Poultry Meat Sector in Australia

Chicken meat production is forecast to achieve a record and reach 1.13 million tonnes in 2014-15 as both domestic uptake and exports are set to rise, according to Caitlin Murray and Beth Deards in the ABARES Agricultural Commodities report for the September 2014 quarter.

Summary

Australian chicken meat production is forecast to rise in 2014-15 to a record 1.13 million tonnes.

Domestic chicken meat consumption is forecast to increase, reflecting relatively favourable prices for chicken meat compared with alternative meats.

Exports of Australian chicken meat are forecast to rise in 2014-15 in response to strong demand from the Asia-Pacific region.

In 2013-14 Australian chicken meat exports were worth A$48 million, a rise of 22 per cent on the previous year.

Exports increased to Papua New Guinea, the Philippines, the Solomon Islands and Laos.

Production to Reach Record High

Australian chicken meat production is forecast to increase by four per cent in 2014-15 to a record 1.13 million tonnes, supported by lower feed grain prices and strong domestic demand. Higher chicken meat production reflects a two per cent increase in the number of birds slaughtered and a marginal rise in the average carcass weight.

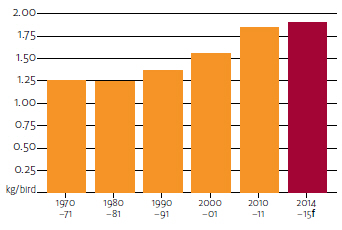

The average carcass weight has been relatively steady in recent years, averaging 1.9kg over the four years to 2013-14. This is around 16 per cent higher than average carcass weights in the early 2000s and 50 per cent higher than in the early 1970s, reflecting strong productivity growth in the Australian chicken meat industry.

Through selective breeding techniques, chickens used for meat production can now reach their ideal slaughter weight in 35 days using 3.4kg of feed, compared with 64 days and 4.7kg of feed in the 1970s.

(f = ABARES forecast)

Consumption to Rise

Australian chicken meat consumption is forecast to rise by three per cent in 2014-15 to 45.6kg per person.

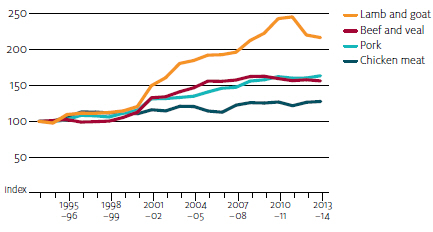

Chicken meat is the most consumed meat in Australia. Per person consumption grew on average by three per cent over the decade to 2013-14, supported by the retail price disparity between chicken and competing meats.

This trend is expected to continue in 2014-15 as chicken meat prices, despite being forecast to increase, remain relatively low compared with beef and sheep meat prices (also forecast to rise). In 2014-15 per person chicken meat consumption is forecast to remain significantly higher than for beef and veal (30.3kg), sheep meat (9.0kg) and pig meat (25.9kg).

Strong Demand for Exports

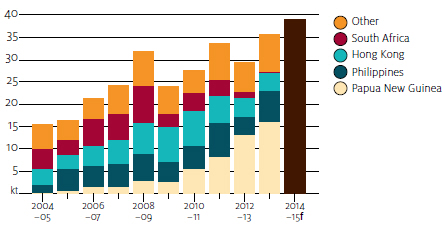

Australian chicken meat exports are forecast to increase by 10 per cent in 2014-15 to a record 39,000 tonnes (shipped weight) with a value of A$54 million, in response to strong demand from the Asia-Pacific region.

Most Australian chicken meat is consumed domestically but exports have increased because of higher production volumes. Exports more than doubled over the decade to 2013-14. About 95 per cent of chicken meat exports are frozen cuts and offal (such as feet, kidneys and livers), which attract a higher price in export markets than domestically. Frozen whole chickens make up most of the remaining five per cent of exports.

In 2013-14, Australian chicken meat exports rose by 21 per cent to 35,400 tonnes (shipped weight) with a value of A$48 million. Exports increased to Papua New Guinea, the Philippines, the Solomon Islands and Laos but decreased to Hong Kong and South Africa.

(f = ABARES forecast)

| Poultry meat outlook in Australia | |||||

| unit | 2012-13 | 2013-14 s | 2014-15 f | % change 2014-15 vs 2013-14 | |

|---|---|---|---|---|---|

| Production a | '000 tonnes | 1,046 | 1,084 | 1,130 | 4.2 |

| Export volume b | '000 tonnes | 29.3 | 35.4 | 39.0 | 10.2 |

| Export value | A$ million | 39.5 | 48.0 | 54.2 | 12.9 |

| a = carcass weight b = shipped weight f = ABARES forecast s = ABARES estimate Sources: ABARES; Australian Bureau of Statistics |

|||||

October 2014