CME: How Will Broiler Industry Respond to Higher Feed Costs?

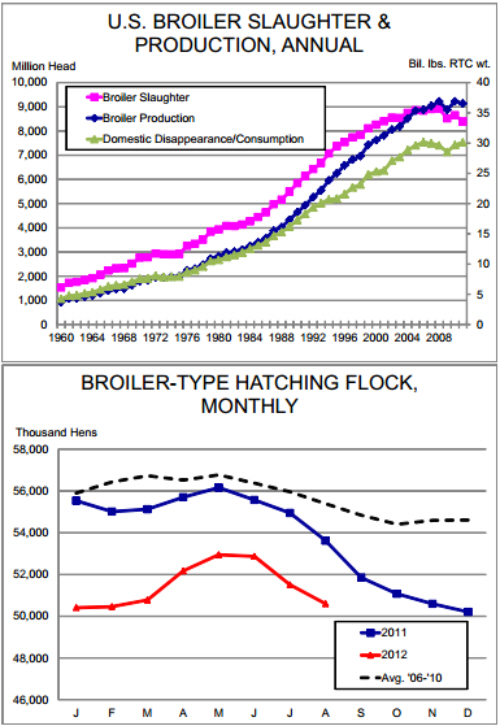

US - How quickly and how much will the broiler industry respond to higher feed costs? That is a major question in efforts to pinpoint total feed usage during the 2012-13 crop year, write Steve Meyer and Len Steiner.This is an industry that is notorious for slow reactions to adverse economic times. To some, that seems foolish or reckless but it

is built on the long-term history of the industry. Those watching the

meat and poultry sector for just the past few years may not realize just

how different today is from yesterday in the broiler sector. As can be

seen in the top chart at right, broiler slaughter, production and domestic consumption have been roughly flat since 2004 save for the costinduced dip in 2009 that was driven primarily by the bankruptcy and

associated complex closures at Pilgrim’s Pride.

But prior to 2004, annual broiler output growth was a steady,

inexorable climb. DLR author Dr. Steve Meyer got quoted pretty widely in the early ‘00s when he quipped that there were now three certain

things in life: Death, taxes and 3% more broilers. Dr. Abner Womack,

long-time director of the University of Missouri’s Food and Agricultural

Policy Research Institute claimed once that the institute made its broiler forecasts by simply matching a ruler to the line on the historical

chart and extending it into the future. Such was the dependability of

broiler output — and, more important, market — growth.

In such an environment, market share is the key performance

variable. If a company had to give up some profitability in the short

run to maintain market share, so be it. The market would soon grow

large enough to bring profits back and the company could capitalize on

its maintained share of the now larger market. Efficient operations and

active product development were keys to success.

That has changed sharply in the past 8 years. A ‘stagnant”

market in terms of size means that one cannot count on growth to

solve profit challenges. But chicken company management has, on

several occasions, not swayed from its market share paradigm thus

driving some periods of extreme losses as they played “chicken” (you

knew it was coming, didn’t you?) to see who could survive the longest.

One such episode ended in May of 2011 when bankruptcies

at several smaller companies and reductions among the giants

(Tyson, Pilgrim’s/JBS, Sanderson, Perdue) began to moderate broiler

production. After nearly a year of such cuts, some managers had to

be wondering if they would ever see results as chicken prices simply

never fired until April and May of this year. And now they are faced

with another cost increase. Will it be another game of “chicken” or a

bottom-line driven, timely reduction in output?

It is too early to determine the answer with any certainty.

Egg sets and chick placements are running very near one year ago

but those levels were 6, 7, sometimes 8% lower than in 2010. Can we

expect additional cuts? As the bottom chart at right shows, the broiler

hatcher flock was built more than a normal seasonal pattern would

have suggested in April and May as the sector actually moved toward

expansion. But higher feed costs caused larger-than-normal reductions in the hatchery flock in both June and July and it remains over

6% smaller than one year ago.

The chicken’s short production cycle will serve it well if feed

prices return to normal in 2013. An expansion decision can result in a

new breeding flock replacement chick in just 3 weeks. That chick will

begin laying at 18-24 weeks of age. Those eggs will hatch in 3 weeks

and a finished broiler will go to harvest 5-7 weeks after that. Roughly

33 weeks from decision to result. Pork producers can respond no

quicker than 10 months even if they have a breeding gilt ready to put

in the herd. A more reasonable period is 11-12 months. Beef cattle

take two years to go from breeding to beef. Even with significant reductions this year, broiler companies will be in a position to respond

far more quickly to any cost reductions — and fill any voids left by reductions in pork and beef output.