CME:Profitability Issues Hit Broiler Producers Hard

US - These are difficult days for US protein buyers, write Steve Meyer and Len Steiner.The pork cutout has hit record levels for seven consecutive days, closing last night over $108/cwt.

Summer cattle are trading near $115/cwt leading to sharply higher prices for steak, round or chuck cuts.

Fed cattle futures for next spring are priced at $126/cwt while hogs are in the lows 90s, which means that hedging your costs for next year will remain a difficult proposition.

If there has been one bright light for buyers this year it has been the chicken market.

That bright light, however, may start to dim quickly as profitability issues have hit broiler producers hard.

Let’s step back and see what’s going on with chicken.

Chicken breast prices, an item ubiquitous at both retail meat counters and foodservice menus, have been particularly week this year.

During the first seven months of the year, the price of chicken breasts averaged about $125/cwt, about 16 per cent lower than a year ago and nine per cent lower than the five year average.

In July, which normally is one of the best months for breast meat values, prices dropped about 25 per cent compared to last year and were 18 per cent lower than the five year average.

To add insult to injury, the price of chicken wings also has been very weak. Wing values were flying high in 2009 and 2010, contributing to producer profitability despite problems in the breast meat complex.

During the first seven months of this year, wing prices are down 34 per cent from a year ago and 24 per cent lower than the five year average.

With more than half of the bird carcass value showing these kind of declines, it is difficult to maintain profitability regardless of how much money you are able to put on dark meat items.

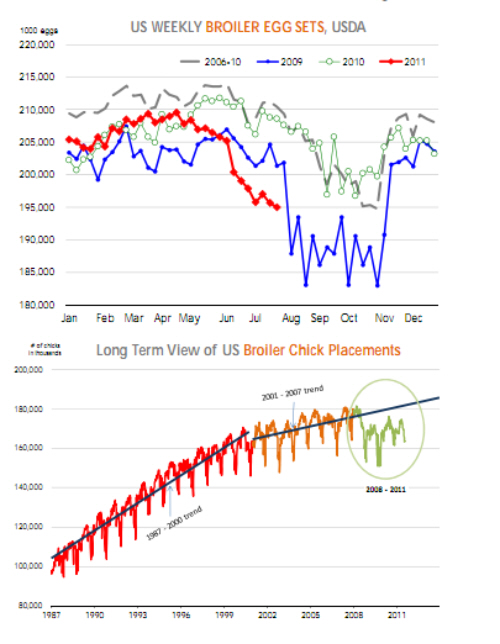

Broiler producers are starting to show some urgency and the top chart illustrates that in the last seven weeks egg sets have dropped by an even larger margin than in 2009.

On average, egg sets since mid June have declined by almost six per cent compared to 2010 levels and chick placements in the last three weeks have been down 4.4 per cent compared to last year.

We expect these kind of low egg set and chick placement numbers to continue, implying broiler slaughter for Q4 down four per cent from a year ago.

At the moment, there is a backlog of chicken in the spot market. Once the spot market is cleaned up, however, expect the tight supplies to push prices higher. This should be supportive of the entire meat complex.

Bottom line: Broiler companies contribute the largest share of meat protein in the US and reductions there will reduce overall US per capita meat protein disappearance and support higher beef and pork prices.