Rabobank's Nan-Dirk Mulder shares highlights from Polish Poultry Conference

Mulder offers a European market outlook including the impact of bird flu outbreaks in the region

Editor's note: Nan-Dirk Mulder is a senior global specialist for animal protein at Rabobank based in the Netherlands. This content first ran on LinkedIn.

Last week, I had the honor to speak about the European Poultry Market Outlook at the Polish Poultry Conference organized by Krajowa Rada Drobiarstwa - Izba Gospodarcza. There were many great speakers, including Poland’s Minister of Agriculture Czesław Siekierski, whereby the opportunities and challenges for the Polish Poultry Industry have been the central theme.

The current European market context is exceptional with very strong demand for poultry, peaking prices for poultry and all other animal proteins especially beef and eggs while supply is very tight. Consumption of chicken has been growing in average by 4% per year in the last two years and this has been also the expectation for this year as well.

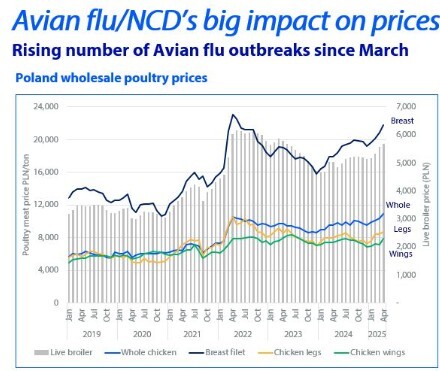

The early March/April outbreak of avian flu (including at parent stock farms) in Poland, Hungary and parts of Italy has however big impact on the current chicken supply and this will impact chicken availability throughout the rest of the year. At the same time, there is a move towards more extensive chicken production in Northwest Europe, including a recent retail driven move to lower density chicken farms in the UK.

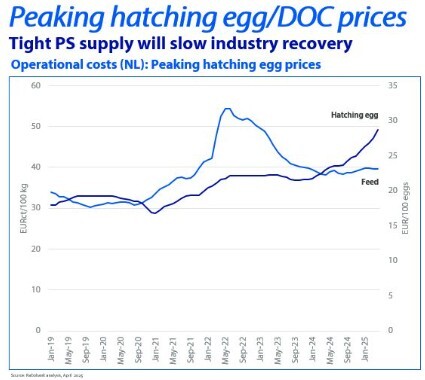

Poland is by far the #1 chicken producer in Europe and the main exporter of chicken in Europe. Prices for live chickens in Poland are currently among the highest in Europe, and the industry is trying to restock but also hatching egg supply is very tight after several years of refocus of several farmers from PS-farms to broiler production in Europe, the tight global PS-breeding flock and the big impact of avian flu. Prices of hatching eggs are peaking in the last few months, and restocking in Europe and markets outside Europe is difficult and slow.

It can be expected that we keep this market situation in Europe for some time as full recovering of production will take time and likely not before the end of Q3 due to the tight hatching egg supply. The recent Brazilian outbreak of avian flu with now a full ban on Brazilian chicken imports will further impact the market and will likely mean even stronger prices in the coming months. Also, the Ukrainian chicken supply will slow after the recent return to the historic quotas. This market context will be especially challenging for non-integrated poultry processors who work with relatively open sourcing from Poland and/or Brazil.

In the longer term, we expect that the Polish poultry supply will further grow but at a lower speed (approximately 3-4% per year) but with Poland still capturing more than 50% of the growth in the European poultry market. However, with increasingly more competition from other countries like Hungary, Romania and Spain.

Access to upstream farming capacity and operational excellence will become increasingly more important, and the industry is expected to further internationalize to more pan-European structures and more involvement from global investors.