Market trend: increasing demand for cage-free eggs in EU, USA and Asia

From 2027, keeping poultry in cages will be banned in the EU. In the USA and Asia, the initiatives are much more fragmented. Frank Hartmann reviews the effect on the market and our customers.Recently, the European Union (EU) voted in favor of the end of the 'cage age'. From 2027, keeping poultry, hogs, calves and rabbits in cages will be banned. Until then, there will be a transitional period. In the USA and Asia, the initiatives are much more fragmented. In this trend article, I discuss the effect on our poultry customers who have commercial layers.

Influencers for cage-free eggs from 2027

The forerunners in restricting enriched cages for commercial layers were the Netherlands, Slovakia and the Czech Republic. The EU is now also opting for a ban with a phasing-out period until 2027. The driving force behind this EU ban are a number of large food groups and animal welfare organizations. At its heart lie a changing understanding of animal welfare as well as a drive for a more sustainable food policy. Commercial companies are happy to include these ethical statements in their communication. And the EU sees it as a measure in its “Farm to Fork“ strategy, a project that works toward a food chain that is fairer, healthier and more environmentally friendly.

At the moment, 48 % of table eggs in Europe still come from houses with enriched cages. These eggs are no longer for sale as whole eggs to consumers. They are mostly processed in the food industry. Even before the EU voted for this ban, a number of large players in the food industry had already switched to cage-free eggs. Nestlé Europa and Mondelēz International are already manufacturing all biscuits or ice creams (or nearly all) using cage-free eggs. Unilever states that 100 % of its sauces are produced using free-range eggs. There is great support among the multinationals, Danone, Walmart, Aldi, Lidl, General Mills and Kellogg's also announced a switch. The list of resounding company names is – so to speak – getting longer every day.

Direct consequences for the commercial layers sector

This news will force the commercial layers sector to invest again in the coming years. On the one hand, many farmers of commercial layers only recently (before 2012) replaced their battery cages with enriched cages. Now financial efforts are again expected to purchase a completely new house design, including new feeding, drinking and nesting systems. Agricultural federations and ministers therefore strive for sufficient advice, guidance and financial support for the sector. Because it is not an investment that will result in lower, daily production costs. The operational costs will be higher. This means that strictly speaking, a higher egg price will be required.

On the other hand, there is unrest about the import from non-EU countries. And this does not only concern cheap cage eggs, but also derived products such as powdered egg yolk. The sector hopes that the EU will do sufficient work on clear import rules for eggs and egg products. Fair competition in the field of imports is an absolute precondition.

Alternatives to layers houses

Currently, 5 types of layout are in circulation globally for use in layers houses. In the summary below, layout 1 and 2 are aimed at reducing the cost price. These 2 types are increasingly being banned. Layouts 3 to 5 are the alternatives.

- Battery cages: They have been banned in the EU since 2012 but are still in use in the United States and Asia. The Kingdom of Bhutan is actually one of the only countries outside the EU with a ban on battery cages. A global map with the status of battery cages.

- Enriched cage: a multi-storey cage principle, which is now being phased out in the EU until 2027.

Alternative systems for commercial layers: - Aviary housing: this housing system also consists of several floors. The floor of the house contains litter in which the animals forage and bathe in sand. Perching systems are provided that serve as resting places.

- Floor housing: is a free-range house without floors, which offers a better overview. Perching systems are provided that serve as resting places. There is no outside run.

- Free range: is a free-range barn with floor housing and free ranging outside during the day. The organic segment also chooses this layout, only here the commercial layers get organic feed and they have a little more space when they are indoors.

Commercial layers in 5 types of lodging: cage systems (1-2) and alternative systems (3-5)

Snowball effect in rest of the world

How is the legislation evolving in other continents when it comes to enriched cages? In the United States, the state of California will switch to cage-free eggs in 2022. And the number of states in the USA that put a deadline on the use of cage eggs is getting longer (in the West: Nevada, Utah, Colorado, Washington, Oregon, California; in the East: Michigan, Massachusetts and Rhode Island). However, the fragmentation between states seems to be turning into a nightmare for retailers when it comes to logistics.

In Asia, too, it is predicted that the cage-free egg will become the standard by 2025. At the moment, it is mainly the multinationals like Charoen Pokphand Foods and hotel chains who set the tone. In Taiwan, the government has already announced that they want to upgrade the guidelines for commercial layers. The aim is to stimulate poultry farmers by lowering the interest rate for investments in cage-free systems. So there is also a snowball effect going on in Asia. While writing this article, I received a newsletter in my inbox saying that Australia will pass a law for a ban by 2036. In other words, the actions are coming too fast to keep track of them.

A dilemma for retailers and food companies?

The list of food companies that state their declaration of intent to go 'cage-free' is also getting longer. That means the demand for cage-free eggs will only increase over time. Will there be enough cage-free eggs as the target date approaches? Some retailers and food companies are expected to face a dilemma. Either the use of cage eggs is prolonged, or those companies will have to buy more aggressively in a market with a limited supply. Which would mean a good price for the commercial layers company.

Egg market evolution

Eggs are popular again, because consumption is rising. When eaten in moderation, eggs are now seen as part of a nutritious and healthy diet. Eggs are relatively affordable in most parts of the world. In itself, therefore, good prospects for the commercial layers sector.

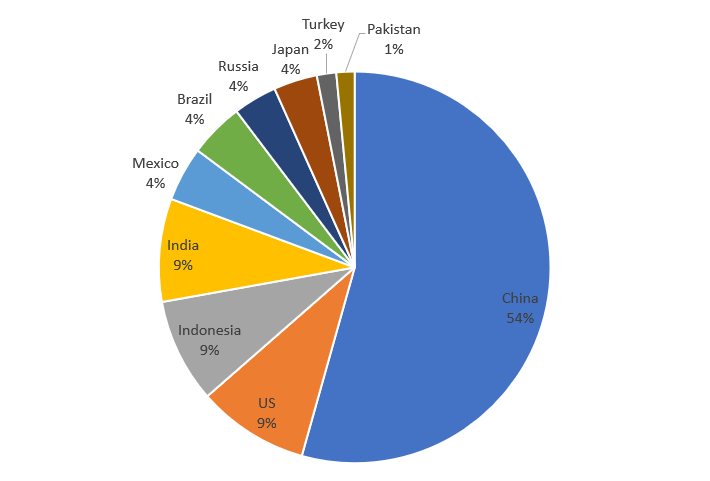

Top 10 egg-producing countries in 2019

China is the largest producer of eggs. Globally, 1 in 3 eggs originates in China. In the coming years, it is expected that India will be the fastest climber in this list.

Conclusion

The EU ban on cages in 2027 will force poultry farmers to make new investments in alternative systems. Unlike many other investments, those extra costs will not translate into lower, daily production costs. The operational costs will be higher. Strictly speaking, the higher egg price is therefore really necessary. The requirement for fair competition and for imports to meet the same conditions is the basis for getting a return on that investment.

In the rest of the world the “cage-free initiatives” are popping up like mushrooms. Measures are often very fragmented. They involve decisions by individual countries, local governments or food companies. This makes it difficult for the commercial layers sector to estimate market demand in the future. Will there be too few cage-free eggs or rather too many? Will the consumer be willing to pay the increased price in the shops? It is certain that consumers are increasingly sensitive to animal-friendly production methods. Governments, retailers and food companies play an important role in justifying a higher egg price.