CME: Currency Rates Will Affect Trade Volume

US - Currency rates bear watching, both for the effect they have on trade volume as well as for what they tell us about the global economy, write Steve Meyer and Len Steiner.Livestock and grain producers sometimes roll their eyes when market analysts start talking about currency rates and world equity markets. After all, it is not that obvious what the exchange rate for the Korean Won has to do with the price of hogs in an Iowa farm or the price of cattle in a Texas ranch.

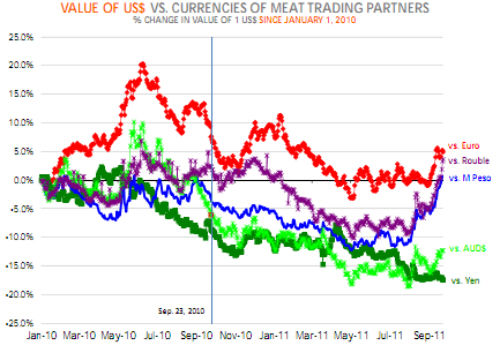

Our view has always been that currency rates bear watching, both for the effect they have on trade volume as well as for what they tell us about the global economy. For better or worse, we live in a world that has never been more integrated than it is today.

Back in April (DLR 4/28) we wondered if “we all were about the pay the price for the sins of “subprime nations” of the Euro area.” At the time the question seemed a bit over the top given projections for good US economic growth and hope that the EU would shore up the finances of its weak members.

Since then, we have see a significant deterioration in world economic conditions and there is a real likelihood of a full blown financial and debt crisis triggered by a Greek sovereign debt default.

Currency markets have responded to the growing uncertainty in world markets. While long term one can make an argument that the US dollar will remain weak, in the short term it appears that other parts of the world, particularly the Euro zone has bigger problems than we do.

Furthermore, as market participants pull back from risky bets in equity markets in other parts of the world, they are putting their money in US bonds and US dollar denominated assets.

Similarly, we have seen demand for assets denominated in Japanese Yen also continue to rise. As the chart to the right shows, the US dollar has strengthened considerably vs. the Mexican Peso, the Euro and the Russian Rouble. We could have added to the chart the Canadian dollar or the Brazilian real.

Indeed, since late July, the Canadian dollar has declined as much as nine per cent vs. the US dollar. On July 26, it took about US$1.06 to purchase one CAD.

Today, December futures are priced at US$0.9676 to purchase one CAD. Canada has been a significant buyer of US beef so far this year, in part because of the strong Canadian currency.

The currency shift has now made US beef products significantly more expensive and it is likely we will US beef exports to Canada and Mexico slow down in Q4.

One would think that shipments to Japan will remain strong given that the US dollar continues to drift lower vs. the Yen. But, the Yen has strengthened even more vs. the Australian currency and the net effect of the cross currency shifts will likely be limited.

On the imported beef front, we it is very likely that we will see more Australian and New Zealand beef move into the US later this year due to the sharp depreciation in those currencies.

December futures show that currently it takes about US$0.9729 to purchase one Australian dollar. This is about 10 per cent less than in late July when it took about US$1.08 to purchase one AUD.

Bottom line: The strong US dollar has made US meat protein and grains more expensive for foreign buyers while making imported beef and other meat protein less expensive for US buyers.

The shifts have negatively impacted US grain futures, which are down below $7/bu. for corn and $13/bu. for soybeans. Cattle prices are also down, in part because of the expected lower exports but also because of fears that another recession will hit beef prices hardest.