US Feed Outlook

A fall in US feed grain production this month largely caused by dry weather has only partially been offset by increases in foreign production, according to the US Feed Outlook by the Economic Research Service of the USDA.2008 Corn Production Declines From Last Month

U.S. feed grain supplies for 2008/09 are reduced this month with lower forecast corn production, reflecting August dryness throughout much of the Corn Belt. Sorghum production is forecast higher. Corn feed and residual use is reduced with the smaller crop and as high feed prices impact meat production. Sorghum feed and residual is raised because of the larger crop. U.S. exports and food, seed, and industrial use are unchanged. Corn and sorghum prices are projected higher, while barley and oat prices are projected lower.

World coarse grain use in 2008/09 is projected lower this month, partly due to increased foreign wheat feeding. Increased foreign beginning stocks and reduced use more than offset the decline in U.S. production, raising projected global ending stocks.

Domestic Outlook

Feed Grain Supplies Reduced This Month

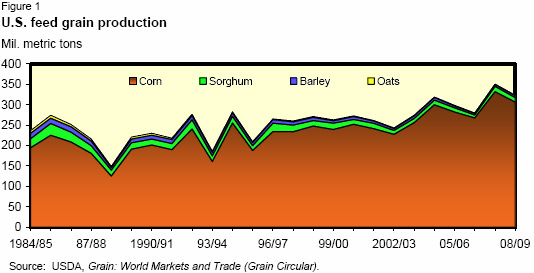

U.S. feed grain production in 2008 is forecast at 323.5 million metric tons, down 5.1 million from a month ago and down 27.4 million from 2007. Production is up on the year for barley, but down for corn, sorghum, and oats. U.S. feed grain supplies for 2008/09 are forecast at 370 million tons, down 5.1 million from last month and down 20.3 million from 2007/08. Forecast beginning stocks are unchanged from last month but are up 7.6 million tons from the previous year.

Total feed grain use is projected at 339.9 million tons in 2008/09, down 2.3 million tons from last month and down 6.6 million from the previous year. The year-toyear decline reflects a decrease in feed grain exports and lower feed and residual use. Feed and residual use in 2008/09 is expected to total 140.5 million tons, down 2.3 million tons from last month and down 20.5 million from 2007/08. Food, seed, and industrial use, at 144.7 million tons, remains unchanged from last month and is up 28.7 million from last year.

When converted to a September-August marketing year, feed and residual use for the four feed grains plus wheat in 2008/09 is projected to total 145.1 million tons, down 2.3 million tons from last month and down 17.9 million from 2007/08. Corn is estimated to account for 91.0 percent of the feed and residual use in 2008/09, down from 94.3 percent in 2007/08.

The projected index of grain-consuming animal units (GCAU) for 2008/09 was up 0.07 million units this month but down 1.51 million from 2007/08. The large increase in feed costs has encouraged a year-over-year decrease in GCAUs, with declines in almost all animal groups. The grain used per GCAU in 2008/09 is expected to be 1.55 tons, down from 1.58 tons last month and 1.72 tons in 2007/08. The year-to-year reduction is partly offset by increased feeding of distillers’ grains.

Corn Crop Forecast Down 8 Per Cent From Last Year

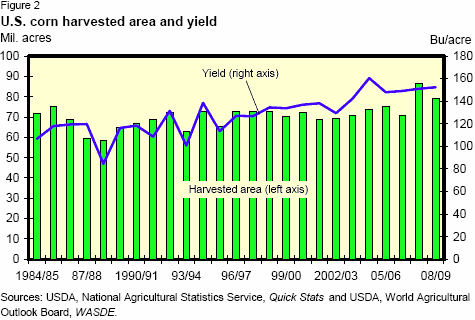

Corn production in 2008 is forecast at 12.072 billion bushels based on September 1 conditions. This level is down 216 million bushels from last month and 1 billion bushels from last year. Area harvested for grain is forecast at 79.3 million acres, unchanged from August but down 8 percent from 2007. If realized, this will be the second largest area harvested for grain since 1944, behind last year’s 86.5 million acres. Planted area remains unchanged from last month. The September 1 corn objective yield data indicate the highest average number of ears per acre on record for the combined 10 objective yield States (Illinois, Indiana, Iowa, Kansas, Minnesota, Missouri, Nebraska, Ohio, South Dakota, and Wisconsin). Record-high ear counts are forecast in all objective yield States except Kansas, Nebraska and Wisconsin.

As of August 31, 61 per cent of the corn acreage was rated in good to excellent condition, down 5 percentage points from last month but 2 points higher than the level a year ago. Regionally, condition ratings declined more than 5 points from last month across the northern and eastern Corn Belt, Ohio and Tennessee Valleys, and the northern half of the Atlantic Coastal States where dry conditions throughout much of August depleted soil moisture supplies. Despite the decreases, crop conditions in these areas remained better than or equal to those of last year. Corn conditions decreased to a lesser extent across the middle Mississippi Valley as mostly dry conditions during August eliminated soil moisture surpluses. Crop conditions improved in Texas while decreasing slightly across the remainder of the southern half of the Great Plains where heavy mid-August rains provided some relief to the drought-stressed crop. Condition ratings in these areas remained below last year’s levels.

There were no changes in 2007/08 corn supply or use, as a result, beginning stocks for 2008/09 are unchanged from last month. Forecast 2008/09 corn use is projected 100 million bushels lower than last month and 175 million bushels below 2007/08. Feed and residual use was lowered 100 million bushels due to increased sorghum feeding, higher expected prices, and lower expected residual loss with the smaller crop.

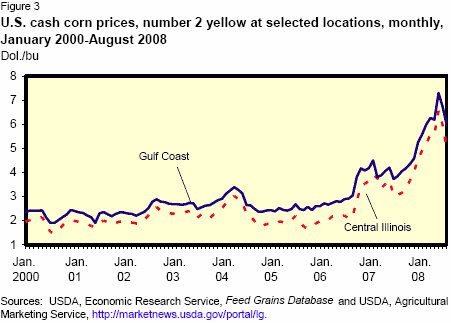

With ending stocks declining 115 million bushels from last month, the 2008/09 season average price received by farmers is forecast at $5.00-$6.00 per bushel, raised 10 cents on both ends of the range. The 2007/08 season average price is lowered 5 cents from last month to $4.20 per bushel.

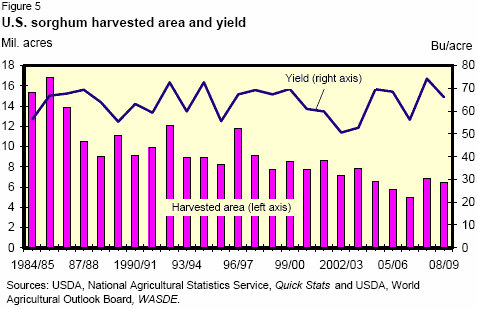

Sorghum Crop Up From Last Month

Sorghum production is forecast at 426 million bushels in 2008, up 16 million bushels from last month but down 79 million bushels from last year. Plantings and area to be harvested for grain were unchanged this month but are down from last year. Based on September 1 conditions, yield is forecast at 66.1 bushels per acre, up 2.4 bushels from last month but down 8.1 bushels from last year. In Kansas, the top producing State, yield is expected to average 76 bushels per acre, up 5 bushels from last month but down 4 bushels from last year. In Texas, the second leading State, yields are expected to average 52 bushels per acre, unchanged from the previous month but 14 bushels below last year.

There were no changes in 2007/08 sorghum supply or use, therefore beginning stocks for 2008/09 are unchanged from last month. In 2008/09, total use of sorghum is expected to be up 10 million bushels from last month but down 75 million bushels from 2007/08. Feed and residual use was raised 10 million bushels with the increase in supplies. Ending stocks are up 6 million bushels from last month.

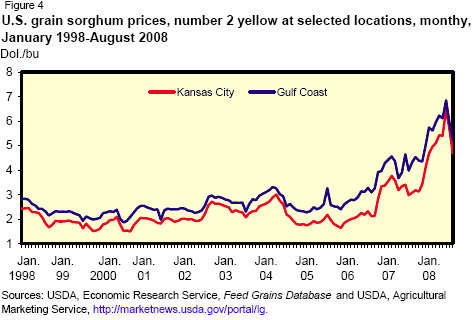

In the 2007/08 marketing year, prices received by farmers for sorghum are expected to average $4.10 per bushel, 98 percent of the corn price. Prices in 2008/09 are projected at $4.45-$5.45 per bushel, 89 to 91 percent of the corn price.

Barley and Oats Supply and Use Remains Unchanged

The 2008 barley and oats production forecasts were unchanged for September 1, but may change when the Small Grains report is released September 30, 2008. No changes were made this month in barley or oat supplies or use. For the 2007/08 marketing year, season average prices for barley and oats remain unchanged. The 2008/09 projected barley price were lowered 25 cents on each end of the forecast range. The 2008/09 projected oats price was lowered 20 cents on the high end of the range and 10 cents on the low end of the range.

International Outlook

World Coarse Grain Production Down, Foreign Up This Month

Global coarse grain production in 2008/09 is projected to reach 1,086.7 million tons, down 2.4 million this month. The net increase in foreign production offsets about half the drop in the US crop. None of the foreign changes are as large as the 5.1-million-ton US change but some are significant, both up and down. Increased foreign barley and oat production more than offsets a decline for corn.

Coarse grain production in the former Soviet Union (FSU) is projected up 3.5 million tons this month to 71.3 million. Russia’s coarse grain crop is up 3.0 million tons this month to 36.8 million due to increased barley yields, boosting barley production to 21.0 million. Harvest reports confirm excellent barley yields, and Russia’s barley crop is forecast to be the largest in 15 years. Ukraine also reports better-than-expected barley yields, and barley production there is up 0.5 million tons this month. However, dryness in eastern Ukraine has hurt corn prospects, dropping corn production 0.5 million tons and leaving coarse grain production unchanged this month. Belarus reported better-than-expected yields for barley, rye and oats, boosting coarse grain production 0.8 million tons to 5.0 million. However, barley production in Kazakhstan and Tajikistan was reduced slightly.

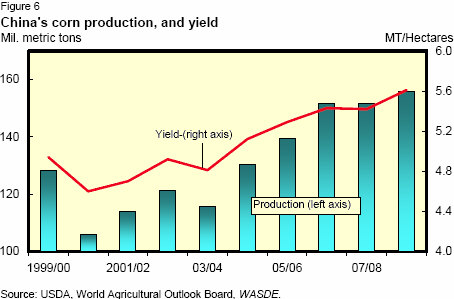

China’s coarse grain production is forecast up 3.2 million tons this month to a record 163.7 million. Corn is up 3.0 million and sorghum is also increased. The growing season has been mostly favorable, with good rains during tasseling and reports of excellent crop conditions.

The major reduction in foreign coarse grain production this month is for Argentina, down 3.0 million tons to 25.9 million. Reduced corn production is expected mostly because area prospects are down. As planting approaches, the government has been rejecting corn export registrations. Corn is seen as riskier than soybeans, both for yields and for marketing due to government intervention. The high cost of fertilizer is also expected to trim yield prospects.

Canada’s coarse grain production is forecast up 1.2 million tons this month to 25.4 million. Surveys by Statistics Canada found increased area and yield for oats barley, and corn, boosting oat production 0.6 million tons to 4.1 million, barley production 0.4 million tons to 10.9 million, and corn production 0.2 million tons to 9.9 million.

Australia’s coarse grain production prospects were cut 1.1 million tons this month to 11.4 million. Dry weather across Western Australia and parts of New South Wales has reduced yield prospects for winter small grains, including barley and oats. Barley production is projected down 1.0 million tons to 7.5 million.

Mexico has had better-than-normal rain across the main corn-growing region, boosting yield prospects. Corn production is projected up 1.0 million tons this month to 24 million, supporting coarse grain production of 31.2 million tons.

Corn production in the Philippines is down 0.8 million tons this month to 6.5 million. The high cost of fertilizer is reducing both area and yield prospects.

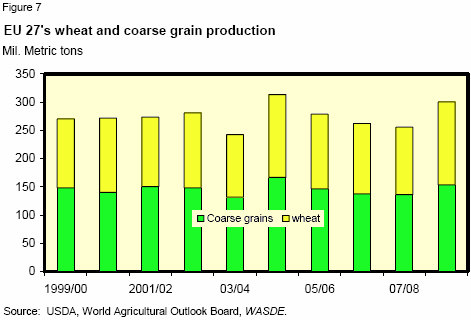

The EU-27 coarse grains crop is projected down 0.8 million tons this month to 153.3 million. Corn production is down 0.4 million tons as hot dry weather in Romania has cut corn production prospects, and increases in other regions are only partly offsetting. EU-27 rye production is down 0.4 million tons based on production data published by the Government of Germany. EU-27 barley production increased slightly this month but oat production declined.

Serbia and Croatia suffered from the same dryness that reduced corn production in Romania. Serbia’s corn crop prospects were cut 0.5 million tons to 6.0 million. Croatia’s corn crop was lowered 0.1 million tons to 2.3 million.

Increased Beginning Stocks Boost Global 2008/09 Supplies

Beginning stocks world coarse grains for 2008/09 increased 2.9 million tons this month to 150.7 million. The increase in beginning stocks more than offsets reduced production prospects, leaving world coarse grain supplies nearly unchanged this month. Brazil’s 2007/08 corn production is revised up 1.1 million tons to 58.6 million, boosting 2008/09 beginning stocks. The latest published stocks estimates by Statistics Canada boost coarse grain stocks 0.7 million tons to 4.2 million, with most of the increase in barley. Saudi Arabia’s barley imports for 2007/08 increased based on exporter’s data, increasing ending stocks 0.6 million tons. Reduced barley exports for Kazakhstan in 2007/08 increased stocks 0.6 million tons.

Foreign Corn Use Prospects Trimmed

World coarse grain use in 2008/09 is projected to reach a record 1,090.3 million tons, down 2.8 million tons this month. Most of the decline is in U.S. corn. However, foreign coarse grain use is also down slightly reduced 0.5 million tons to 804.8 million. Foreign corn feed use is down 1.0 million tons but increased use of barley, sorghum and oats is partly offsetting.

Corn feed use in Argentina for 2008/09 is reduced 1.0 million tons due to sharply lower production prospects. Corn feed use projected for Ukraine is reduced 0.5 million tons to 5.0 million because of reduced corn production prospects and very large supplies of cheap feed-quality wheat. Israel’s projected corn feed use is cut 0.3 million tons to 0.9 million due to increased imports and feeding of low quality wheat. Corn use in the Philippines is reduced 0.4 million tons due to lower production prospects and increased imports of feed wheat. South Korea’s corn feed use is reduced 0.5 million tons to 5.9 million, the lowest level in 10 years, due to increased imports of feed-quality wheat.

These declines in corn use are partly offset by increases for China, up 1.0 million tons due to increased production and strong growth in meat production; and for South Africa, up 0.6 million tons as increased domestic use in 2007/08 is boosting 2008/09 prospects.

Barley feed consumption is increased for Russia, Iran and Algeria but is reduced for Ukraine.

World Coarse Grain Ending Stocks Increased This Month

World coarse grain ending stocks for 2008/09 are projected up 3.2 million tons this month to 147.0 million. An increase of 6.0 million tons in foreign stocks more than offsets the U.S. decline. The largest increase is for the FSU, up 3.8 million tons to 9.2 million, mostly due to increased barley stocks expected in Russia (up 1.7 million), Kazakhstan (up 0.6 million), Ukraine (up 0.6 million), and Belarus (up 0.2 million). China’s corn ending stocks are increased 2.0 million tons because of increased production. Canada’s ending stocks prospects are up 1.4 million tons to 4.5 million due to increased production and beginning stocks. Brazil’s corn ending stocks are up 1.1 million tons reflecting the increase in beginning stocks. Saudi Arabia’s coarse grain stocks are projected up 0.9 million tons this month as global barley supplies are ample. Significantly reduced ending stocks are forecast for the EU-27 and Australia.

World 2008/09 Coarse Grains Trade Prospects Trimmed

World coarse grain trade projected for 2008/09 (October-September) was reduced 4.0 million tons this month to 111.0 million. This contrasts sharply with the 1.9- million-ton increase in forecast 2007/08 trade, expected to reach a record 126.9 million tons.

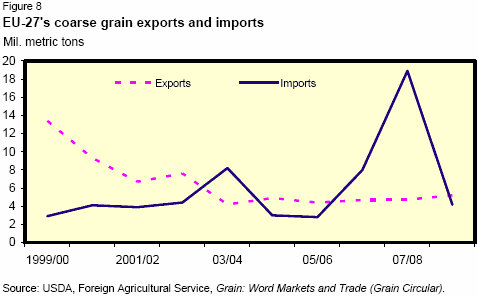

Most of this month’s drop in 2008/09 trade is for corn, down 3.8 million tons to 84.3 million. Reduced production is cutting Argentina’s export prospects 3.0 million tons to 12.0 million. Export prospects for Ukraine and Serbia were also reduced due to lower production. U.S. export prospects are unchanged.

Corn imports for the EU-27 in 2008/09 are slashed 1.0 million tons to 3.0 million as large supplies of low-quality wheat are expected to limit the demand for imported corn. Mexico’s corn imports are cut 1.0 million tons to 9.5 million because of increased production. Increased imports of low quality wheat are expected to trim corn imports by South Korea (down 0.5 million) and Israel (down 0.3 million). Corn imports by Canada are reduced due to increased coarse grain production and higher stocks. Colombia corn imports for 2008/09 are lowered in line with reduced 2007/08 imports.

World barley trade for 2008/09 is increased slightly to 19.1 million tons, with increased prospects for Ukraine and Russia mostly offset by lower exports for Australia and Kazakhstan. However, 2007/08 (October-September) barley trade is increased 2.0 million tons this month to 17.9 million. Ukraine barley shipments have been strong in recent months, boosting forecast exports 1.9 million tons to 3.9 million. Recent shipments boost 2007/08 barley exports for Australia and Russia but reduce shipments from Kazakhstan.

Further Reading

| - | You can view the full report by clicking here. |

September 2008