CME: Corn Prices Lower, Good News for Producers

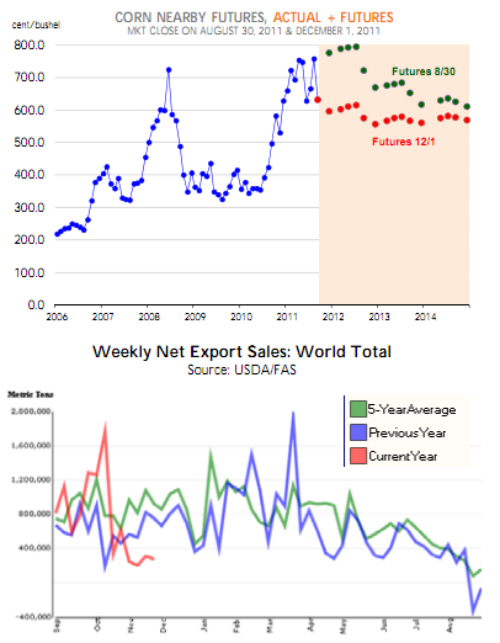

US - Corn prices have been trending lower in recent weeks, which has been welcome news for livestock and poultry producers, write Steve Meyer and Len Steiner. It was not long ago that producers were

looking at 2012 corn futures near $8 per bushel, a price level

that was unsustainable despite record livestock prices.

Since

the end of August, December corn futures have declined $1.80

per bushel or 23 per cent. March and May corn futures are also down

by a similar amount. So what has prompted the pullback in

corn futures and what does this imply for US livestock production and prices in 2012?

It appears to us that the retreat in the corn market

reflects the impact of two main drivers: First, corn demand has

been disappointing to this point. The latest USDA weekly export sales report showed net corn export shipments for the period 18 - 24 November at 280,600 MT, while last year net exports for

the comparable week were 758,000 MT.

Weekly net export

sales have been trending lower for the last few weeks (see

chart) and this has some market participants questioning

whether USDA will further reduce its corn exports estimate in

for the 2011-12 marketing year.

The last WASDE report kept

export demand at 1.6 billion bushels, the same as the October

estimate. Large world corn importers, including Japan but also

China, have been pulling back on their orders.

Some have increased their use of feed wheat as offers appear to be blow US

corn values.

Instability in currency markets also has been an

issue. As for the other two major corn demand drivers, feed

and ethanol, the picture is mixed.

Broiler producers have been

cutting back sharply and this will have a negative impact on

overall feed use. We also continue to hear of some substitution

of feed wheat for corn in areas where the basis allows for this.

Ethanol demand, on the other hand, appears to be in good

shape. Crude prices near $100 per barrel and lower corn prices

will likely push ethanol corn use higher in the coming weeks.

The second issue impacting corn futures has been the ongoing

instability in outside markets, particularly the possibility that

Euro zone leaders may not be able to find a way out of the current crisis. This has led some market participants to limit

their risk exposure.

Markets have been trying to price in the

risk of a looming financial and debt crisis in Europe since summer but the issue has taken on more urgency in the last few

weeks. Until some resolution has been found, agricultural commodities will remain under pressure, including corn. In our

view, the decline in corn prices will have a more immediate impact on hog production as even before the recent pullbacks producers were looking as modest profits for 2012. Some producers

have been chomping at the bit to expand and this pullback may

provide the opportunity to do so.