US Feed Outlook

By ERS USDA. This monthly report examines supply, use, prices, and trade for feed grains, including supply and demand prospects in major importing and exporting countries. Focuses on corn; also contains information on sorghum, barley, oats and hay.Corn Production Second Highest on Record

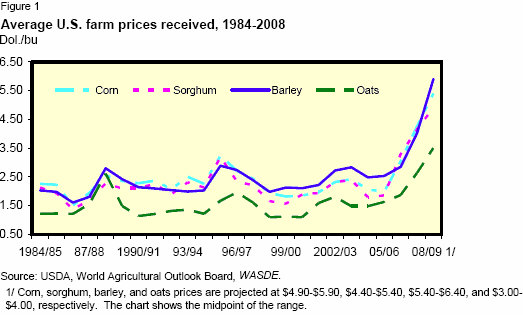

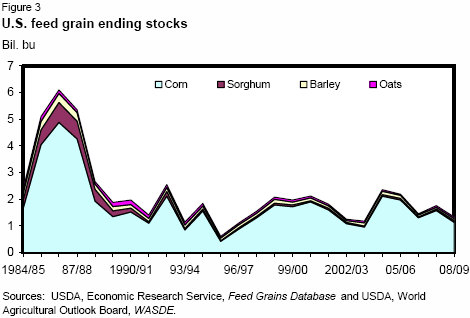

This month’s outlook is shaped by the first survey-based forecasts for corn and sorghum production. In spite of excessive rains and flooding, the 2008 corn crop is forecast to be the second largest on record. Sorghum production is forecast down 19 percent from last year. With larger production, U.S. feed use and ethanol projections are increased. U.S. corn export prospects are unchanged for 2008/09, but sorghum projections are reduced to the lowest level in 37 years. Ending stocks for the four feed grains in 2008/09 are projected up from last month but down from 2007/08. Supplies are expected to be larger than last month, and prices are expected to be weaker, but still record high.

Domestic Outlook

Feed Grain Supply Down From Last Year

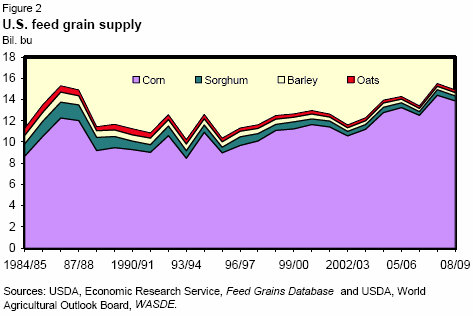

U.S. feed grain production in 2008 is forecast at 328.6 million metric tons, up 14.3 million from a month ago but down 22.3 million from 2007. Production from last year is up for barley, but down for corn, sorghum, and oats. Feed grain supply in 2008/09 is forecast at 375.1 million tons, up 13.5 million from last month but down 15.2 million from 2007/08. Forecast beginning stocks are nearly unchanged from last month, but up 7.6 million tons from the previous year.

Total feed grain use is projected at 342.2 million tons in 2008/09, up 5.9 million from last month, but down 4.3 million from the previous year. The year-to-year decline reflects decreases in feed and residual use and in exports; feed grain use for ethanol is up. Feed and residual use in 2008/09 is expected to total 142.8 million tons, up 2.2 million from last month, but down 18.2 million from 2007/08. Food, seed, and industrial use at 144.7 million tons is up 4.4 million from last month and up 28.7 million from last year. Exports are forecast at 54.7 million tons, down 0.8 million from last month and down 14.8 million from last year. The Bureau of Census issued revised numbers for 2007, which primarily moved some trade from one month to the next, but in the process, market year exports for feed grains in 2006/07 changed from 58.442 million tons to 58.342 million. Imports were unchanged for the year, even with small monthly changes. These trade changes caused slight revisions in feed and residual use in 2006/07—from 148.273 million tons to 148.174 million.

Feed and Residual Use To Decrease

When converted to a September-August marketing year, feed and residual use for the four feed grains plus wheat in 2008/09 is projected to total 147.43 million tons, down 9 percent from 2007/08. Corn is estimated to account for 91 percent of feed and residual use in 2008/09, down 3 percent from 2007/08.

The projected index of grain-consuming animal units (GCAU) for 2008/09 was down 1.8 percent from 2007/08. There were decreases in cattle on feed, pork, and dairy, and the increase in poultry on feed does not offset these decreases. Thus, feed needs by cattle, pork, dairy, and poultry are expected to decrease slightly in 2008/09. The grain used per GCAU in 2008/09 is forecast at 1.58 tons, down from 1.72 tons in 2007/08.

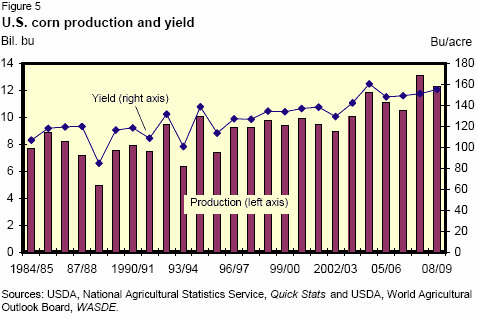

Second Largest Corn Crop Forecast

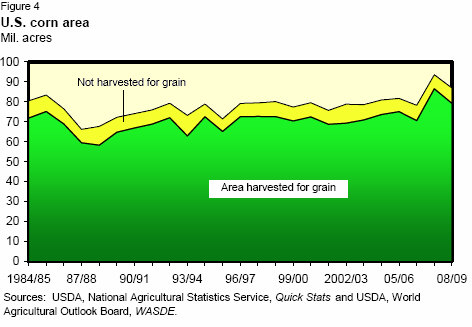

U.S. corn production in 2008 is forecast at 12.3 billion bushels, up 573 million bushels from last year and the second largest production on record. As forecast, this year’s crop is 786 million bushels below last year’s record. This is the first survey-based forecast of the season and reflects August 1 conditions. The average corn yield is forecast at 155.0 bushels per acre, compared with last month's adjusted trend yield of 148.4 bushels and the actual 2007 yield of 151.1 bushels. If realized, yield would also be the second highest on record. The August 1 survey data indicate an increase in the average number of stalks per acre for the combined 10 objective yield States (Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Nebraska, Ohio, South Dakota, and Wisconsin). Record-high stalk counts were recorded in Illinois, Indiana, Iowa, Minnesota, Missouri, and Ohio.

Because of the excessive rain and flooding during June, USDA’s National Agricultural Statistics Service conducted an extensive re-interview of producers in flood-affected areas. As a result, corn-planted area for all purposes, at 87.0 million acres, is down 350,000 acres from June and 7 percent below last year. Despite the decrease, planted acreage is the second highest since 1946, behind last year. Growers expect to harvest 79.3 million acres for grain, up 350,000 acres from expectations in June but 8 percent lower than last year. If realized, this would be the second highest area harvested for grain since 1944, behind last year.

Projected ending stocks for 2008/09 increased 301 million bushels from last month but are down 442 million from the forecast for 2007/08. Beginning stocks were increased 22 million from last month, and, even with higher production this month supplies are down 517 million bushels from 2007/08. Expected domestic use in 2008/09 is up 350 million bushels from the projection for 2007/08, as additional ethanol plants are expected to come on stream, needing more corn. Corn feed and residual use was raised 100 million bushels this month as increased corn yields and higher production can be expected to boost residual use. Higher corn feeding is also expected despite a small reduction in livestock numbers, as lower expected corn prices result in less wheat and barley feeding. Projected corn exports are unchanged this month but are down 425 million bushels from 2007/08 because of increased global corn production along with expected plentiful world supplies of feed wheat.

Minor changes were made in the third quarter data to true up imports and exports, which changed feed and residual. In addition, late last month, the Bureau of Census released trade revisions for the 2007 calendar year, which caused minor changes in the trade estimates and corresponding changes in feed and residual use. Exports in 2006/07 changed from 2,124.686 million bushels to 2,125.369 million. Imports had an even smaller change in 2006/07, going from 11.984 million bushels to 11.983 million. The Energy Information Administration has also made some small changes in the monthly ethanol production from the original monthly reports. The numbers show up at irregular intervals included in the history at

http://tonto.eia.doe.gov/dnav/pet/hist/m_epooxe_yop_nus_1m.htm. The monthly changes resulted in corn used for ethanol increasing by 142,000 bushels in 2004/05, 549,000 bushels in 2005/06, and 2.409 million bushels in 2006/07. These trade and ethanol changes caused slight changes in the feed and residual use for example, in 2006/07—from 5,597.829 million bushels to 5,594.736 million.

With increased ending stocks this month, the forecast price for 2008/09 was lowered to $4.90-$5.90 per bushel. In 2007/08, the season-average price received by farmers is expected to be $4.25 per bushel, down from $4.35 per bushel last month.

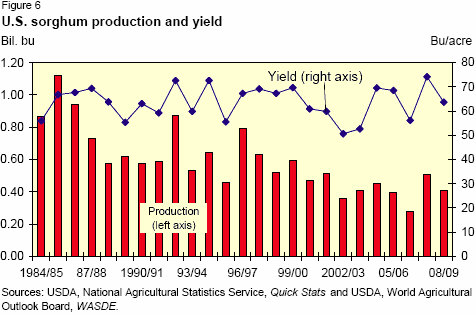

Sorghum Crop Forecast Down 19 Percent From Last Year

The first survey-based forecast for sorghum indicates production of 410 million bushels in 2008, down 10 million from last month and down 95 million from last year. Plantings, at 7.30 million acres, are down 0.42 million from 2007. Area to be harvested for grain, at 6.44 million acres, is down 0.36 million from 2007. Yields are forecast at 63.7 bushels per acre, down 1.9 bushels from the earlier projection based on trend yields (1998-2007, excluding 2002 and 2003), and down 10.5 bushels from 2007.

Sorghum supplies in 2007/08 remain unchanged this month, but exports are raised 10 million bushels from the July forecast. Total use is raised 10 million bushels to 485 million, which lowers ending stocks to 52 million bushels for 2007/08.

Sorghum supplies in 2008/09 are down 20 million bushels from last month because of lower production and beginning stocks. Supplies are down 75 million bushels year-to-year, as lower production more than offsets higher carryin. Given lower production, total use of sorghum in 2008/09 is expected to be down 20 million bushels from last month. Feed and residual use remains unchanged this month. Exports were lowered 30 million bushels and are down 145 million from the forecasted 275 million bushels in 2007/08. With reduced export demand and lower expected prices, food, seed, and industrial use was increased 10 million bushels.

The Bureau of Census has released trade revisions for calendar year 2007. These have resulted in minor changes in sorghum exports for marketing year 2006/07 and a corresponding decline in feed and residual. For 2006/07, sorghum exports were reduced 4.6 million bushels.

In the 2007/08 marketing year, prices received by farmers for sorghum are expected to average $4.15 per bushel. Prices in 2008/09 are projected at $4.40-$5.40 per bushel.

Barley Production Remains Unchanged

Barley production for 2008 is forecast at 218 million bushels, nearly unchanged from a month ago and up 6 million from 2007. Based on August 1 conditions, producers expect yields to average 59.9 bushels per acre, a decrease of 0.5 bushels from last year, but an increase of 0.1 bushels from the July forecast.

Total barley supplies in 2008/09 were raised 5 million bushels this month, mostly reflecting a larger import forecast. Barley feed and residual use in 2008/09 was projected 15 million bushels lower, offsetting a 15-million-bushel increase in projected feed, seed, and industrial use. Feed, seed, and industrial use, however, is still projected down 8 million bushels from 2007. Exports for 2008/09 remain unchanged this month. With higher expected imports and the very small increase in production, ending stocks are projected up from last month and higher than last year.

The Bureau of Census has released trade revisions for calendar year 2007. These have resulted in minor decreases in barley exports for marketing year 2006/07. Revisions were also received from the Alcohol and Tobacco Tax and Trade Bureau (TTB), which resulted in small increases in food, seed, and industrial use and corresponding decreases in feed and residual use. Also included in these changes are malt and malt extract exports.

Prices received by farmers for barley in 2008/09 are expected to average $5.40- $6.40 per bushel, compared with the reported $4.02 per bushel for 2007/08.

Oats Production To Decrease

The 2008 oat crop is forecast at 90 million bushels, down 3 million from the July forecast. The forecast yield, at 62.3 bushels per acre, is down 2.1 bushels from last month but up 1.4 bushels from last year. Total supplies for 2008/09 were lowered slightly this month as production declined. Total use was unchanged this month, and ending stocks for 2008/09 were reduced in line with the change in production to 64 million bushels.

The Bureau of Census has released trade revisions for calendar year 2007. These have resulted in minor changes in oat imports and exports for marketing year 2006/07 and a corresponding decline in feed and residual.

Prices received by farmers in 2008/09 are expected to average $3.00-$4.00 per bushel, compared with the $2.63 per bushel expected in 2007/08.

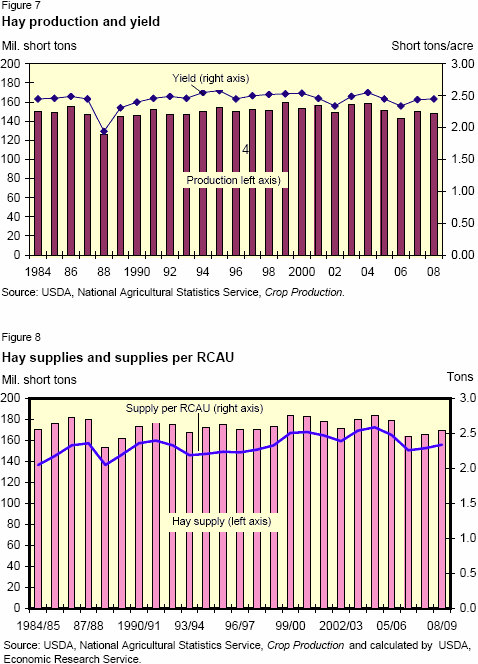

All Hay Production To Decrease

All hay production in 2008 is forecast at 148 million tons, down 2.35 million from 2007 due to lower harvested acres. The all-hay yield is expected to be 2.45 tons per acre, up from 2.44 tons per acre in 2007. Harvested acres are forecast at 60.4 million acres, down from 61.6 million last year.

Alfalfa hay production is forecast at 70.9 million tons, down 2 percent from last year. Yields are expected to average 3.41 tons per acre, slightly higher than the 3.35 tons per acre last year. Harvested area is forecast at 20.8 million acres, unchanged from June but 4 percent below the previous year’s acreage.

Other hay production is forecast at 77.0 million tons, down 1 percent from last year. Based on August 1 conditions, yields are expected to average 1.94 tons per acre, down slightly from last year. Harvested area, at 39.7 million acres, is unchanged from June but down 1 percent from the previous year.

Roughage-consuming animal units (RCAUs) in 2008/09 are estimated to be up slightly from 2007/08. With hay production down and RACUs up, hay supply per RCAU is 2.34 tons, compared with 2.29 tons in 2007/08.

The weighted average price received by farmers for all hay was $133 per ton in 2007/08, up from $110 in 2006/07. The alfalfa hay price in 2007/08 was $138 per ton, compared with $113 in 2006/07. The weighted average price received by farmers for hay other than alfalfa and alfalfa mixtures was $120 per ton in 2007/08, up from $103 in 2006/07.

International Outlook

World Coarse Grains Production To Increase in 2008/09

World coarse grain production in 2008/09 is projected up 20.1 million tons this month to 1,089.1 million. This increase means that world production is expected to increase year-to-year, up 13.1 million tons, whereas last month a decline was expected. Most of this month’s increase is in U.S. corn, but foreign coarse grain production prospects also increased significantly this month, up 5.8 million tons to 760.3 million.

Foreign barley production is projected up 4.2 million tons this month to 142.1 million. World millet production is up 1.6 million tons this month to 34.9 million. While foreign oats and rye production are up fractionally, corn and sorghum are down.

Barley production in the EU-27 is forecast up 1.9 million tons this month to 62.7 million. The largest increases are for Spain, France, and Germany, where harvest reports indicate increased area and yields.

Ukraine’s barley production is projected up 1.5 million tons this month to 12.0 million. Flooding in Western Ukraine reduced area slightly, but high yields in harvest reports were more than offsetting. Harvest reports in Russia also indicated good yields, boosting production 0.5 million tons to 18.0 million. Production prospects in Belarus were also up slightly, but Turkey and Afghanistan had reduced prospects this month.

Millet production prospects in India increased 1.5 million tons this month to 12.0 million tons. Exceptionally good monsoon rains boosted yield prospects. However, rains in the corn- and sorghum-producing zones were late, reducing planted area and cutting production 0.5 million tons for each crop. Millet production prospects in Russia and Ukraine also increased slightly this month.

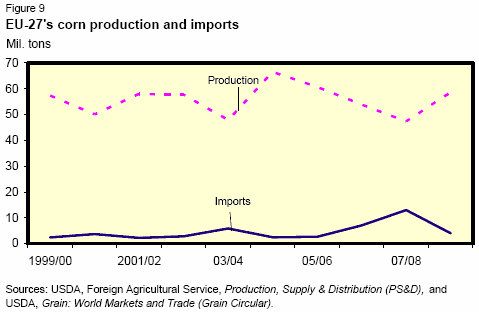

Foreign corn production prospects for 2008/09 are down slightly this month to 477.5 million tons, due to mostly offsetting changes. EU-27 corn production is projected up 1.1 million tons to 58.6 million, mostly because of increased area reported for Germany and Spain. There were several years of historical downward revisions to EU-27 corn production that were more than offset for 2008/09 by improved production prospects.

Turkey’s corn production prospects increased 0.5 million tons to 4.0 million as ample irrigation supplies boost yield prospects. Corn yield prospects also improved this month in Belarus.

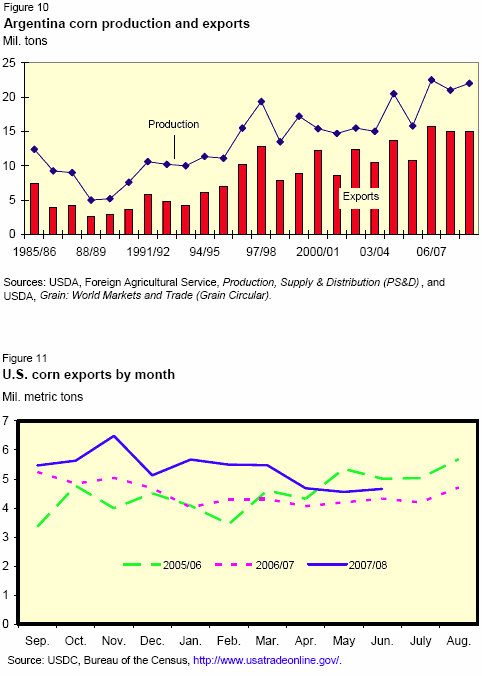

However, these increases in foreign corn production were offset by a 1.5-millionton reduction for Argentina to 22.0 million tons. High production costs are expected to limit the use of fertilizer, trimming yield prospects. Uncertainty about Government export policy is encouraging production of soybeans at the expense of corn, reducing area prospects slightly. This reduction, plus the decline in India and a small reduction in prospects for corn production in Afghanistan, leave foreign corn production prospects down slightly this month.

World oat production and rye production are up slightly this month mostly due to increased production prospects in Russia and Ukraine.

Foreign 2008/09 Coarse Grains Use Nearly Unchanged This Month

Foreign coarse grain use in 2008/09 is projected up fractionally this month at 805.3 million tons. Some significant reductions are offsetting the increases caused by increased production. The large supply and competitive price of low quality wheat is expected to increase wheat feeding at the expense of coarse grains, especially in the EU-27 and South Korea. EU-27 coarse grain use is projected down 1.5 million tons to 149.8 million due to reduced corn and sorghum imports and feeding caused by an increase in wheat feed use. South Korea’s corn imports and feed use are down 0.5 million tons this month due to increased feed wheat imports. There are also smaller declines in projected 2008/09 coarse grain use this month for Afghanistan, Argentina, Taiwan, Mexico, and Turkey.

However, increased production and lower price prospects are expected to increase coarse grain use in several countries. Russia’s coarse grain use is projected up 0.9 million tons this month to 30.7 million, with more than half the increase due to ,feed and residual use. India’s consumption of feed grains is up 0.8 million tons as more millet is used as food. Ukraine is expected to increase coarse grain use 0.6 million tons to 14.3 million, with much of the increase due to feeding. Smaller increases are forecast this month in feed use in Saudi Arabia, Venezuela, Canada, and Belarus.

Foreign Coarse Grains 2008/09 Ending Stocks Up

Foreign coarse grain ending stocks for 2008/09 are projected up 2.9 million tons this month to 110.8 million. The largest increase is for corn stocks in Brazil. Brazil is expected to export 2.0 million tons less corn in both local marketing years 2007/08 (March 2008-April 2009) and 2008/09 (March 2009-April 210). This boosts 2007/08 ending stocks 2.0 million tons and increases projected 2008/09 ending stocks 4.0 million tons. The increase in Brazil for 2008/09 is partly offset by coarse grain ending stock reductions of 1.6 million for India, 0.6 million tons for Argentina, and 0.5 million tons for Australia, as well as changes to other countries.

World 2008/09 Corn Trade Cut, U.S. Export Prospects Unchanged

World corn trade in 2008/09 (October-September) is projected to reach only 88.0 million tons, down 4.3 million tons this month and 10 percent lower than the record in 2007/08. Increased competition from feed wheat and slowing macro-economic growth are expected to limit imports.

EU-27 corn imports in 2008/09 are forecast down 2.5 million tons this month to 4.0 million, an abrupt drop from 13.0 million in 2007/08. Large internal grain supplies, including both wheat and feed grains, are expected to limit the need for imports.

South Korea’s 2008/09 corn imports are down 0.5 million tons this month to 8.2 million, as imports of low-quality wheat for feeding are expected to replace corn. Taiwan’s corn imports for 2008/09 were trimmed 0.2 million tons to 4.2 million due to flat meat production prospects and slowing imports in 2007/08.

Corn export prospects for Brazil were slashed 3.0 million tons to 9.0 million. Without the premium prices paid by the EU-27 for non-GMO corn and with a strong currency, Brazil will have trouble competing with Argentina, the United States, and Black Sea feed wheat. Argentina’s corn exports are projected down 1.5 million tons this month to 15.0 million due to reduced production prospects. However, corn exports by Belarus and Russia were increased slightly.

U.S. corn export prospects for 2008/09 were left unchanged this month as export sales for the new year support the year-to-year decline forecast.

Several changes were made for corn trade in 2007/08 (October-September). U.S. corn exports were reduced 1.0 million tons to 61.0 million due to the slowing pace of export shipments. South Africa’s corn exports were dropped 0.8 million tons to 1.0 million based on the slow start to their export program. Argentina’s corn exports were raised 0.5 million tons while those of Brazil were reduced 0.5 million. Ukraine corn was raised 0.5 million tons because of the strong late season shipments.

U.S. sorghum export prospects for 2008/09 (October-September) were cut 0.7 million tons to 3.3 million, the lowest level in decades, as weak demand is expected in both the EU-27 and Mexico. EU-27 sorghum imports were reduced 0.5 million tons as wheat feeding is expected to replace sorghum. Mexico’s sorghum imports are forecast down 0.2 million tons this month due to increased production.

Further Reading

| - | You can view the full report by clicking here. |

August 2008