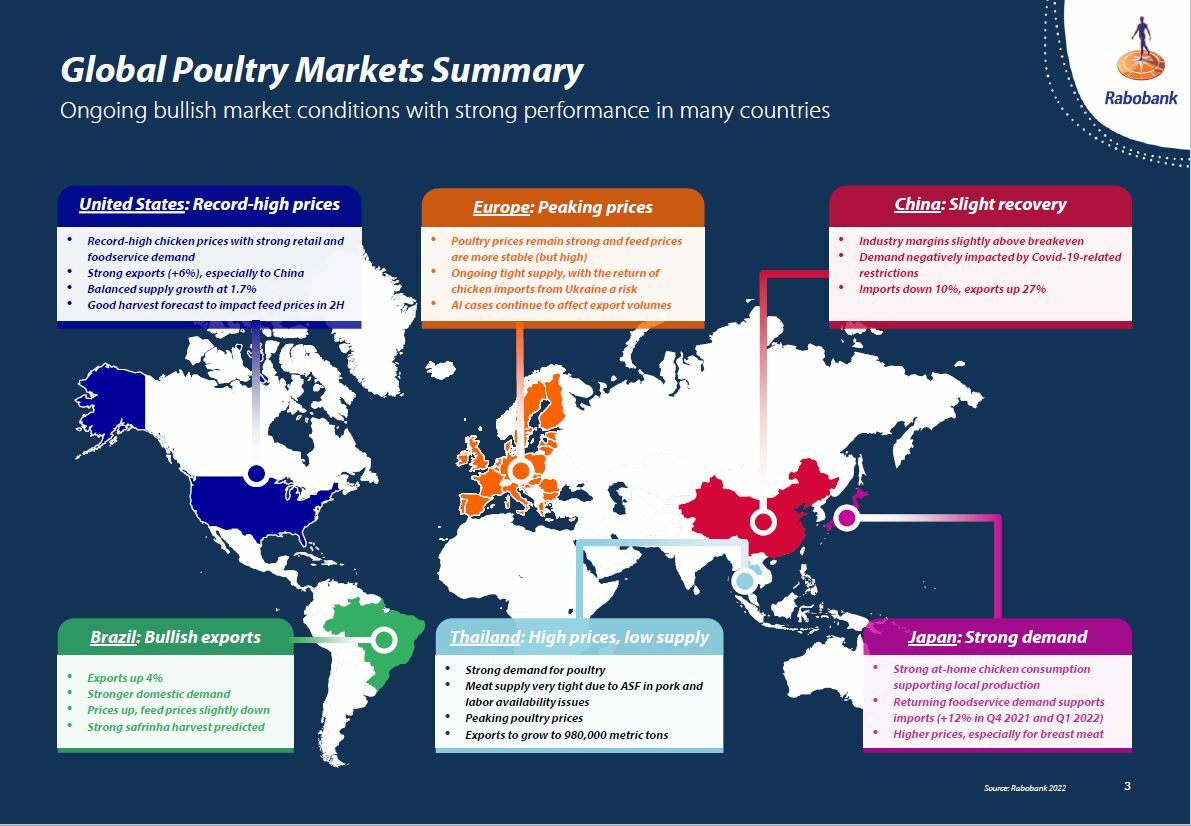

Rabobank's Poultry Quarterly Q3 2022: Bullish outlook amid strong demand, operational challenges

Global poultry industry in one of most bullish periods in recent yearsAccording to Rabobank's Poultry Quarterly report, global prices continue their upward trend. Demand is strong, with most countries open after adopting ‘living with Covid’ strategies. This is pushing up poultry demand, while global pressure on spending power and high food prices are also leading consumers toward the lowest-priced meat protein: poultry. Markets in most of Europe, the Americas, the Middle East and Africa (MEA) region and more areas in Asia are operating above break even.

The biggest challenge for the industry is on the operational side. Feed and energy prices are higher than they have been in many years and are expected to stay high into 2023. In addition to lingering Covid-19 impacts, the industry currently faces one of the highest-pressure avian flu (AI) seasons in history with 53 million birds culled primarily in the layer and duck sector but also significant number of broilers. The Ukraine crisis directly affects global feed commodity, energy and fertilizer prices, further challenging industry operations in 2H 2022.

One consequence of this challenging context is that supply will be tight. Midsized and small producers are downscaling in response to higher working capital requirements and risks. New investment projects have been delayed, given the rise in investment costs, with high steel prices, rising interest rates, high logistical costs, and a tight labor supply. Genetics supply has tightened following Covid-19-related downscaling. In Asia, African swine fever (ASF) has also had a big impact on the local meat supply, with Thailand and the Philippines especially affected and facing tight local meat supply conditions.

In this challenging market context, the differences between winners and losers will be significant. Companies with strong market power, strong biosecurity, and strong operations – with high efficiency and solid procurement – will likely outpace the market. Traders are expected to benefit, as global trade volumes will rise, with leading countries and companies that do not face AI restrictions also benefiting.