Prospects for Poultry Markets in the EU - 2007 - 2014

This feature is taken from the Avec Annual Report for 2007. A link to the full report is also provided. The medium-term perspectives for animal products are relatively positive for poultry, pig meat and the dairy markets, while beef meat production is expected to continue to decline.Total per capita meat consumption would recover from the 2006 market disruption due to Avian Influenza and is projected to increase by 3.2 % altogether by the end of the forecast period. The poultry sector should exhibit relatively favorable medium-term perspectives, however, with a slower growth than in the last decade.

EU poultry meat demand to grow faster than production …

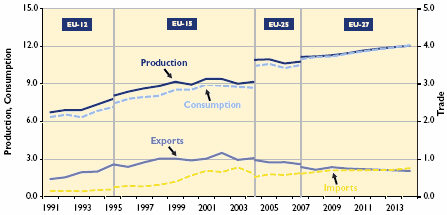

The appearance of the H5N1 strain of this virus in the EU in early 2006 caused a short-term disruption in the market balance of poultry meat, with weakening consumer confidence and export opportunities, and thus falling prices leading to lower production. EU-25 poultry meat production decreased to 10.6 mio t (-2.9 %) in 2006 as a consequence of the lower (internal and external) demand. Bulgarian and Romanian production of poultry meat in 2006 amounted to 324 000 t (3 % of EU-25 production).

The short-term disruption due to Avian Influenza is not expected to alter the medium-term outlook for poultry production that remains relatively positive as competitive prices with respect to other meats, strong consumer preference and increased use in food preparations should continue to play in favour of poultry. EU-27 per capita consumption is projected to increase from 22 kg in 2006 to 24.3 kg by 2014, driven by growing consumer preference in the EU-12 and a recovery from the Avian Influenza in the EU-15.

Production and consumption are expected to grow at a lower pace than in the nineties, in line with the slowdown observed in most recent pre-AI years (1999-2004), when production only grew by 1.9 % per year on average, as compared to average growth rates of 2.3 % per year over the period 1995-1998.

... leading to gradually declining exports and increasing imports

Despite the temporary ban by several third countries in response to the Avian Influenza cases, EU-25 exports recorded a slight (0.9 %) increase and amounted to 922 000 t in 2006.This increase in exports was entirely made up by non-refunded exports. EU-27 poultry exports are projected to decline gradually over the medium term due to strong competition on the world markets by low cost producers and unfavourable $/€ and Brazilian Real/€ exchange rates.

Due to the lower domestic demand and the partial bans on third country supply by the EU (established as Avian Influenza protection measures), EU-25 poultry meat imports decreased to 578 000 t (-4 %) in 2006.The conclusion of agreements with Brazil and Thailand on a new regime for imports into the EU will result in increased imports over the short term and a more moderate growth over the medium term. With the decline of extra-EU exports, the EU-27 is projected to become a net importer of poultry meat by 2013-2014.

Poultry meat still keeps its place in the overall meat consumption

Following the 2000/2001 BSE scare and the 2003 Avian Influenza in the Netherlands, the EU consumption pattern was again disrupted in late 2005 and in 2006 due to the highly pathogenic Avian Influenza scare and eventual outbreak. Poultry consumption fell sharply in a number of Member States that has lead to an estimated decline in aggregate per capita consumption of 0.9 kg in the EU-25 in 2006.The decline in poultry consumption could not be totally offset by increasing pork and beef and veal consumption, resulting in a drop in the overall level of EU per capita meat consumption by 0.6 kg.

The long-term trend towards higher per capita consumption of meat slowed down at the beginning of the 1990s, but the large increases in meat consumption in 1998, 1999 and in 2002 and 2003 appear to be in contradiction with the view that meat consumption, in general, is saturated. According to the European Commission projections for the individual types of meat, total meat consumption in the EU-27 is set to increase from 84 kg/capita in 2006 to around 86.7 kg/capita by the year 2014.

Pig meat, with a share of about 50 % is by far the most preferred meat by EU consumers, followed by poultry, with a share of around 26 %, which has overtaken beef/veal since 1996. The projections up to the year 2014 exhibit a further expansion of poultry consumption with a corresponding decline in the shares of beef, sheep and goat meat.The consumption of pig meat is forecast to maintain its 50 % share in total meat consumption but is projected to grow at a lower rate than poultry which should reach a share of 28% (+1.8%).

Further Reading

|

|

Take a look at Avec's Annual Report for 2007 by clicking here. |

November 2007