction of grain prices, it seems increasingly likely that relief in the form of lower grain prices will arrive no later than crop year 2023-2024 (Crop years start in September).

For commodities in general, the year 2023 is likely to be different from 2022 in several ways. First, interest rates are now higher, the world economy is cooling, and the pace of inflation is slower. Crude oil, for example, started last year at $75 per barrel, rose to $130 and then fell back. In a similar fashion, many commodity prices that were high are returning to lower levels including, importantly for agriculture, fertilizer prices.

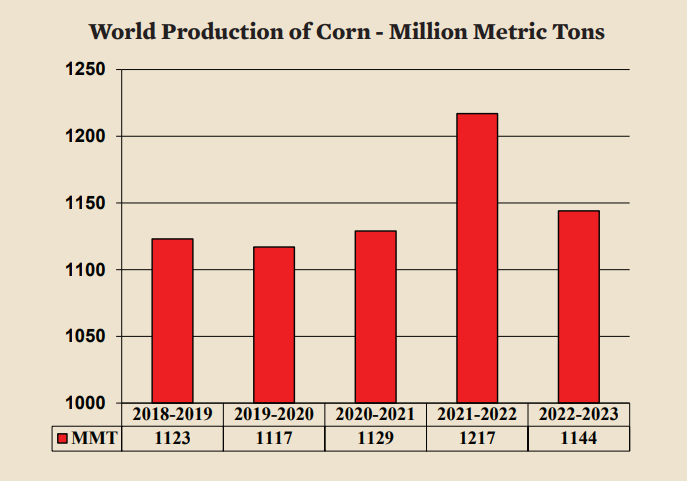

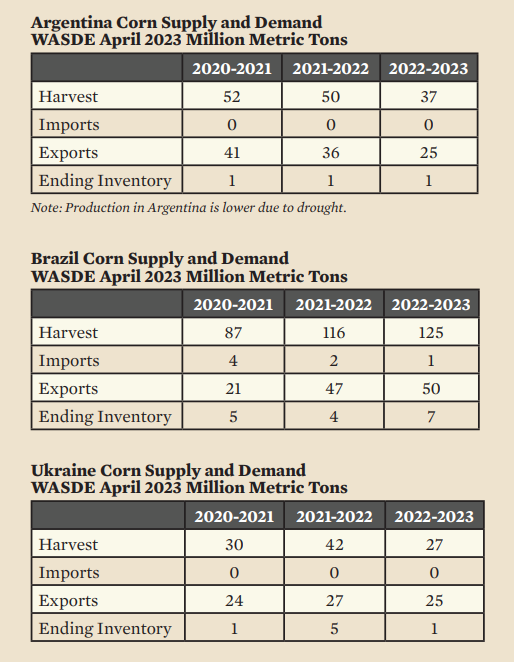

Grain prices were supported during the last crop year in part by the worst drought in decades in Argentina and a war that broke out in a breadbasket. With the shift from “La Niña” to El Niño in the Pacific, a bumper crop in expected a year from now in Argentina. As for the war, predictions are bound to be wrong, but it is possible that the situation will be no worse this year than last year. With a relatively good harvest in the Northern Hemisphere this year, grain prices would fall from their current high levels.

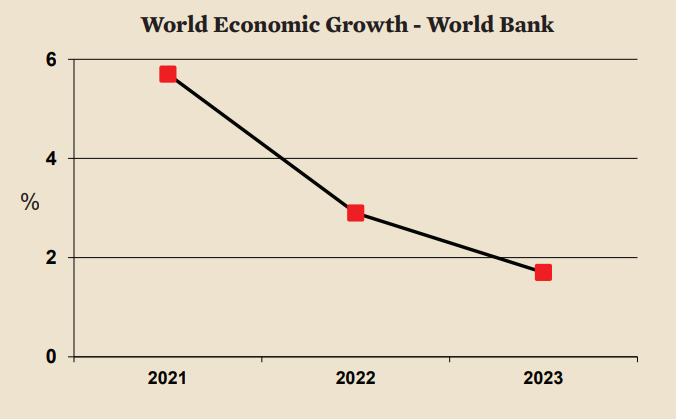

Whether it be crude or corn, bull markets do not last forever because high prices stimulate additional production and discourage use. That potent combination eventually brings a bull market to its knees. Given that underlying economic fact of life, grain markets are likely to begin a bear market sometime in 2023. Use of grain will also be tempered by a slowing world economy. In 2021 world growth was a blistering 5.7%. The World Bank projects growth of only 1.7% in 2023.

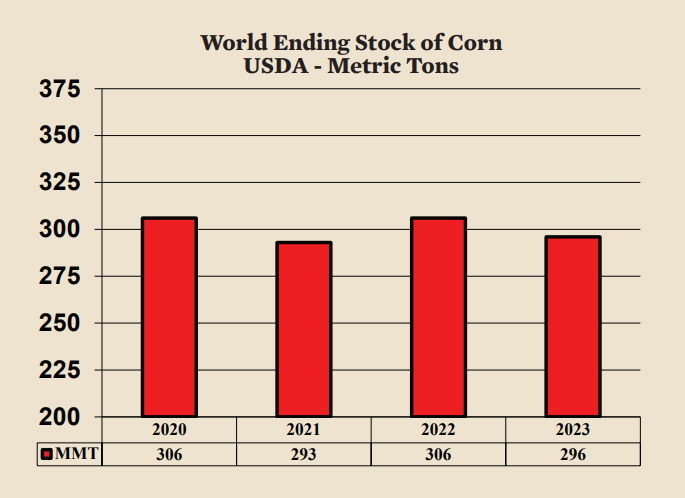

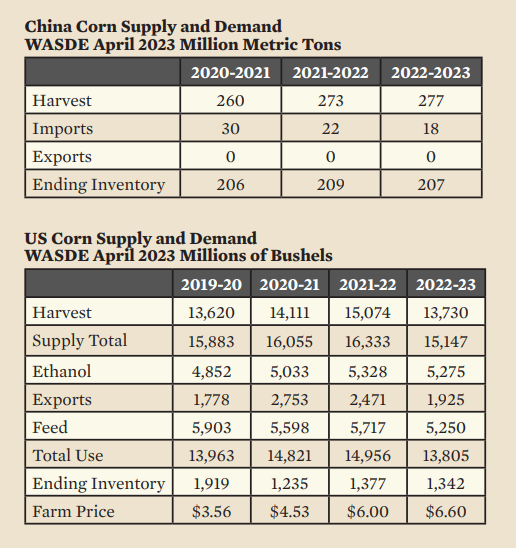

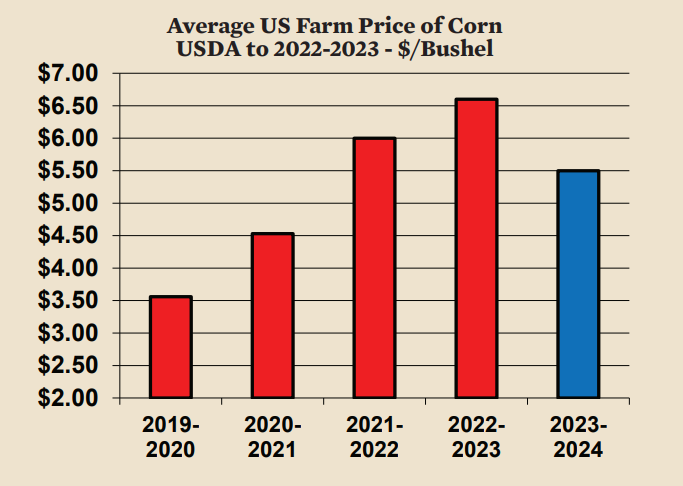

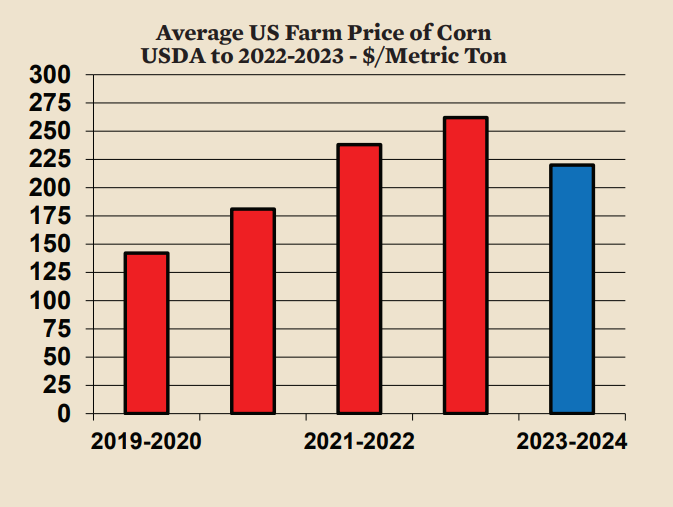

Corn

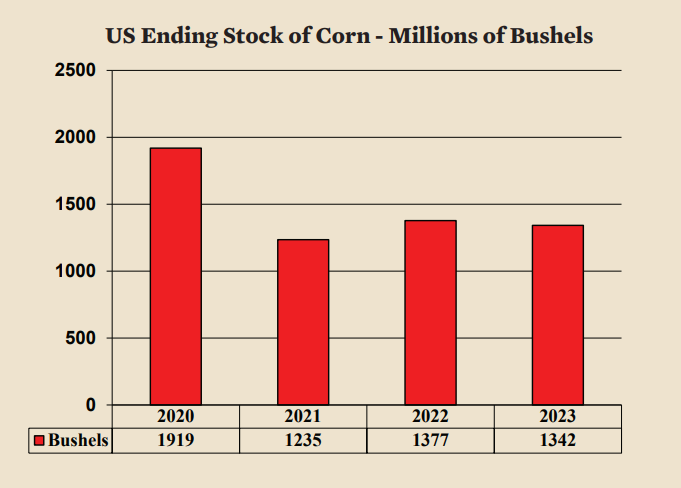

The average price of corn this crop year in the US is higher than last crop year. Prices rose due in part to uncertain prospects for the harvest in Argentina and, of course, the Ukraine. After this crop year, a bear market, and lower average prices in crop year 2023-2024 can be expected to follow this long bull market. A regression to the mean is inevitable particularly considering the expected development of “El Niño” conditions in the Pacific Ocean which generally affect crops favorably.

The average price of corn this crop year in the US is higher than

last crop year. Prices rose due in part to uncertain prospects

for the harvest in Argentina and, of course, the Ukraine. After

this crop year, a bear market, and lower average prices in crop

year 2023-2024 can be expected to follow this long bull market.

A regression to the mean is inevitable particularly considering

the expected development of “El Niño” conditions in the Pacific

Ocean which generally affect crops favorably.

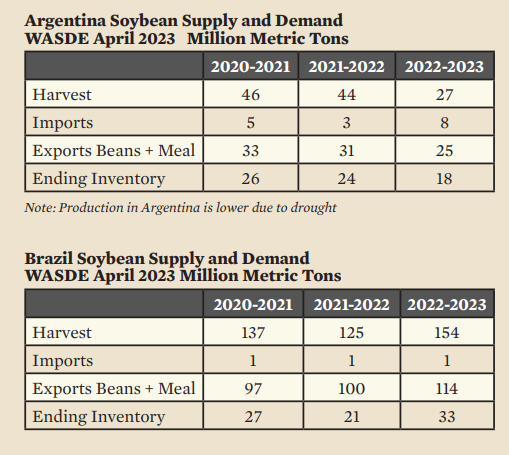

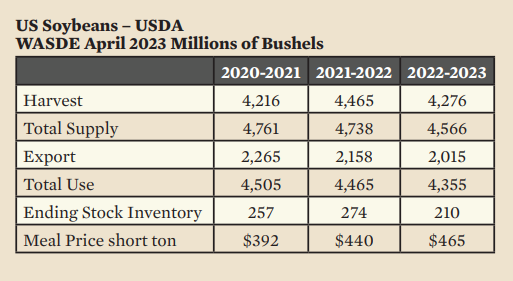

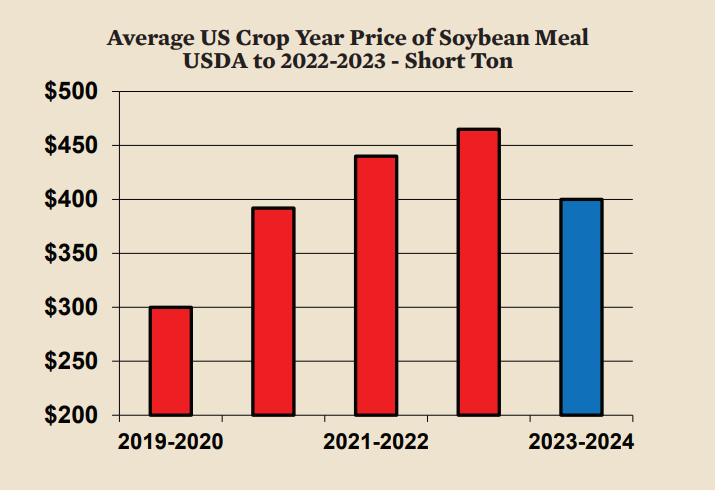

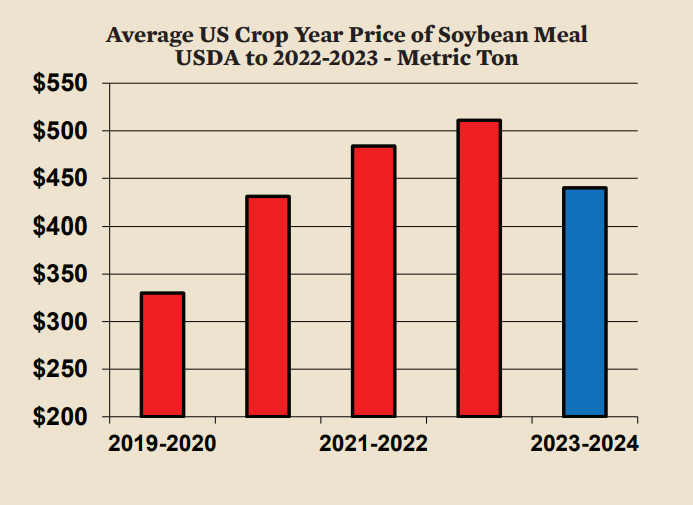

Soybeans

Soybean meal prices were less affected by the war and more affected by drought and floods in Argentina and Brazil last crop year and a continuing drought in Argentina this crop year. Production in South America dropped by 15 MMT last crop year but will bounce back 10 MMT this crop year. The enormous capacity for Brazil to increase soybean production (mostly) negated the effect of a serious drought in Argentina this year and puts a long term cap on prices in the future.

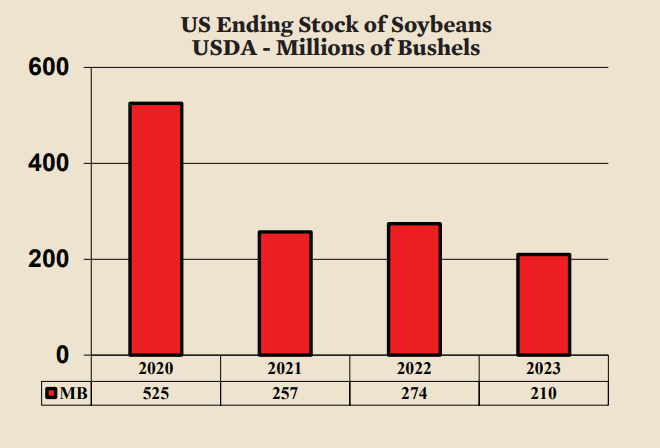

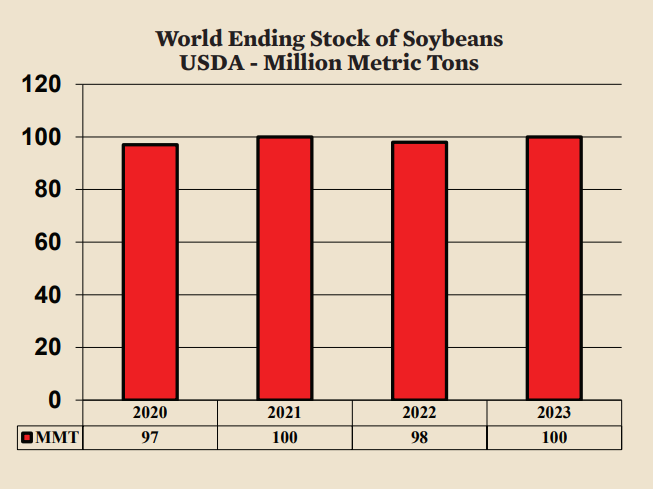

US ending stock will fall somewhat this crop year while world ending stocks are remarkably stable in the light of the severe drought in Argentina. A bear market next crop year 2023-2024 is a reasonable expectation given the likelihood of increased production in the US, Brazil and Argentina.

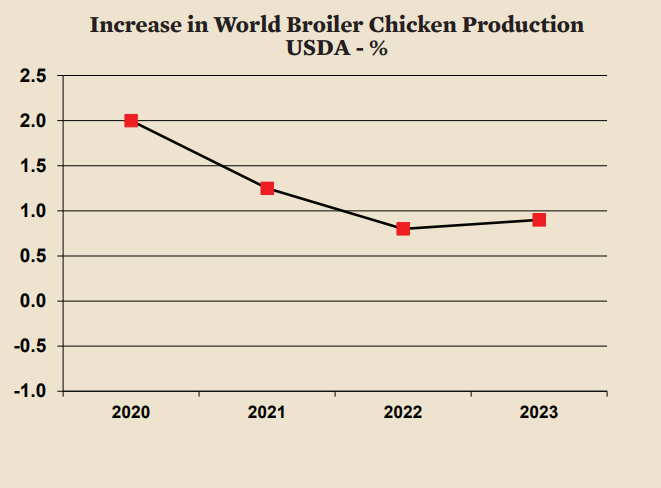

Chicken Industry

The world chicken industry expanded just 0.8% last year and slow growth is projected to continue this year. The latest USDA estimate puts world chicken growth at just 0.9% this year. The slow acceleration in production growth is due to a looming recession and continued relatively high grain prices. Normal growth in the world chicken industry should be about 2% per year.

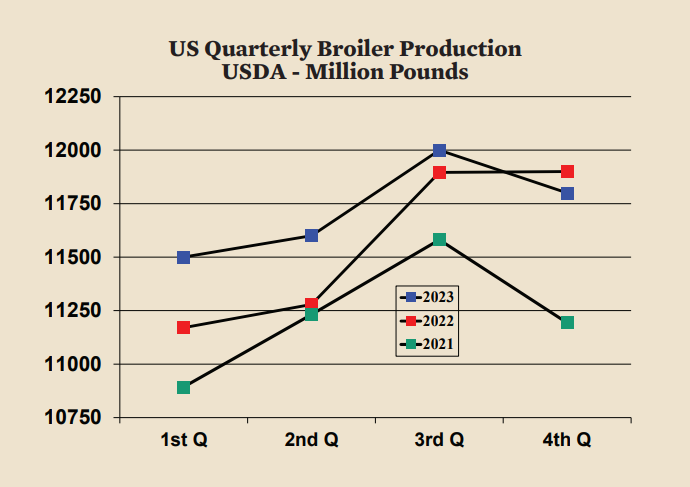

In the US, production rose 3% last year and is expected to rise 1.6% this year. Production accelerated in the last half of 2022 leading to a decline in wholesale prices. The increase over year earlier numbers between August and November of 2022 reached 5.8%, an unusually high number. The comparison of the same months this year (August to November 2023 versus August to November 2022) is likely to show a much smaller percentage increase.

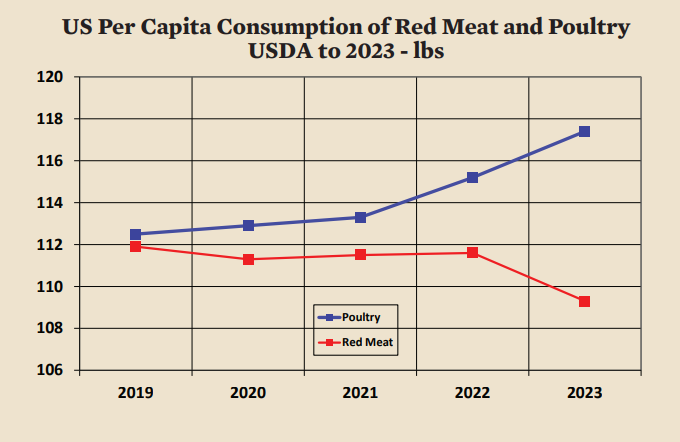

Between 2019 and 2023 poultry per capita consumption in the US increased while red meat per capita consumption declined. This year red meat per capita consumption is expected to fall by two pounds (one kilo) while poultry consumption rises by two pounds (one kilo). The relative scarcity of red meat this year and the resulting higher prices for red meat will help poultry prices recover.

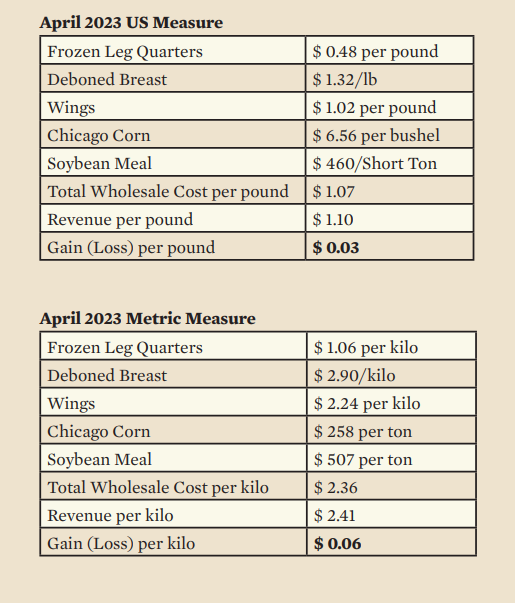

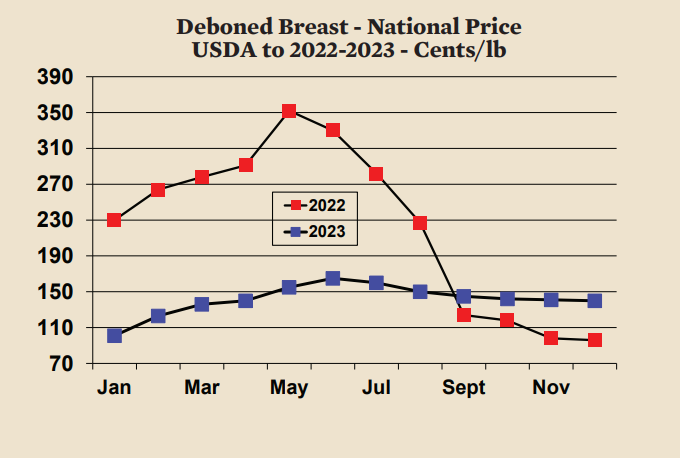

Deboned Breast

Deboned breast meat prices fell sharply in the last half of last year with increased supply but have recovered somewhat in recent months. Prices are now around $1.30 per pound ($2.90 per kilo) down sharply from $3.50 per pound ($7.70 per kilo) a year ago. In 2023, prices are rising seasonally but are likely to average significantly less than in 2022.

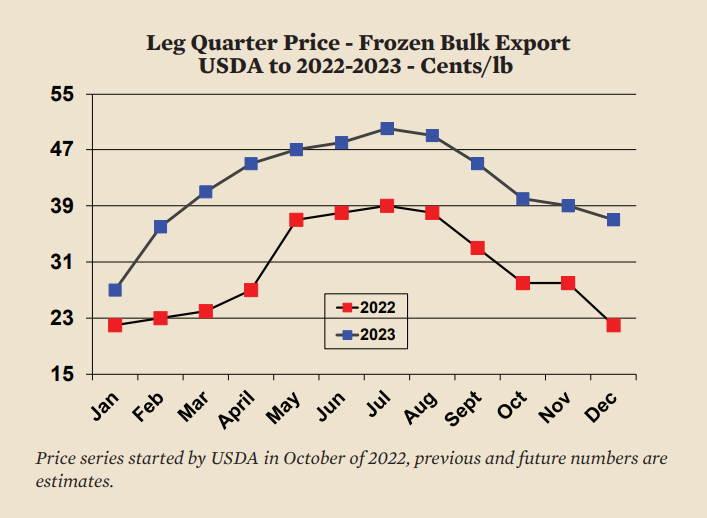

Frozen Leg Quarters for Export

In marked contrast to deboned breast, leg quarter prices are higher than last year. One year ago, frozen leg quarters for export were just 25 cents ($0.55 per kilo). Now the price is nearly double at 48 cents (105 cents per kilo). Robust domestic demand for fresh leg quarters and international demand for frozen leg quarters sent prices higher. Overall, the average price in 2023 can be expected to be higher than that of 2022.

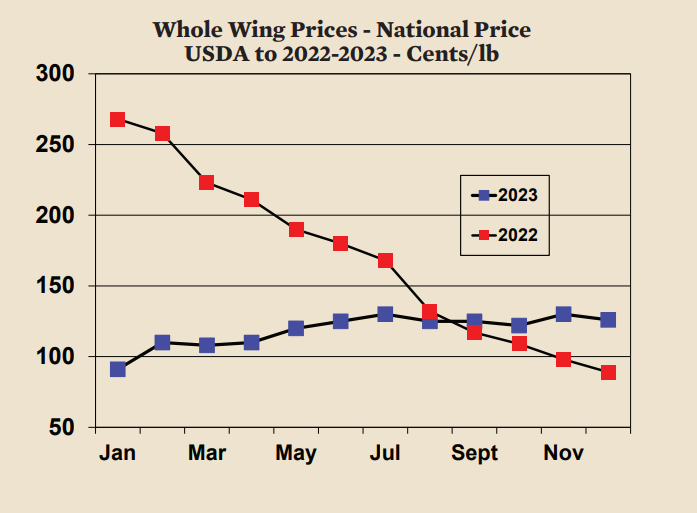

Wings

The falling price of wings last year was a harbinger of declines in the other chicken parts that came later. The wholesale price is now less than 50% of what it was at this time last year. The year-to-year comparisons are likely to show wings exceeding last year’s price by the end of the year. Overall, the average price of wings, like deboned breast is likely to be lower this year compared to last year.

Chicken production in the US is now profitable thanks to the recent seasonal increase in chicken prices. The industry is likely to remain profitable as grain prices fall and competing meatscontinue to remain scarce.